Question: based on the calculation, should this project ne approved or rejected??? What is the internal rate of return (IRR) using the data below? $3,000,000.00 :

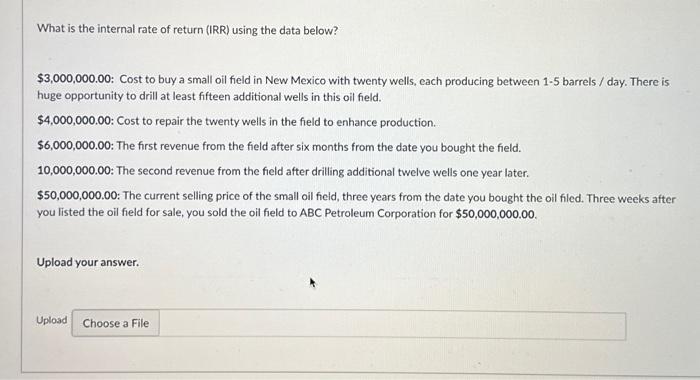

What is the internal rate of return (IRR) using the data below? $3,000,000.00 : Cost to buy a small oil field in New Mexico with twenty wells, each producing between 1-5 barrels / day. There is huge opportunity to drill at least fifteen additional wells in this oil field. $4,000,000,00 : Cost to repair the twenty wells in the field to enhance production. $6,000,000.00 : The first revenue from the field after six months from the date you bought the field. 10,000,000.00: The second revenue from the field after drilling additional twelve wells one year later. $50,000,000,00 : The current selling price of the small oil fieid, three years from the date you bought the oil filed. Three weeks after you listed the oil field for sale, you sold the oil field to ABC Petroleum Corporation for $50,000,000.00. Upload your answer. NPV^>0 Accept project NPV =0 No profit or no loss NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts