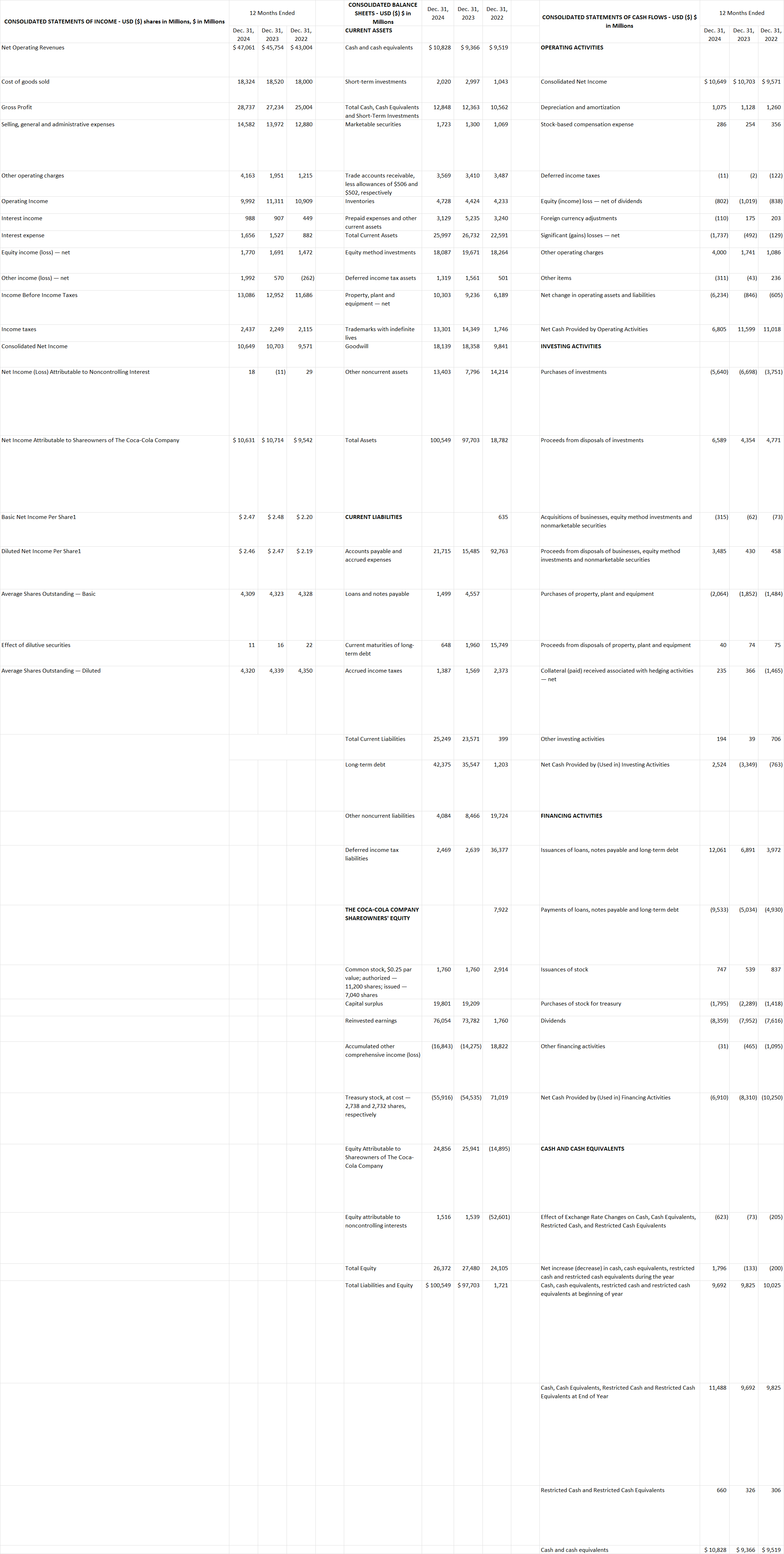

Question: based on the data provided what is the inventory turnover ratio for 2024 CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $in Millions

based on the data provided what is the inventory turnover ratio for 2024

CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $in Millions Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses (Other operating charges Operating Income Interest income Interest expense Equity income (loss) net Other income (loss) net Income Before Income Taxes Consolidated Net Income Net Income (Loss) Attributable to Noncontrolling Interest [Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share Diluted Net Income Per Sharet 'Average Shares Outstanding Basic Effect of dilutive securities 'Average Shares Outstanding Diluted 12 Months Ended Dec. 31, 2024 $47,061 18,324 28,737 14,582 4,163 9,992 988 1,656 4,770 1,992 13,086 2437 10,649 18 $10,631 $2.47 $2.46 4309 a 4320 Dee. 31, 2023 $45,754 18,520 27,234 13,972 4951 11311 907 4,527 1,691 570 12,952 2249 10,703 (a1) $10,714 $2.48 $2.47 4323 16 4339 Dee. 31, 2022 $43,004 18,000 25,004 12,880 4215 10,909 449 382 1472 (262) 11,686 2a15 9s71 29 $9,542 $2.20 $2.19 4328 2 4350 CONSOLIDATED BALANCE SHEETS - USD ($) $in Millions 'CURRENT ASSETS Cash and cash equivalents 'Short-term investments Total Cash, Cash Equivalents 'and Short-Term Investments Marketable securities 'Trade accounts receivable, less allowances of $506 and $502, respectively Inventories Prepaid expenses and other 'current assets Total Current Assets Equity method investments Deferred income tax assets Property, plant and 'equipment net 'Trademarks with indefi lives Goodwill (Other noncurrent assets Total Assets 'CURRENT LIABILITIES 'Accounts payable and accrued expenses Loans and notes payable Current maturities of long- term debt 'Accrued income taxes Total Current Liabilities Long-term debt 'Other noncurrent liabilities Deferred income tax liabilities 'THE COCA-COLA COMPANY 'SHAREOWNERS' EQUITY 'Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040 shares Capital surplus Reinvested earnings 'Accumulated other 'comprehensive income (loss) Treasury stock, at cost 2,738 and 2,732 shares, respectively Equity Attributable to 'Shareowners of The Coca~ Cola Company Equity attributable to noncontrolling interests Total Equity 'Total Liabilities and Equity Dec. 31, 2024 $10,828 2,020 12,848 4723 3,569 4728 3,29 25,997 18,087 1319 10,303 13,301 18,139 13,403 100549 24,715 1,499 648, 1,387 25,249 42375 4084 2,469 1,760 19,801 76,054 (16,843) (65,916) 24,856 1516 26,372 $100,549 Dec. 31, 2023 $9,366 2,997 12,363 1,300 3410 42a 5235 26,732 19,671 1,561 9,236 14,349 18,358 7,796 97,703 15,485 4387 1,960 1569 23571 35547 8,466 2,639 1,760 19,209 73,782 (24,275) (64,535) 25,941 1539 27,480 $97,703 Dec. 31, 2022 $9519 1,043 10,562 1,089 3487 4233 3,240 22591 18,264 501 6,89 1,746 9841 14214 18,782 635, 92,763, 2373 399 1,203 19,724 36377 7,922 2914 1,760 18,822 71,019 (14,895) (62,601) 24,05 4724 CONSOLIDATED STATEMENTS OF CASH FLOWS - USD (S) $ in Millions OPERATING ACTIVITIES. ted Net Income Depreciation and amortization 'Stock-based compensation expense Deferred income taxes Equity (income) loss net of dividends Foreign currency adjustments Significant (gains) losses net Other operating charges Other items "Net change in operating assets and lal 'Net Cash Provided by Operating Activities INVESTING ACTIVITIES Purchases of investments Proceeds from disposals of investments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable securities Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Collateral (paid) received associated with hedging activities, net Other investing activities 'Net Cash Provided by (Used in) Investing Acti FINANCING ACTIVITIES Issuances of loans, notes payable and long-term debt Payments of loans, notes payable and long-term debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities 'Net Cash Provided by (Used in) Financing Activities 'CASH AND CASH EQUIVALENTS Effect of Exchange Rate Changes on Cash, Cash Equivalents, Restricted Cash, and Restricted Cash Equivalents "Net increase (decrease) in cash, cash equivalents, restricted 'cash and restricted cash equivalents during the year Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents at End of Year Restricted Cash and Restricted Cash Equivalents Cash and cash equivalents 12 Months Ended Dec. 31, 2024 $10,649 1,075 286 (a) (802) (110) (1737) 4,000 @y (6,234) 6805 (5,640) 6589 (15) 3,485 (2,064) 40 235 194 2524 12,061 (9533) 787 (1,795) (3,359) 1) (6910) (623) 4,796 9,692 11,488 660 $10,828 Dec. 31, Dec. 31, 2023 2022, $10,703 $9571 128 1,260 254356 (2) (a2) (1,019) (838) 175203, (492) (129) 1,741 1,086 (43) 236 (846) (605) 11599 11,018 (6,698) (3,751) 4354471 (62) (73) 430458 (1,852) (1,484) m 7S 366 (1,465) 39706 (3.349) (763) 6891 3,972 (5,034) (4,930) 539837 (2,289) (1,418) (7,952) (7,616) (465) (2,095) (8,310) (10,250) (73) (205) (233) (200) 9825 10,025 9,692 9,825 326 306 $9,366 $9,519