Question: Based on the chart above yous someone help me answer these questions? Total Home Down Interest Loan Mortgage Monthly Taxes Monthly Loan Term Price Payment

Based on the chart above yous someone help me answer these questions?

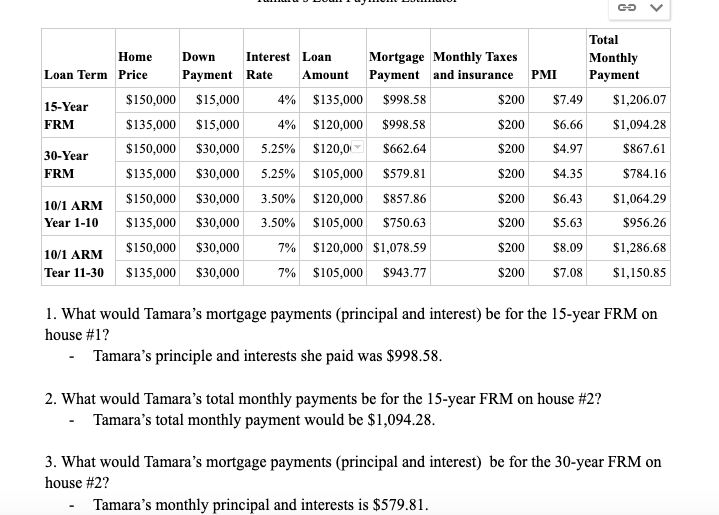

Total Home Down Interest Loan Mortgage Monthly Taxes Monthly Loan Term Price Payment Rate Amount Payment and insurance PMI Payment 15-Year $150,000 $15,000 $998.58 4% $135,000 $200 $7.49 $1,206.07 FRM $135,000 $15,000 4% $120,000 $998.58 $200 $6.66 $1,094.28 $662.64 $150,000 $30,000 5.25% $120,07 30-Year $200 $4.97 $867.61 FRM $135,000 $30,000 5.25% $ 105,000 $579.81 $200 $4.35 $784.16 $200 10/1 ARM $150,000 $30,000 3.50% $120,000 $857.86 $6.43 $1,064.29 Year 1-10 $135,000 $30,000 3.50% $105,000 $750.63 $200 $5.63 $956.26 $150,000 $30,000 $200 7% $120,000 $1,078.59 $8.09 10/1 ARM $1,286.68 Tear 11-30 $135,000 $30,000 7% $105,000 $943.77 $200 $7.08 $1,150.85 1. What would Tamara's mortgage payments (principal and interest) be for the 15-year FRM on house #12 - Tamara's principle and interests she paid was $998.58. 2. What would Tamara's total monthly payments be for the 15-year FRM on house #2? Tamara's total monthly payment would be $1,094.28. 3. What would Tamara's mortgage payments (principal and interest) be for the 30-year FRM on house #2? Tamara's monthly principal and interests is $579.81. 5. What would Tamara's mortgage payments (principal and interest) be for year 7-year on a 10/1 ARM? 6. What would Tamara's mortgage payments (principal and interest) be for year 25 on a 10/1 ARM? 7. What would Tamara's mortgage payments be for year 5 on a 10/1 ARM? 8. What would Tamara's mortgage payments be for year 15 on a 10/1 ARM? 9. Should Tamaea choose to pay PMI, or should she choose to make a bigger down payment? Total Home Down Interest Loan Mortgage Monthly Taxes Monthly Loan Term Price Payment Rate Amount Payment and insurance PMI Payment 15-Year $150,000 $15,000 $998.58 4% $135,000 $200 $7.49 $1,206.07 FRM $135,000 $15,000 4% $120,000 $998.58 $200 $6.66 $1,094.28 $662.64 $150,000 $30,000 5.25% $120,07 30-Year $200 $4.97 $867.61 FRM $135,000 $30,000 5.25% $ 105,000 $579.81 $200 $4.35 $784.16 $200 10/1 ARM $150,000 $30,000 3.50% $120,000 $857.86 $6.43 $1,064.29 Year 1-10 $135,000 $30,000 3.50% $105,000 $750.63 $200 $5.63 $956.26 $150,000 $30,000 $200 7% $120,000 $1,078.59 $8.09 10/1 ARM $1,286.68 Tear 11-30 $135,000 $30,000 7% $105,000 $943.77 $200 $7.08 $1,150.85 1. What would Tamara's mortgage payments (principal and interest) be for the 15-year FRM on house #12 - Tamara's principle and interests she paid was $998.58. 2. What would Tamara's total monthly payments be for the 15-year FRM on house #2? Tamara's total monthly payment would be $1,094.28. 3. What would Tamara's mortgage payments (principal and interest) be for the 30-year FRM on house #2? Tamara's monthly principal and interests is $579.81. 5. What would Tamara's mortgage payments (principal and interest) be for year 7-year on a 10/1 ARM? 6. What would Tamara's mortgage payments (principal and interest) be for year 25 on a 10/1 ARM? 7. What would Tamara's mortgage payments be for year 5 on a 10/1 ARM? 8. What would Tamara's mortgage payments be for year 15 on a 10/1 ARM? 9. Should Tamaea choose to pay PMI, or should she choose to make a bigger down payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts