Question: Based on the following data, would Beth and Roger Simmons recelve a refund or owe additional taxes? What is the amount? (Do not round any

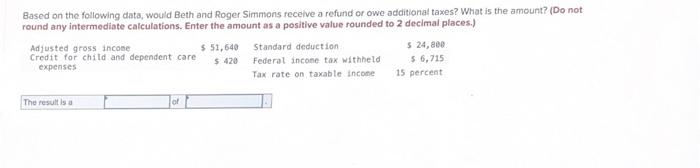

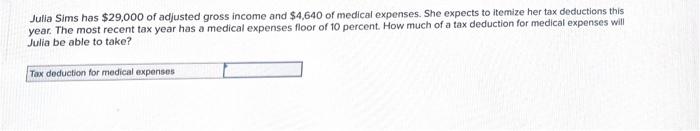

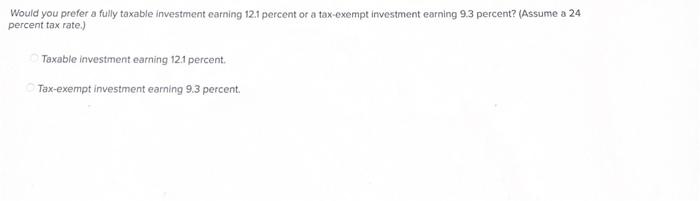

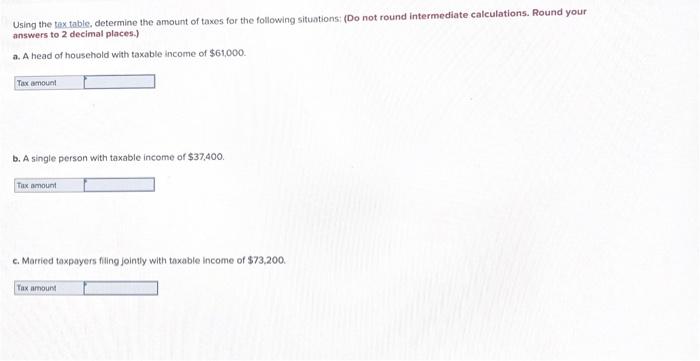

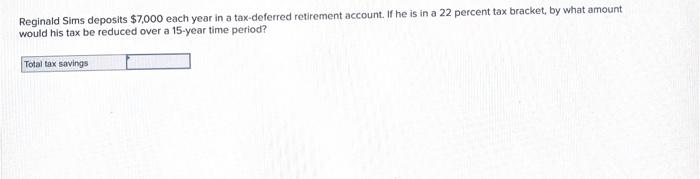

Based on the following data, would Beth and Roger Simmons recelve a refund or owe additional taxes? What is the amount? (Do not round any intermediate calculations. Enter the amount as a positive value rounded to 2 decimal places.) Reginald Sims deposits $7,000 each year in a tax-deferred retirement account. If he is in a 22 percent tax bracket, by what amount would his tax be reduced over a 15-year time period? Julia Sims has $29,000 of adjusted gross income and $4,640 of medical expenses. She expects to itemize her tax deductions this year. The most recent tax year has a medical expenses floor of 10 percent. How much of a tax deduction for medical expenses will Julia be able to take? Would you prefer a fully taxable investment earning 12.1 percent or a tax-exempt investment earning 9.3 percent? (Assume a 24 percent tax rate.) Taxable investment earning 12.1 percent. Tax-exempt investment earning 9.3 percent. Using the tex table, determine the amount of taxes for the following situations; (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of houschold with taxable income of $61,000. b. A single person with taxable income of $37,400. c. Married taxpayers fling jointly with taxable income of $73,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts