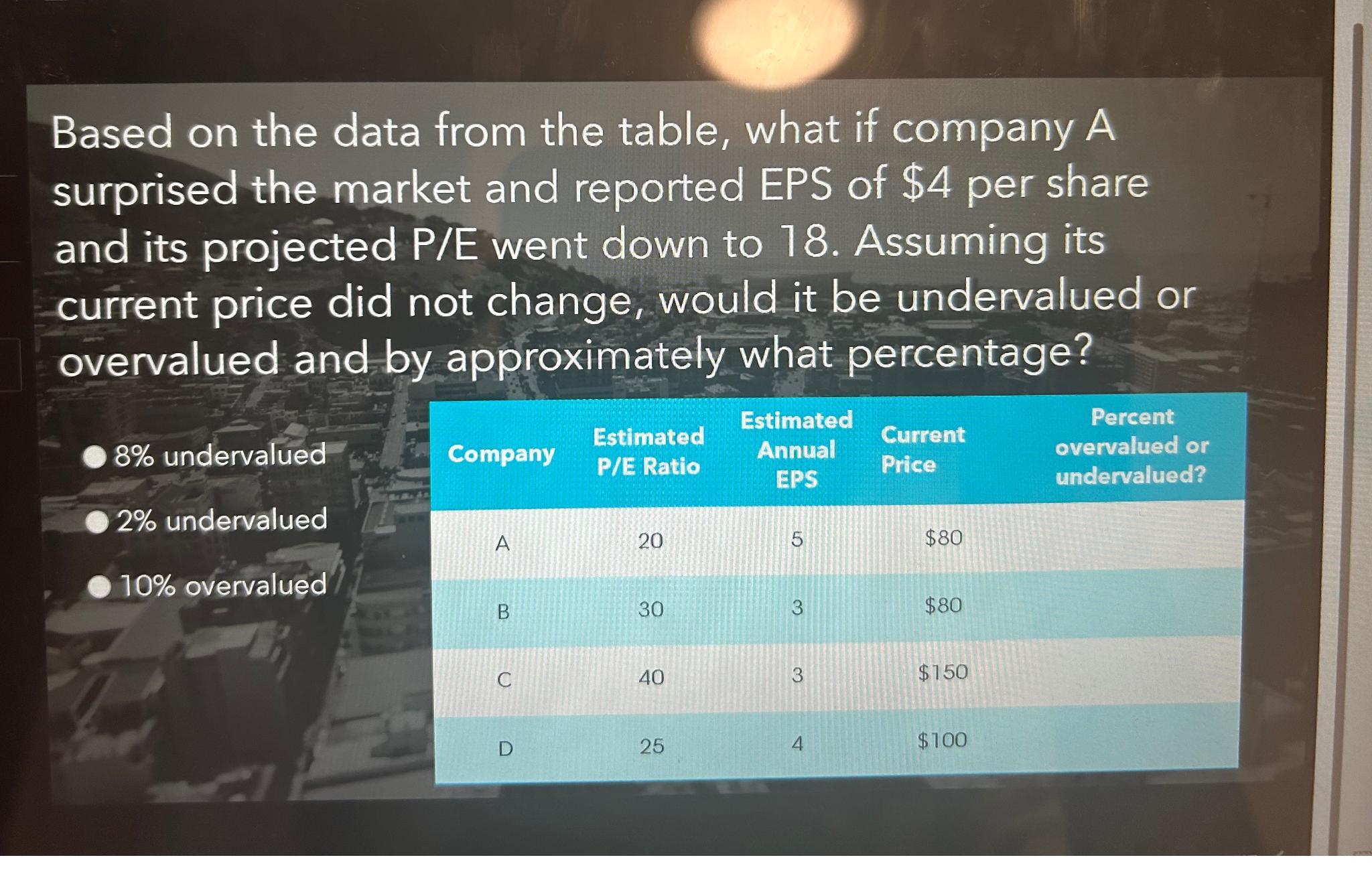

Question: Based on the data from the table, what if company A surprised the market and reported EPS of $4 per share and its projected

Based on the data from the table, what if company A surprised the market and reported EPS of $4 per share and its projected P/E went down to 18. Assuming its current price did not change, would it be undervalued or overvalued and by approximately what percentage? 8% undervalued 2% undervalued 10% overvalued Company A B C D Estimated P/E Ratio 20 30 40 25 Estimated Annual EPS 5 3 3 4 Current Price $80 $80 $150 $100 Percent overvalued or undervalued?

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

To determine if Company A would be undervalued or overvalued we can calculate the ... View full answer

Get step-by-step solutions from verified subject matter experts