Question: Based on the current ratio from the previous question, Costco is: 1. highly illiquid and in financial trouble. 2. has slightly more than enough liquid

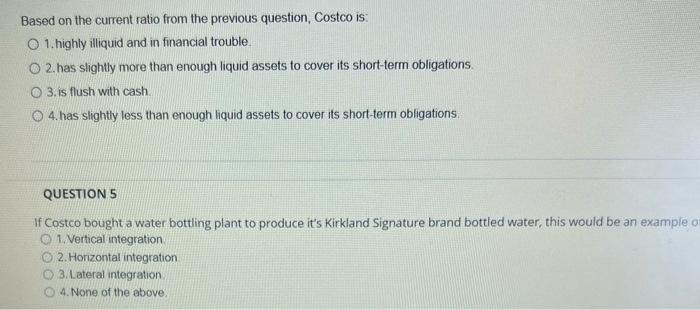

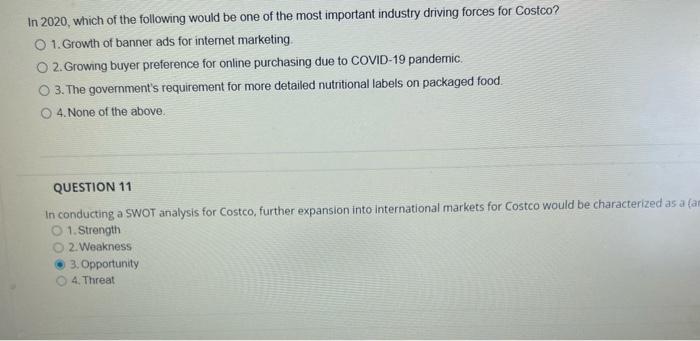

Based on the current ratio from the previous question, Costco is: 1. highly illiquid and in financial trouble. 2. has slightly more than enough liquid assets to cover its short-term obligations. 3. is flush with cash. 4. has slightly less than enough liquid assets to cover its short-term obligations. QUESTION 5 If Costco bought a water bottling plant to produce it's Kirkland Signature brand bottled water, this would be an example 1. Vertical integration. 2. Horizontal integration 3. Lateral integration 4. None of the above. In 2020, which of the following would be one of the most important industry driving forces for Costco? 1. Growth of banner ads for internet marketing. 2. Growing buyer preference for online purchasing due to COVID-19 pandernic. 3. The government's requirement for more detailed nutritional labels on packaged food. 4. None of the above. QUESTION 11 In conducting a SWOT analysis for Costco, further expansion into international markets for Costco would be characterized as a fa 1. Strength 2. Weakness 3. Opportunity 4. Threat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts