Question: Based on the H-model the implored expected rate of return for UHS is closest to Universal Home Supplies, Inc. UHSoperates nearly 200 department stores and

Based on the H-model the implored expected rate of return for UHS is closest to

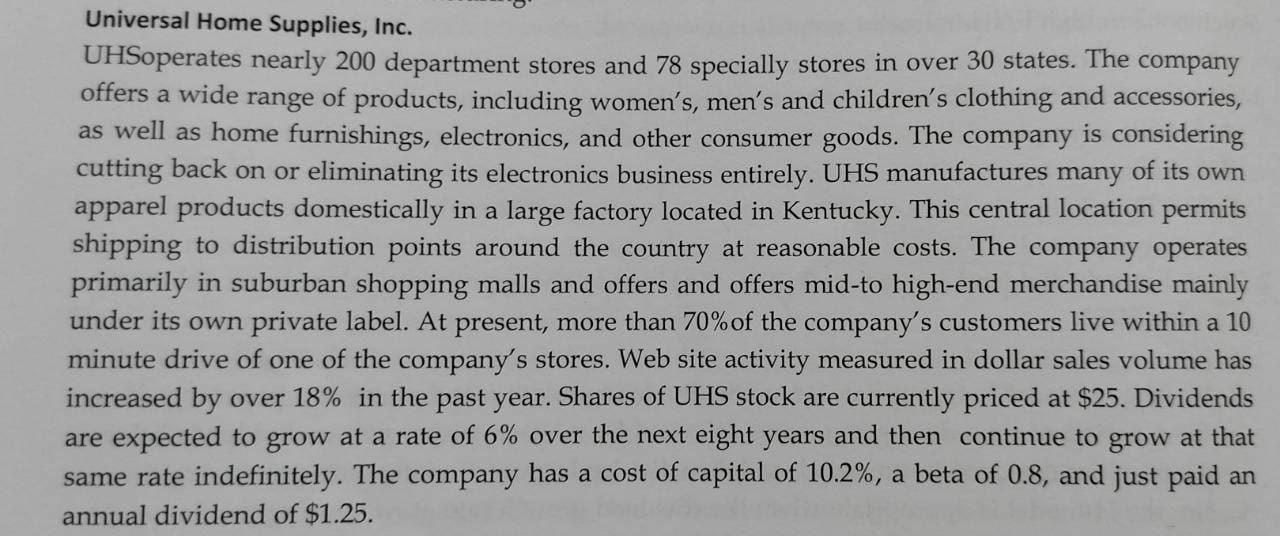

Universal Home Supplies, Inc. UHSoperates nearly 200 department stores and 78 specially stores in over 30 states. The company offers a wide range of products, including women's, men's and children's clothing and accessories, as well as home furnishings, electronics, and other consumer goods. The company is considering cutting back on or eliminating its electronics business entirely. UHS manufactures many of its own apparel products domestically in a large factory located in Kentucky. This central location permits shipping to distribution points around the country at reasonable costs. The company operates primarily in suburban shopping malls and offers and offers mid-to high-end merchandise mainly under its own private label. At present, more than 70%of the company's customers live within a 10 minute drive of one of the company's stores. Web site activity measured in dollar sales volume has increased by over 18% in the past year. Shares of UHS stock are currently priced at $25. Dividends are expected to grow at a rate of 6% over the next eight years and then continue to grow at that same rate indefinitely. The company has a cost of capital of 10.2%, a beta of 0.8, and just paid an annual dividend of $1.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts