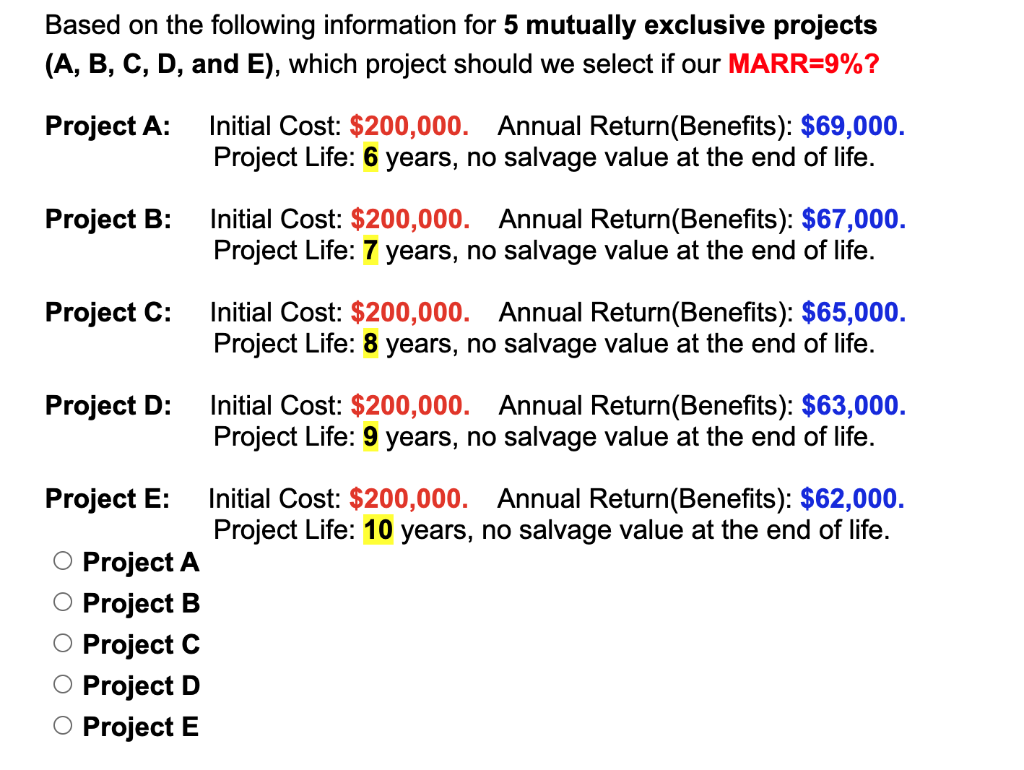

Question: Based on the following information for 5 mutually exclusive projects (A, B, C, D, and E), which project should we select if our MARR =9%

Based on the following information for 5 mutually exclusive projects (A, B, C, D, and E), which project should we select if our MARR =9% ? Project A: Initial Cost: $200,000. Annual Return(Benefits): $69,000. Project Life: 6 years, no salvage value at the end of life. Project B: Initial Cost: $200,000. Annual Return(Benefits): $67,000. Project Life: 7 years, no salvage value at the end of life. Project C: Initial Cost: $200,000. Annual Return(Benefits): $65,000. Project Life: 8 years, no salvage value at the end of life. Project D: Initial Cost: $200,000. Annual Return(Benefits): $63,000. Project Life: 9 years, no salvage value at the end of life. Project E: Initial Cost: $200,000. Annual Return(Benefits): $62,000. Project A Project Life: 10 years, no salvage value at the end of life. Project B Project C Project D Project E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts