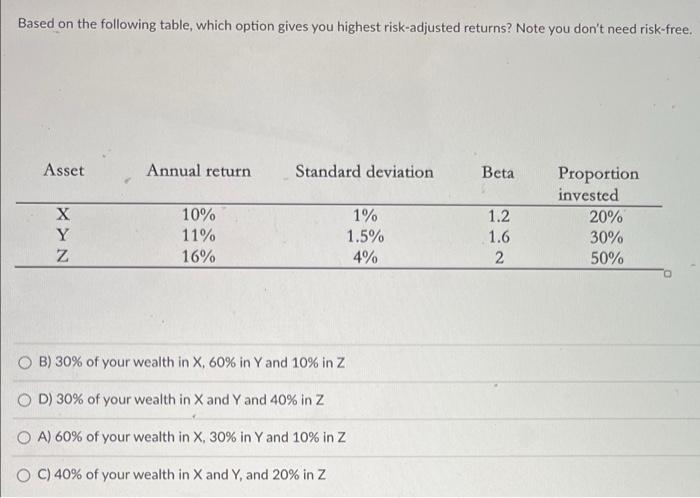

Question: Based on the following table, which option gives you highest risk-adjusted returns? Note you don't need risk-free. Asset Annual return Standard deviation Beta XN 10%

Based on the following table, which option gives you highest risk-adjusted returns? Note you don't need risk-free. Asset Annual return Standard deviation Beta XN 10% 11% 16% Y 1% 1.5% 4% Proportion invested 20% 30% 50% 1.2 1.6 2 B) 30% of your wealth in X, 60% in Yand 10% in z OD) 30% of your wealth in X and Y and 40% in Z O A) 60% of your wealth in X, 30% in Y and 10% in z OC) 40% of your wealth in X and Y, and 20% in Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts