Question: Based on the DMAIC methodology, what recommendations can you make to the company? THREE DOT FOUR CAPITAL MANAGEMENT John Galt was recently promoted to Senior

Based on the DMAIC methodology, what recommendations can you make to the company?

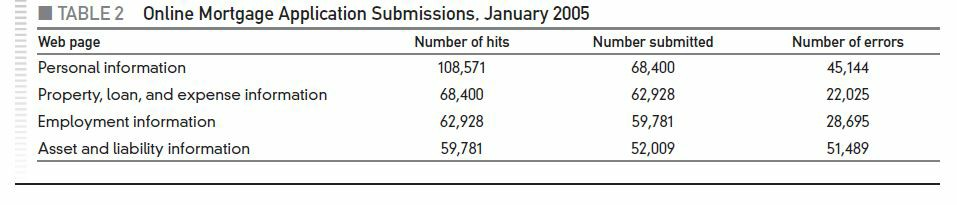

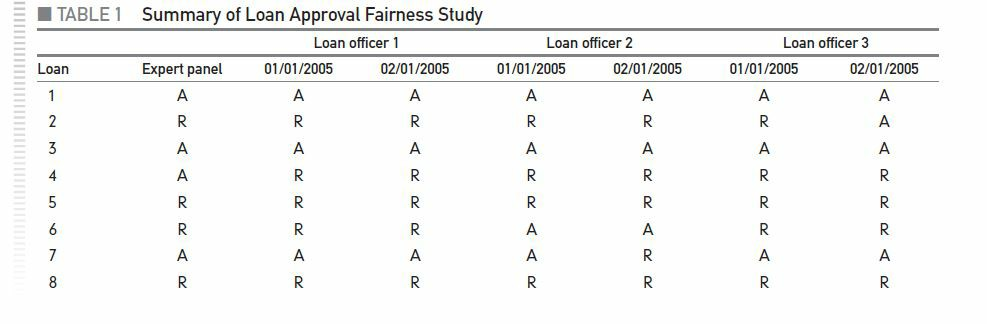

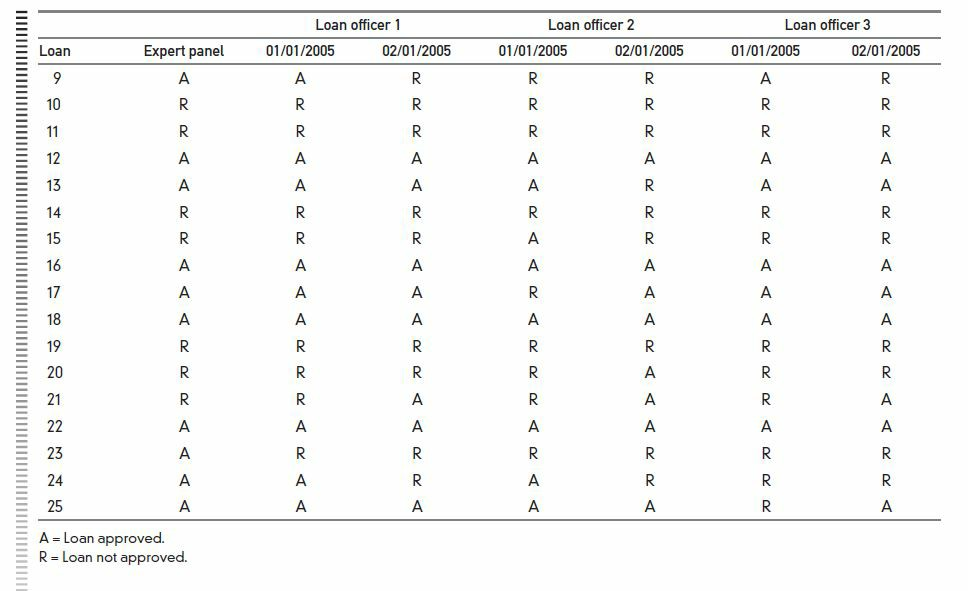

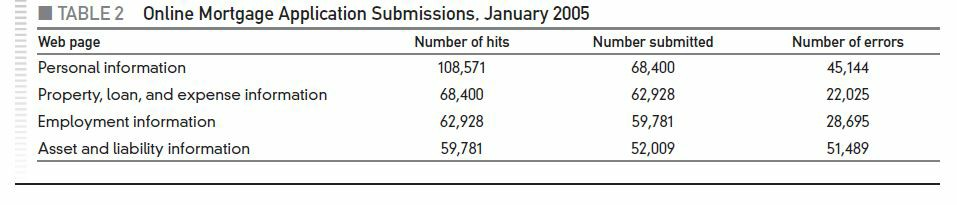

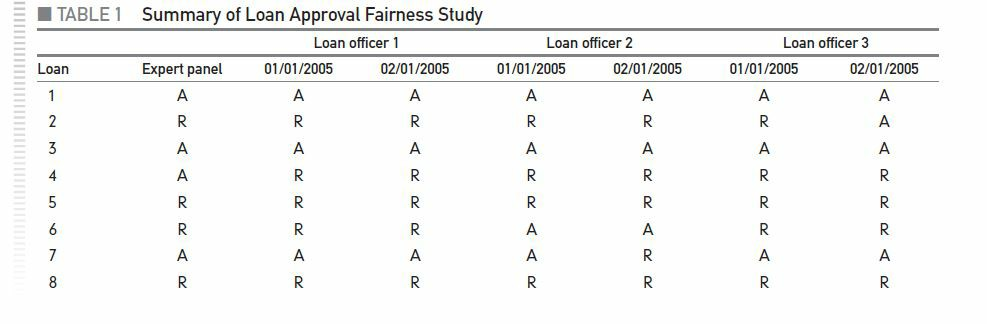

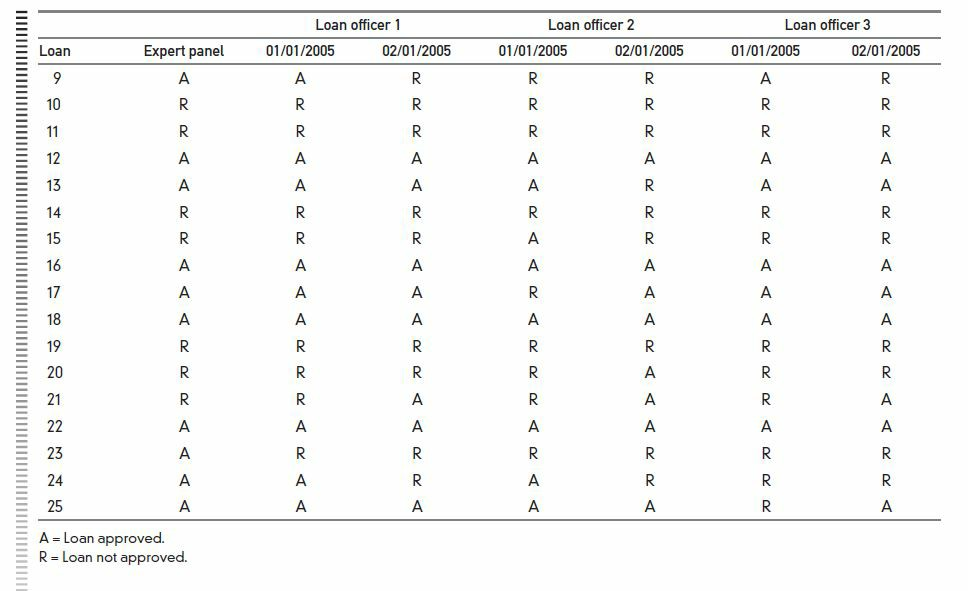

THREE DOT FOUR CAPITAL MANAGEMENT John Galt was recently promoted to Senior Vice President information the applicant will be asked to supply on subse- of Consumer Lending at Three Dot Four Capital quent Web pages. Clicking on the Continue button at the Management. Three Dot Four is a large financial ser- bottom of the Instruction page takes the user to the first of vices organization ranked among the top 20 financial four Web pages, each containing a Web-based form to col- institutions in terms of total assets. A key consideration lect the required data. in John's promotion was his past success leading the The first Web page, Personal Information, solicits bank's quality and productivity group. In particular, information regarding the applicant and requires entering there appears to be a significant amount of dissatisfac- information in 33 fields. Information collected on this page tion among both the bank's customers and the bank's includes the applicant's and coapplicant's names, full loan officers with its online mortgage application addresses, previous addresses, dates of birth, Social Security process. numbers, phone numbers, e-mail addresses, and so on. To The online mortgage application process is initi- continue on to the next page, the user selects the Continue ated when a customer clicks on the Apply for a Home button located at the bottom of the Personal Information Mortgage Now link on Three Dot Four's homepage. This page. When the Continue button is selected on a given page, link takes the user to an Instruction page that overviews a check is made to ensure that none of the required fields the application process and provides a checklist of the has been left blank. If the validation check is passed, the 254 Process Improvement: Six Sigma next Web page in the application process is displayed. In cases where the validation check fails, the blank fields are highlighted and the user is asked to enter the infor- mation in these fields. Once information has been entered for all required fields on the Personal Information page, the second and applications completed at one of the bank's branch offices. Initially, John identified two areas in need of improve- ment: the fairness of loan approval decisions and the accu- racy of the information in loan applications submitted online. In terms of the fairness of loan approval decisions, IIIIIIII UUUUUUU next Web page in the application process is displayed. In cases where the validation check fails, the blank fields are highlighted and the user is asked to enter the infor- mation in these fields. Once information has been entered for all required fields on the Personal Information page, the second pageProperty, Loan, and Expensesis displayed. This page is used to collect information about the prop- erty the loan will be used to purchase, the type of loan the applicant desires, and information about the appli- E cant's monthly expenses. In total, the Property, Loan, and Expenses page contains 10 data fields. Once the information has been entered for all required fields on the Property, Loan, and Expenses page, the Employment page is displayed. This page captures information about the applicant's and coappli- cant's employment history, including salary and other income information. The Employment page contains 16 user fields. Finally, the last Web page in the applica- tion process captures information about the applicant's Assets and Liabilities. In particular, the user is asked to supply information about checking accounts, savings accounts, credit card accounts, investment accounts, car loans, and so on. In total, this page contains 22 data fields. When the applicant clicks on the Submit Application button at the bottom of the Assets and Liabilities page, a final validation check is performed and the information is transferred to one of the bank's loan officers. The loan officers subsequently print out the information and then add the application to their backlog of other in-process applications. To even out the work across the loan offic- ers, all loan officers process loan applications submitted via the Web, as well as applications received via the mail and applications completed at one of the bank's branch offices. Initially, John identified two areas in need of improve- ment: the fairness of loan approval decisions and the accu- racy of the information in loan applications submitted online. In terms of the fairness of loan approval decisions, over the last couple of years, the company has received numerous complaints from applicants questioning the organization's fairness in making loan approval decisions. To begin understanding this problem, John initiated a study in which 25 loan applications were randomly selected. These loan applications were then evaluated by a panel of three experts to determine whether the loan should be approved or rejected. Next, three loan officers were selected and asked to evaluate each of the 25 loans two times. The data collected from this study is summarized in Table 1. To investigate the issue related to the accuracy of information in online mortgage applications, John formed a process improvement team. The team began by collecting data on the total number of hits each page in the Web appli- cation process received as well as the number of times the page was actually completed during the month of January. In addition, the team performed a detailed audit of all the information that was submitted during January and tallied the number of fields that contained errors across all submit- ted information. A summary of the team's preliminary results is given in Table 2. Questions 1. What is the DPMO for the loan applications submitted via the Web? 2. What could be done to improve the DPMO? 3. Regarding the fairness of the loan approval process, what recommendations would you make? 111 TABLE 2 Online Mortgage Application Submissions, January 2005 Web page Number of hits Number submitted Personal information 108,571 68,400 Property, loan, and expense information 68,400 62,928 Employment information 62,928 59,781 Asset and liability information 59,781 52,009 Number of errors 45,144 22,025 28,695 51,489 TABLE1 Summary of Loan Approval Fairness Study Loan officer 1 Loan Expert panel 01/01/2005 02/01/2005 Loan officer 2 01/01/2005 02/01/2005 Loan officer 3 01/01/2005 02/01/2005 - N N + L 5 Loan officer 1 01/01/2005 02/01/2005 Loan officer 2 01/01/2005 02/01/2005 Loan officer 3 01/01/2005 02/01/2005 Loan Expert panel TTTTTTIIIII A = Loan approved. R = Loan not approved