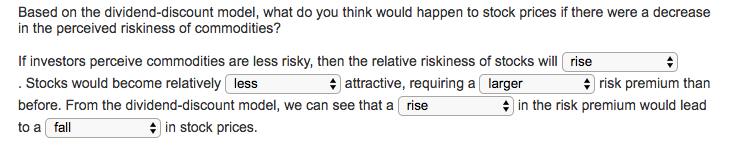

Question: Based on the dividend-discount model, what do you think would happen to stock prices if there were a decrease in the perceived riskiness of commodities?

Based on the dividend-discount model, what do you think would happen to stock prices if there were a decrease in the perceived riskiness of commodities? If investors perceive commodities are less risky, then the relative riskiness of stocks will rise Stocks would become relatively less attractive, requiring a larger risk premium than + in the risk premium would lead before. From the dividend-discount model, we can see that a rise to a fall in stock prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts