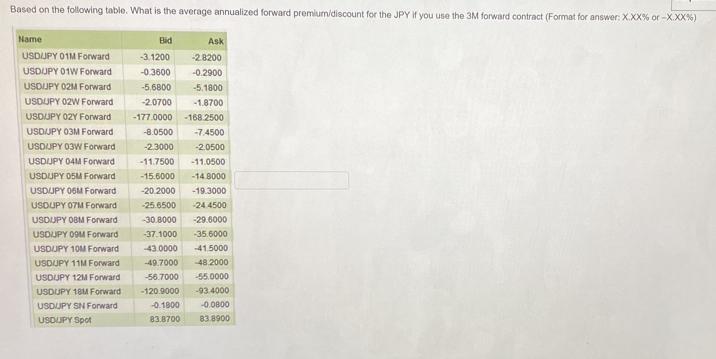

Question: Based on the following table. What is the average annualized forward premium/discount for the JPY if you use the 3M forward contract (Format for

Based on the following table. What is the average annualized forward premium/discount for the JPY if you use the 3M forward contract (Format for answer: X.XX% or -X.XX%) Name USDUPY 01M Forward USDUPY 01W Forward USDUPY 02M Forward USDUPY 02W Forward USDUPY 02Y Forward USDUJPY 03M Forward USDUPY 03W Forward USDUPY 04M Forward USDUPY 05M Forward USDUPY 06M Forward USDUPY 07M Forward USDUPY 0BM Forward USDUPY 09M Forward USDUPY 10M Forward USDUPY 11M Forward USDUPY 12M Forward USDUPY 18M Forward USDUPY SN Forward USDUPY Spot Bid -3.1200 -2.8200 -0.3600 -0.2900 -5,6800 -5.1800 -2.0700 -1.8700 -177.0000 -168.2500 -8.0500 -7.4500 -2.3000 -2.0500 -11.7500 -11.0500 -15.6000 -14.8000 -20.2000 -19.3000 -25.6500 -24.4500 -30.8000 -29.6000 -37.1000 -35.6000 -43.0000 -41.5000 -48.2000 55.0000 -93.4000 -0.0800 83.8900 -49.7000 -56.7000 -120.9000 Ask -0.1800 83.8700

Step by Step Solution

3.35 Rating (142 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Mid spot r... View full answer

Get step-by-step solutions from verified subject matter experts