Question: Based on the data set provided, please answer the highlighted portions. Also if you can, please show work so that I can follow along! Use

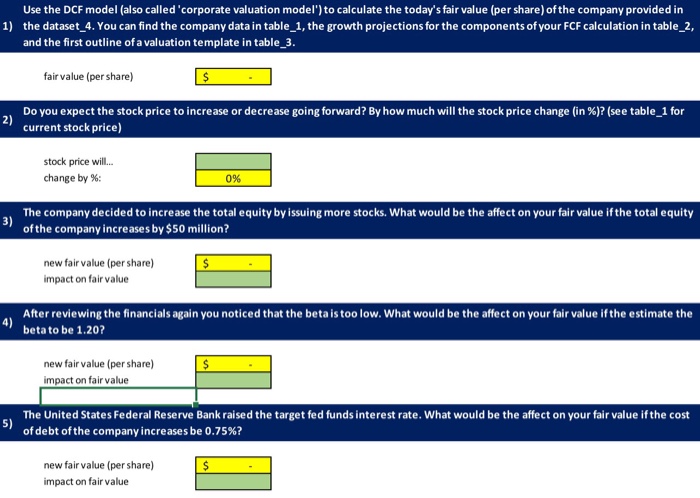

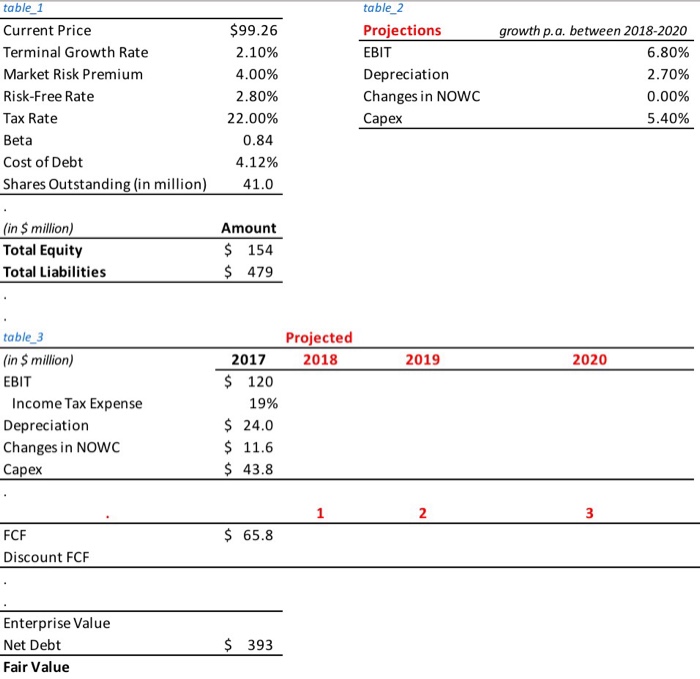

Use the DCF model (also called'corporate valuation model') to calculate the today's fair value (per share) of the company provided in 1) the dataset 4. You can find the company data in table_1, the growth projections for the components of your FCF calculation in table 2, and the first outline of a valuation template in table 3 fair value (per share) Do you expect the stock price to increase or decrease going forward? By how much will the stock price change (in %)? (see table-1 for current stock price) 2) stock price will.. change by % 0% The company decided to increase the total equity by issuing more stocks. What would be the affect on your fair value ifthe total equity of the company increases by $50 million? 3) new fair value (per share) impact on fair value After reviewing the financials again you noticed that the beta is too low. What would be the affect on your fair value if the estimate the beta to be 1.20 4) new fairvalue (per share) impact on fair value The United States Federal Reserve Bank raised the target fed funds interest rate. What would be the affect on your fair value if the cost of debt ofthe company increases be 0.75%? 5) new fair value (per share) impact on fair value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts