Question: Based on the financial data provided, please answer the two questions. How can the farm improve cash flow? What cash flow management techniques is the

Based on the financial data provided, please answer the two questions.

How can the farm improve cash flow?

What cash flow management techniques is the farm performing well?

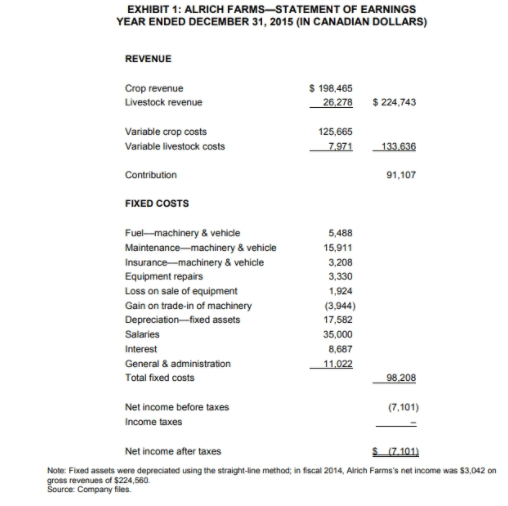

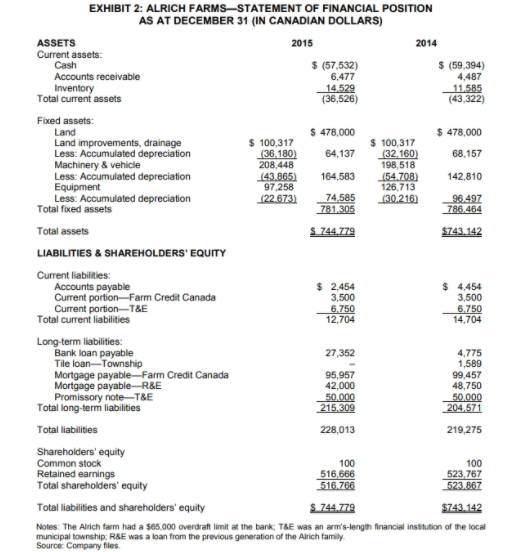

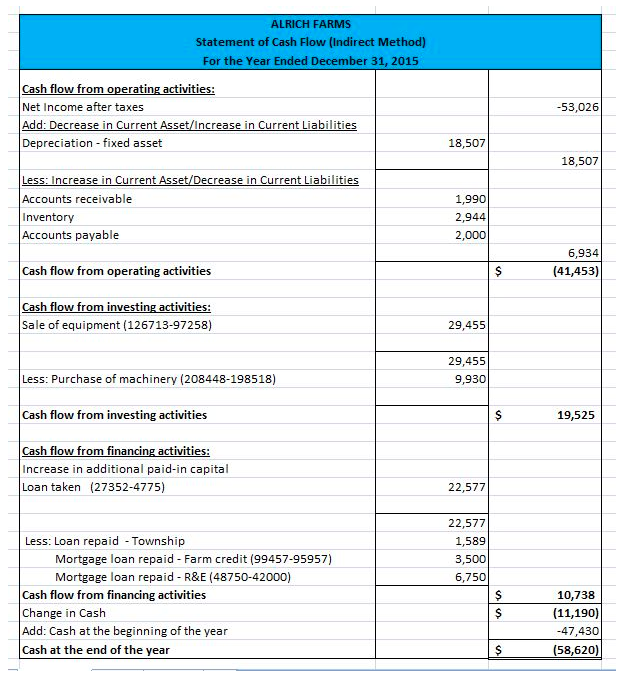

EXHIBIT 1: ALRICH FARMS-STATEMENT OF EARNINGS YEAR ENDED DECEMBER 31, 2015 (IN CANADIAN DOLLARS) REVENUE Crop revenue Livestock revenue $ 198,465 26,278 $ 224,743 Variable crop costs Variable livestock costs 125,665 7.971 133.636 Contribution 91,107 FIXED COSTS Fuel machinery & vehide Maintenance-machinery & vehicle Insurancemachinery & vehicle Equipment repairs Loss on sale of equipment Gain on trade-in of machinery Depreciation-fixed assets Salaries Interest General & administration Total fixed costs 5,488 15,911 3.208 3,330 1,924 (3,944) 17,582 35,000 8,687 11.022 98,208 Net income before taxes Income taxes (7,101) Net income after taxes (7.1011 Note: Fixed assets were depreciated using the straight-line method in fiscal 2014, Alrich Farms's net income was $3,042 on gross revenues of $224,560 Source: Company files EXHIBIT 2: ALRICH FARMS-STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31 (IN CANADIAN DOLLARS) ASSETS 2015 2014 Current assets: Cash $ (57,532) $ (59.394) Accounts receivable 6,477 4,487 Inventory 14,529 11.585 Total current assets (36,526) (43,322) Fixed assets: Land $ 478,000 $ 478,000 Land improvements, drainage $ 100,317 $ 100,317 Less: Accumulated depreciation (36.180) 64,137 (32,160) 68,157 Machinery & vehicle 208,448 198,518 Less: Accumulated depreciation (43.865) 164,583 154.708) 142,810 Equipment 97,258 126,713 Less: Accumulated depreciation (22.673) 74,585 130.216) 96.497 Total fixed assets 781.305 786,464 Total assets $ 744.779 $743.142 LIABILITIES & SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $ 2,454 $ 4,454 Current portion-Farm Credit Canada 3,500 3,500 Current portion--T&E 6.750 6.750 Total current liabilities 12,704 14,704 Long-term liabilities: Bank loan payable 27,352 4,775 Tile loan-Township 1.589 Mortgage payable --Farm Credit Canada 95,957 99,457 Mortgage payable-R&E 42,000 48,750 Promissory noteT&E 50.000 50.000 Total long-term liabilities 215,309 204,571 Total liabilities 228,013 219,275 Shareholders' equity Common stock 100 100 Retained earnings 516,666 523 767 Total shareholders' equity 516.766 523.867 Total liabilities and shareholders' equity S. 744.779 $743.142 Notes: The Alrich farm had a $65.000 overdraft limit at the bank, T&E was an arm's-length financial institution of the local municipal township: R&E was a loan from the previous generation of the Alrich family Source: Company files ALRICH FARMS Statement of Cash Flow (Indirect Method) For the Year Ended December 31, 2015 Cash flow from operating activities: Net Income after taxes Add: Decrease in Current Asset/Increase in Current Liabilities Depreciation - fixed asset -53,026 18,507 18,507 Less: Increase in Current Asset/Decrease in Current Liabilities Accounts receivable Inventory Accounts payable 1,990 2,944 2,000 Cash flow from operating activities 6,934 (41,453) $ Cash flow from investing activities: Sale of equipment (126713-97258) 29,455 Less: Purchase of machinery (208448-198518) 29,455 9,930 cash flow from investing activities $ 19,525 Cash flow from financing activities: Increase in additional paid-in capital Loan taken (27352-4775) 22,577 22,577 1,589 3,500 6,750 Less: Loan repaid - Township Mortgage loan repaid - Farm credit (99457-95957) Mortgage loan repaid - R&E (48750-42000) Cash flow from financing activities Change in Cash Add: Cash at the beginning of the year Cash at the end of the year $ 10,738 (11,190) -47,430 (58,620)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts