Question: 11. Based on the financial statements given in Table 1 and 2 above, calculate the efficiency ratios, liquidity ratios, leverage ratios, and profitability ratios for

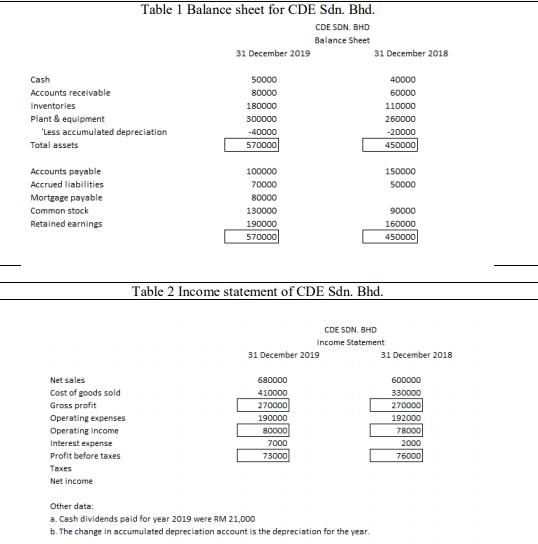

11. Based on the financial statements given in Table 1 and 2 above, calculate the efficiency ratios, liquidity ratios, leverage ratios, and profitability ratios for CDE Sdn. Bhd. in 2019. Where data is available, also the calculate ratios for 2018. Use a 360-day year. All sales are on credit to business customers. Assume an income tax rate of 30 percent.

12. Analyse the financial health of CDE Sdn. Bhd. using the ratios calculated in 11.

Table 1 Balance sheet for CDE Sdn. Bhd. CDE SDN. BHD Balance Sheet 31 December 2019 31 December 2018 Cash 50000 40000 Accounts receivable 80000 60000 Inventories 180000 110000 Plant & equipment 300000 260000 'Less accumulated depreciation -40000 -20000 570000 450000 Total assets Accounts payable 100000 150000 Accrued liabilities 70000 50000 Mortgage payable 80000 Common stock 130000 90000 Retained earnings 190000 160000 570000 450000 Table 2 Income statement of CDE Sdn. Bhd. CDE SDN. BHD Income Statement 31 December 2019 31 December 2018 Net sales 680000 600000 Cost of goods sold 410000 330000 270000 192000 78000 Gross profit 270000 Operating expenses 190000 80000 Operating income Interest expense 7000 2000 Profit before taxes 73000 76000 s Net income Other data: a. Cash dividends paid for year 2019 were RM 21,000 b. The change in accumulated depreciation account is the depreciation for the year.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

11 Ratios calculated for the year 2019 are as follows B D Efficiency Ratios Total Asset Turnover Rat... View full answer

Get step-by-step solutions from verified subject matter experts