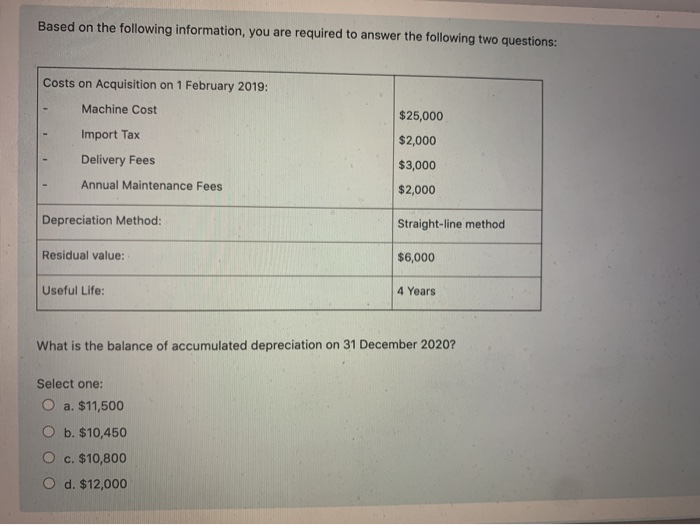

Question: Based on the following information, you are required to answer the following two questions: Costs on Acquisition on 1 February 2019: Machine Cost $25,000 Import

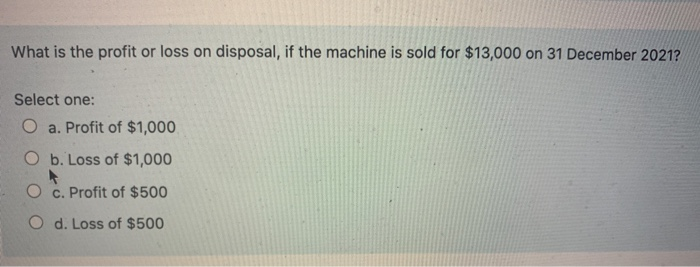

Based on the following information, you are required to answer the following two questions: Costs on Acquisition on 1 February 2019: Machine Cost $25,000 Import Tax Delivery Fees $2,000 $3,000 Annual Maintenance Fees $2,000 Depreciation Method: Straight-line method Residual value: $6,000 Useful Life: 4 Years What is the balance of accumulated depreciation on 31 December 2020? Select one: O a. $11,500 O b. $10,450 O c. $10,800 d. $12,000 What is the profit or loss on disposal, if the machine is sold for $13,000 on 31 December 2021? Select one: O a. Profit of $1,000 O b. Loss of $1,000 O c. Profit of $500 O d. Loss of $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts