Question: Based on the following information, calculate the expected return and standard deviation for the two stocks: table [ [ , Rate of return if

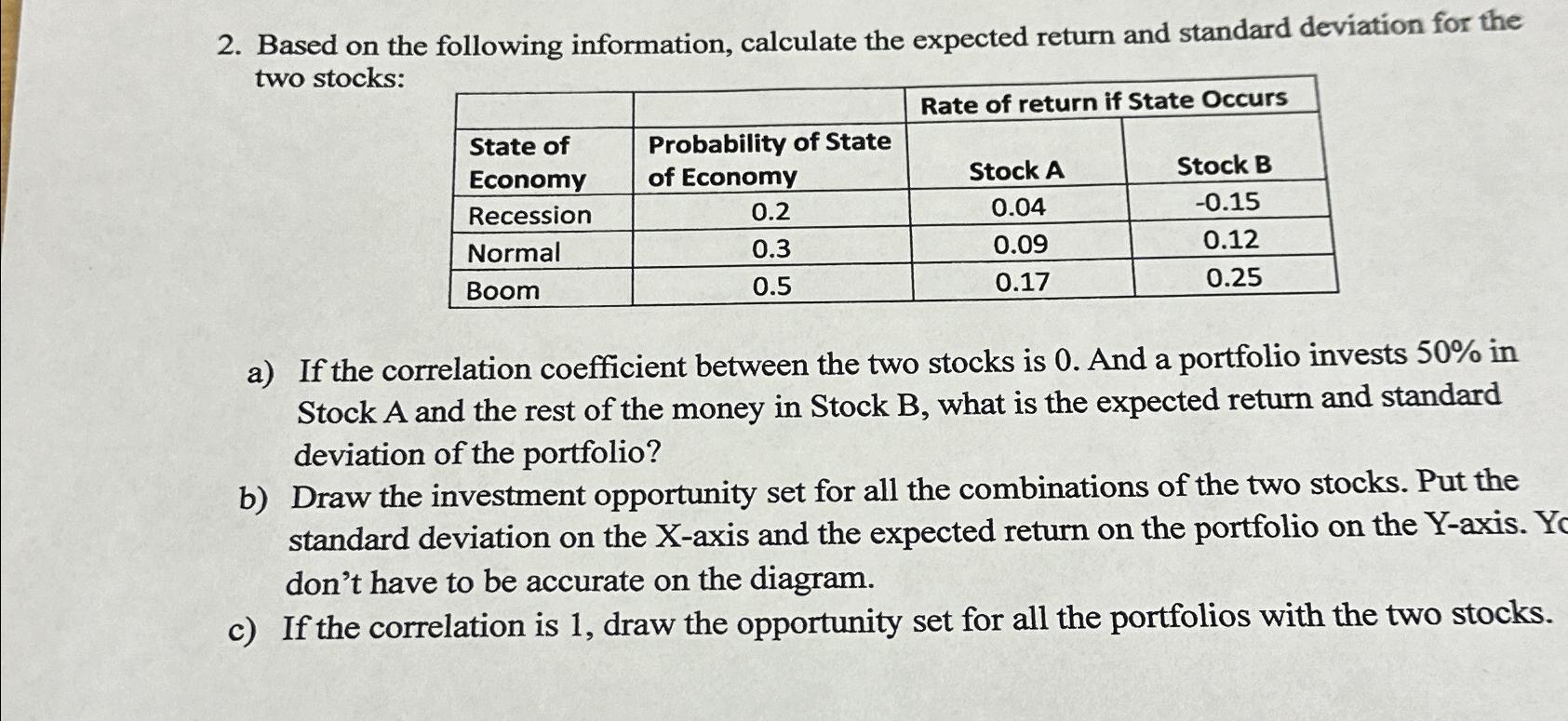

Based on the following information, calculate the expected return and standard deviation for the two stocks:

tableRate of return if State OccurstableState ofEconomytableProbability of Stateof EconomyStock AStock BRecessionNormalBoom

a If the correlation coefficient between the two stocks is And a portfolio invests in Stock A and the rest of the money in Stock B what is the expected return and standard deviation of the portfolio?

b Draw the investment opportunity set for all the combinations of the two stocks. Put the standard deviation on the axis and the expected return on the portfolio on the axis. don't have to be accurate on the diagram.

c If the correlation is draw the opportunity set for all the portfolios with the two stocks.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock