Question: Based on the following growth table discuss the return on both arithmetic and geometric growth from Sheet 1. Suggest how AR becomes more profitable

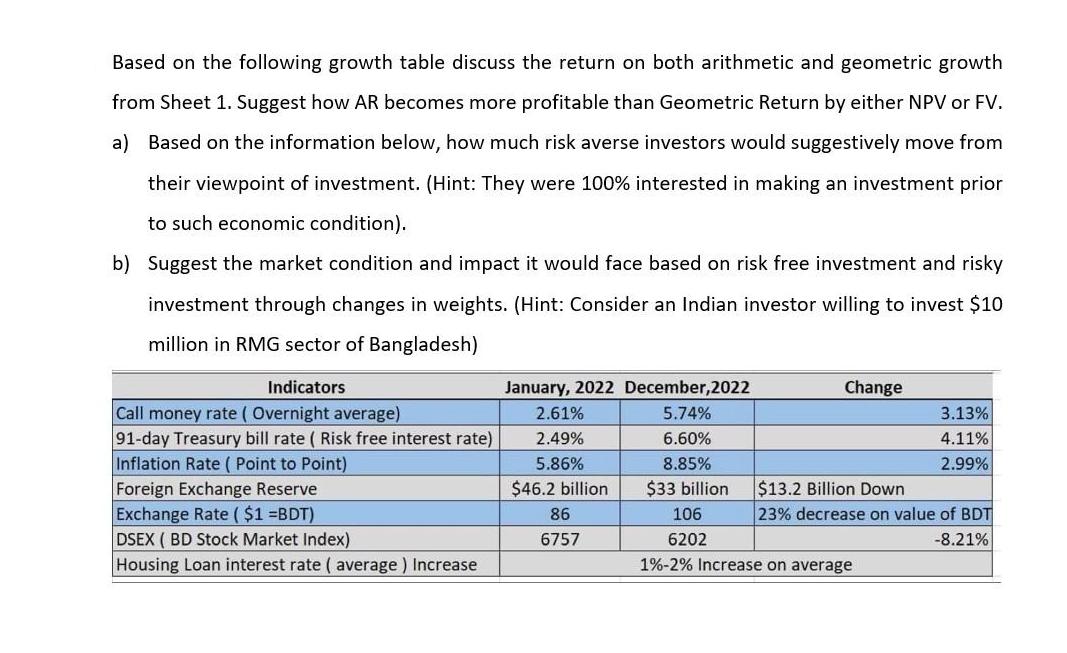

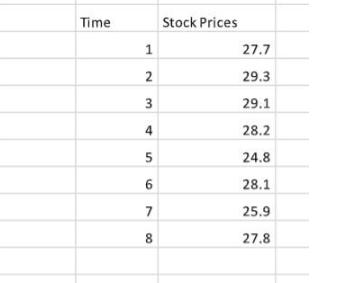

Based on the following growth table discuss the return on both arithmetic and geometric growth from Sheet 1. Suggest how AR becomes more profitable than Geometric Return by either NPV or FV. a) Based on the information below, how much risk averse investors would suggestively move from their viewpoint of investment. (Hint: They were 100% interested in making an investment prior to such economic condition). b) Suggest the market condition and impact it would face based on risk free investment and risky investment through changes in weights. (Hint: Consider an Indian investor willing to invest $10 million in RMG sector of Bangladesh) Indicators Call money rate ( Overnight average) 91-day Treasury bill rate ( Risk free interest rate) Inflation Rate ( Point to Point) Foreign Exchange Reserve Exchange Rate ($1 =BDT) DSEX (BD Stock Market Index) Housing Loan interest rate (average) Increase January, 2022 December,2022 2.61% 5.74% 2.49% 6.60% 5.86% 8.85% $46.2 billion $33 billion 86 106 6757 6202 1% -2% Increase on average Change 3.13% 4.11% 2.99% $13.2 Billion Down 23% decrease on value of BDT -8.21% Time 1 2 3 4 5 6 7 8 Stock Prices 27.7 29.3 29.1 28.2 24.8 28.1 25.9 27.8

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

a Risk averse investors would be less likely to make investments in such economic conditions They may opt for risk free investments such as treasury bills or bonds which offer higher returns with lower risk They may also diversify their portfolios to reduce risk b The market condition ... View full answer

Get step-by-step solutions from verified subject matter experts