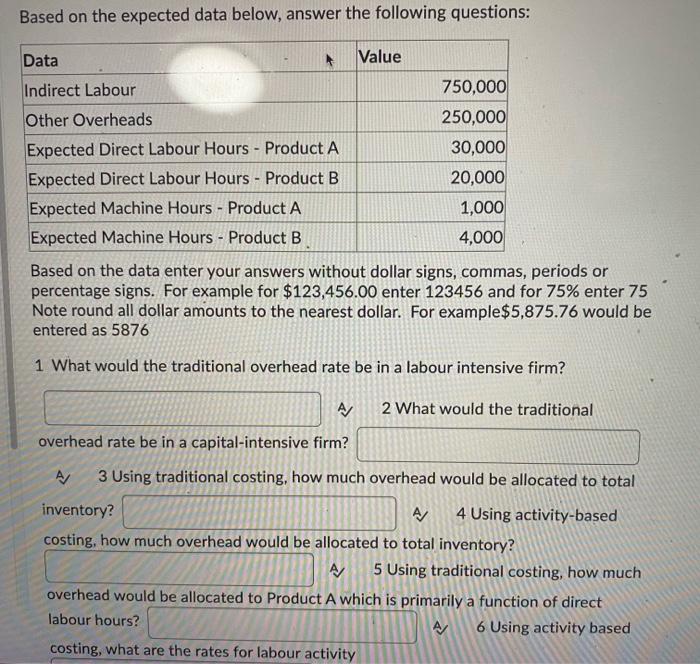

Question: Based on the expected data below, answer the following questions: Data Indirect Labour Other Overheads Expected Direct Labour Hours - Product A Expected Direct Labour

Based on the expected data below, answer the following questions: Based on the data enter your answers without dollar signs, commas, periods or percentage signs. For example for $123,456.00 enter 123456 and for 75% enter 75 Note round all dollar amounts to the nearest dollar. For example $5,875.76 would be entered as 5876 1 What would the traditional overhead rate be in a labour intensive firm? A 2 What would the traditional overhead rate be in a capital-intensive firm? A 3 Using traditional costing, how much overhead would be allocated to total inventory? A 4 Using activity-based costing, how much overhead would be allocated to total inventory? A 5 Using traditional costing, how much overhead would be allocated to Product A which is primarily a function of direct labour hours? A 6 Using activity based costing, what are the rates for labour activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts