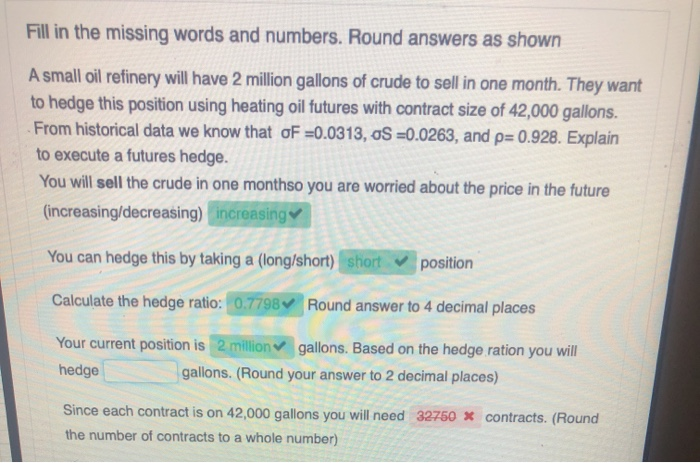

Question: based on the hedge ratio you will ? gallons Fill in the missing words and numbers. Round answers as shown A small oil refinery will

Fill in the missing words and numbers. Round answers as shown A small oil refinery will have 2 million gallons of crude to sell in one month. They want to hedge this position using heating oil futures with contract size of 42,000 gallons. From historical data we know that oF =0.0313, OS =0.0263, and p= 0.928. Explain to execute a futures hedge. You will sell the crude in one monthso you are worried about the price in the future (increasing/decreasing) increasing You can hedge this by taking a (long/short) short position Calculate the hedge ratio: 0.7798 Round answer to 4 decimal places Your current position is 2 million gallons. Based on the hedge ration you will hedge gallons. (Round your answer to 2 decimal places) Since each contract is on 42,000 gallons you will need 32750 * contracts. (Round the number of contracts to a whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts