Question: Based on the case study below 1 . Situation Analysis Size - up the situation facing Drinkworks. This section should provide a foundation for your

Based on the case study below

Situation Analysis

Sizeup the situation facing Drinkworks. This section should provide a foundation for your recommendations by assessing the business objectives and strengthsweaknesses relative to competitors, identifying key insights about consumers, and highlighting relevant external factors eg social, economic, and technological trends Your goal should not be to summarize information provided by the client, but rather to call attention to critical issues and offer valueadded insights that explain why your recommendations make sense.

Use porters forces, and a SWOT analysis

Brand positioning

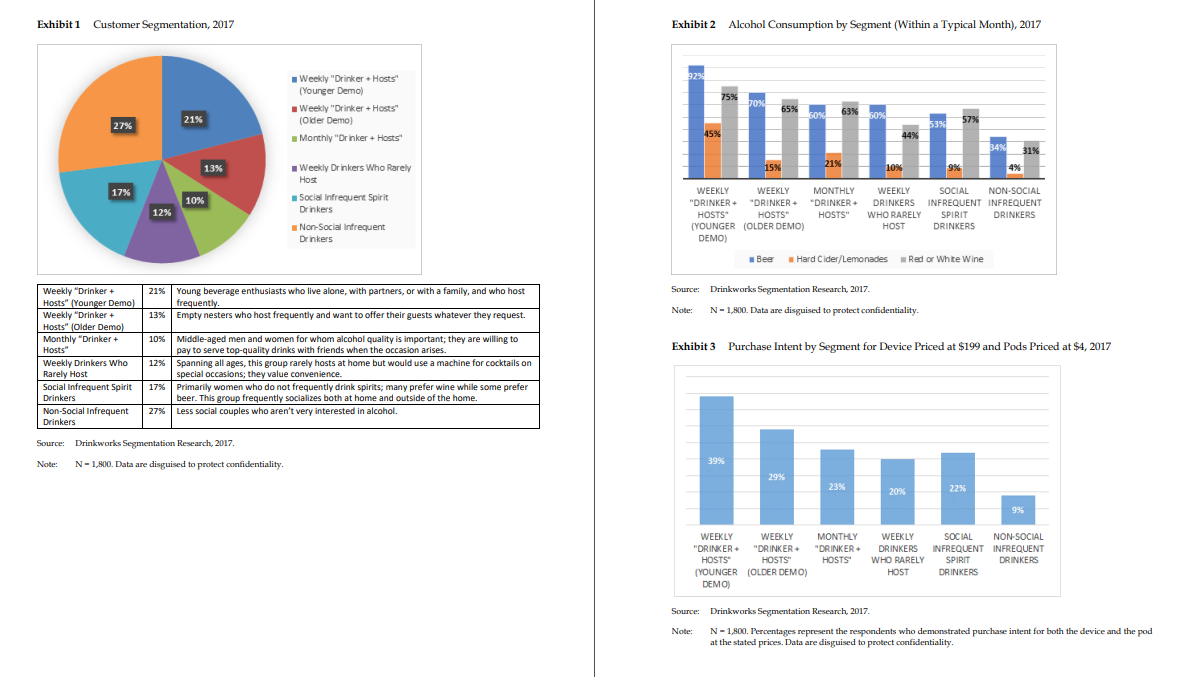

Identify and describe brand positioning of Drinkworks. This section should explain its brand values and explain how the firms tangible and intangible brand assets contribute to its relative competitive advantages in the marketplace. Use STP segmentationtargetingpositioning to explain what is the right target for Drinkworks and what is its potential market size? What is its value proposition and how should it be positioned compared to its competitors?

Segement, target and postion, based on the data related in the case

Marketing mix

Strategic alternatives

Focusing on product and pricing decisions. Which pods should Davis introduce and how should the device and pods be priced? Specify the target market for each strategic alternative and why your product and pricing decisions serve their needs. Be aware that Drinkworks expects you to consider at least two and no more than four mutually exclusive courses of action. Be sure to clearly explain the reasoning behind your recommendations and consider both financial implications and potential implementation challenges. You may wish to include tables andor figures to illustrate your ideas.

Other Marketing Mix Recommendations

Discuss implications of your strategy for other aspects of the marketing mix:

Distribution: What distribution channels should Davis select to launch Drinkworks?

Promotion: How to promoteadvertise Drinkworks?

Drinkworks: Home Bar by Keurig

In the summer of Nathaniel Davis, CEO of Drinkworks, was going through the results of his companys latest market research. Developed through a joint venture JV between home coffeebrewing and soft drink giant Keurig Dr Pepper KDP; operating as Keurig Green Mountain at the time and global beerbrewing company AnheuserBusch InBev AB InBev Daviss team at Drinkworks created a home bar appliance that, similar to a Keurig coffee machine, used pods to make singleserving cocktails or beer with a touch of a button. Since the founding of the JV and leveraging technology from previous research and development R&D efforts of both parent companies, Davis and his team had developed and iterated the technology for the device, and now had to decide which target segment to focus on whether to launch alcoholic cocktail pods or nonalcoholic cocktail mixer pods, and how to price both the device and the pods. Davis was aware that AB InBev, a global leader in beer with $ billion in sales, was looking for new growth opportunities. Could Drinkworks be the companys next billiondollar opportunity?

US Market for Alcoholic Beverages

In total US sales of alcoholic beveragesincluding sales for onpremise and offpremise consumptionwere $ billion, including about $ billion for beer, $ billion for wine, and $ billion for distilled spirits Of total sales, an estimated $ billion related to inhome consumption

AtHome Cocktail Consumption

In a survey, those who had consumed alcohol at home during the past three months cited relaxation holidays drinking with meals and spending time with friends as the most frequent reasons When deciding to drink at home rather than at a bar or restaurant, consumers were usually driven by the fact that drinking at home was more relaxing and cheaper Of those who consumed drinks at home, reported drinking wine, beer, and spirits including mixed drinks, cocktails, shots, and drinks on the rocks Athome alcohol consumption was often related to social gatherings, including people purchasing alcohol to bring to parties or those buying alcohol before hosting gatherings. In an April survey, of adults reported that they had hosted at least one party at their homes in the past three years Of those, reported purchasing nonalcoholic drinks beforehand; purchased beer or wine; and purchased hard alcohol Fiftyone percent of hosts noted that they tried to provide types of alcohol their friends would like, and offered multiple types of alcohol at their parties People consumed alcohol at home more frequently than away from home, but cocktail consumption did not follow this trend. I

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock