Question: Based on the following information, answer the questions below. The time from acceptance to maturity on a $5m Banker's Acceptance (BA) is 180 days. The

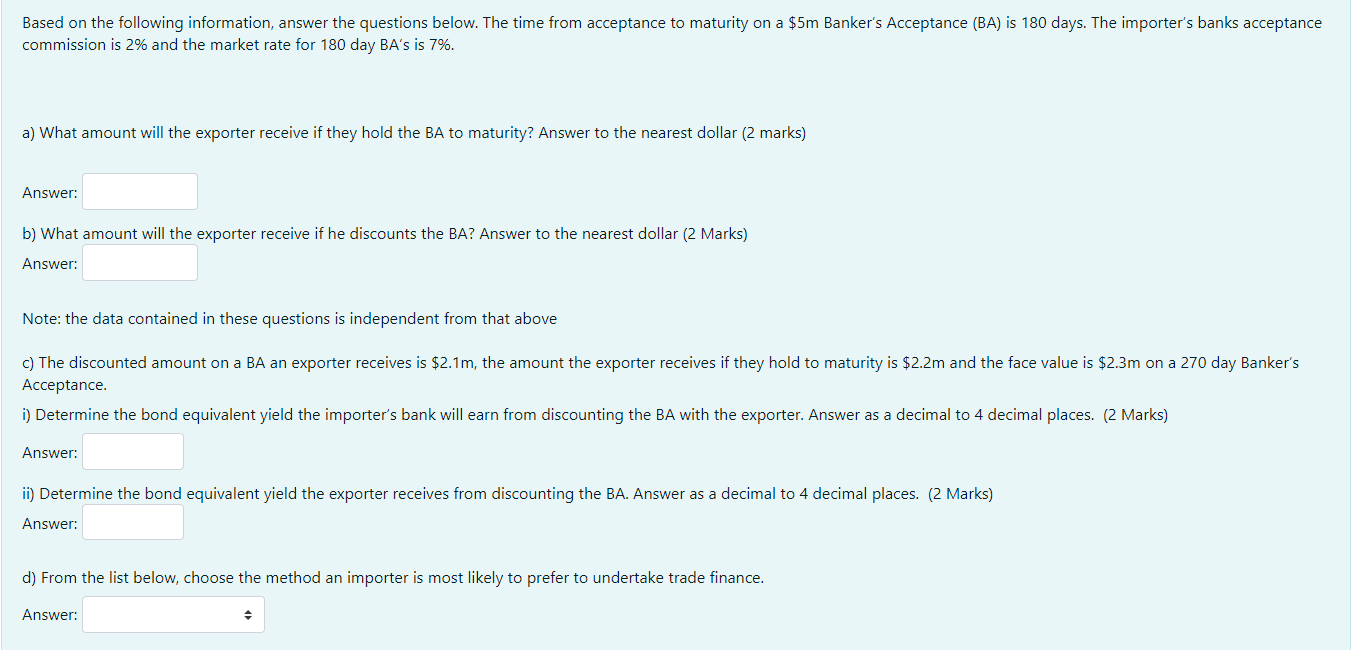

Based on the following information, answer the questions below. The time from acceptance to maturity on a $5m Banker's Acceptance (BA) is 180 days. The importer's banks acceptance commission is 2% and the market rate for 180 day BA's is 7%. a) What amount will the exporter receive if they hold the BA to maturity? Answer to the nearest dollar (2 marks) Answer: b) What amount will the exporter receive if he discounts the BA? Answer to the nearest dollar (2 Marks) Answer: Note: the data contained in these questions is independent from that above c) The discounted amount on a BA an exporter receives is $2.1m, the amount the exporter receives if they hold to maturity is $2.2m and the face value is $2.3m on a 270 day Banker's Acceptance. i) Determine the bond equivalent yield the importer's bank will earn from discounting the BA with the exporter. Answer as a decimal to 4 decimal places. (2 Marks) Answer: ii) Determine the bond equivalent yield the exporter receives from discounting the BA. Answer as a decimal to 4 decimal places. (2 Marks) Answer: d) From the list below, choose the method an importer is most likely to prefer to undertake trade finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts