Question: Based on the corporate valuation model, the total corporate value of Chen Lin Inc. is $975 million. Its balance sheet shows $210 million in notes

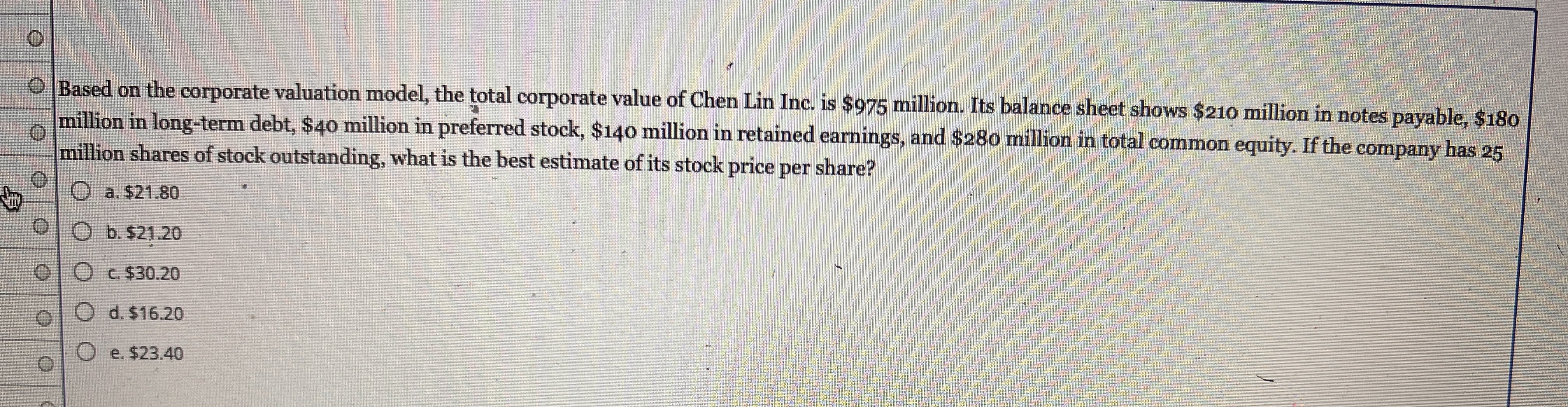

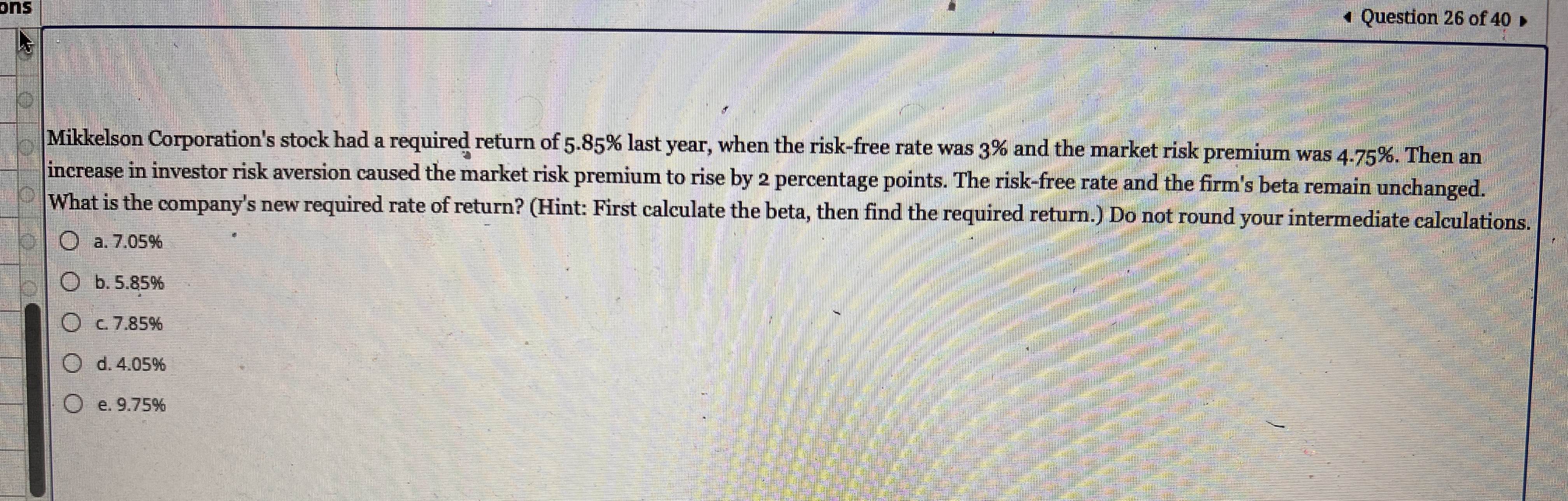

Based on the corporate valuation model, the total corporate value of Chen Lin Inc. is $975 million. Its balance sheet shows $210 million in notes payable, $180 million in long-term debt, $40 million in preferred stock, $140 million in retained earnings, and $280 million in total common equity. If the company has 25 million shares of stock outstanding, what is the best estimate of its stock price per share? a. $21.80 b. $21.20 c. $30.20 d. $16.20 e. $23.40 Mikkelson Corporation's stock had a required return of 5.85% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2 percentage points. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.) Do not round your intermediate calculations. a. 7.05% b. 5.85% c. 7.85% d. 4.05% e. 9.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts