Question: Based on the data of Deere & Co. (DE), summarize the annual balance sheets in the past 3 years (in ONE paragraph) and the annual

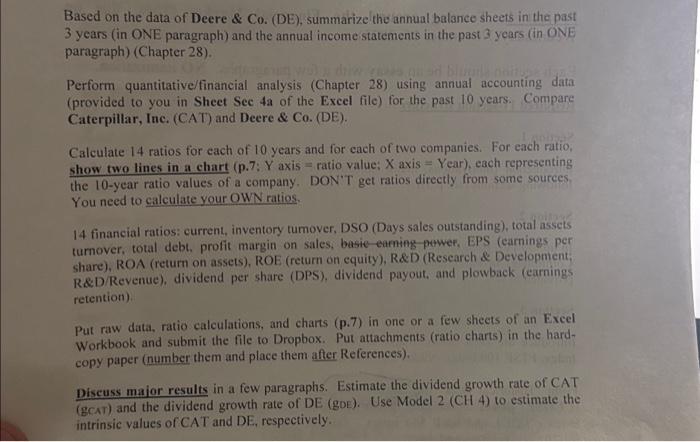

Based on the data of Deere \& Co. (DE), summarize the annual balance sheets in the past 3 years (in ONE paragraph) and the annual income statements in the past 3 years (in ONE paragraph) (Chapter 28). Perform quantitative/financial analysis (Chapter 28) using annual accounting data (provided to you in Sheet Sec 4a of the Excel file) for the past 10 years. Compare Caterpillar, Inc. (CAT) and Deere \& Co0 (DE). Calculate 14 ratios for each of 10 years and for each of two companies. For each ratio, show two lines in a chart (p.7: Y axis = ratio value; X axis =Y ear), each representing the 10 -year ratio values of a company. DON'T get ratios directly from some sources. You need to calculate your OWN ratios. 14 financial ratios: current, inventory tumover, DSO (Days sales outstanding), total assets turnover, total debt, profit margin on sales, basie-eaming petwer, EPS (earnings per share), ROA (return on assets), ROE (retum on equity), R\&D (Research \& Development; R\&D/Revenue), dividend per share (DPS), dividend payout, and plowback (earnings retention). Put raw data, ratio calculations, and charts (p.7) in one or a few sheets of an Exeel Workbook and submit the file to Dropbox. Put attachments (ratio charts) in the hardcopy paper (number them and place them after References). Discuss major results in a few paragraphs. Estimate the dividend growth rate of CAT (gCAr) and the dividend growth rate of DE (gDE). Use Model 2 ( CH4) to estimate the intrinsic-values of CAT and DE, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts