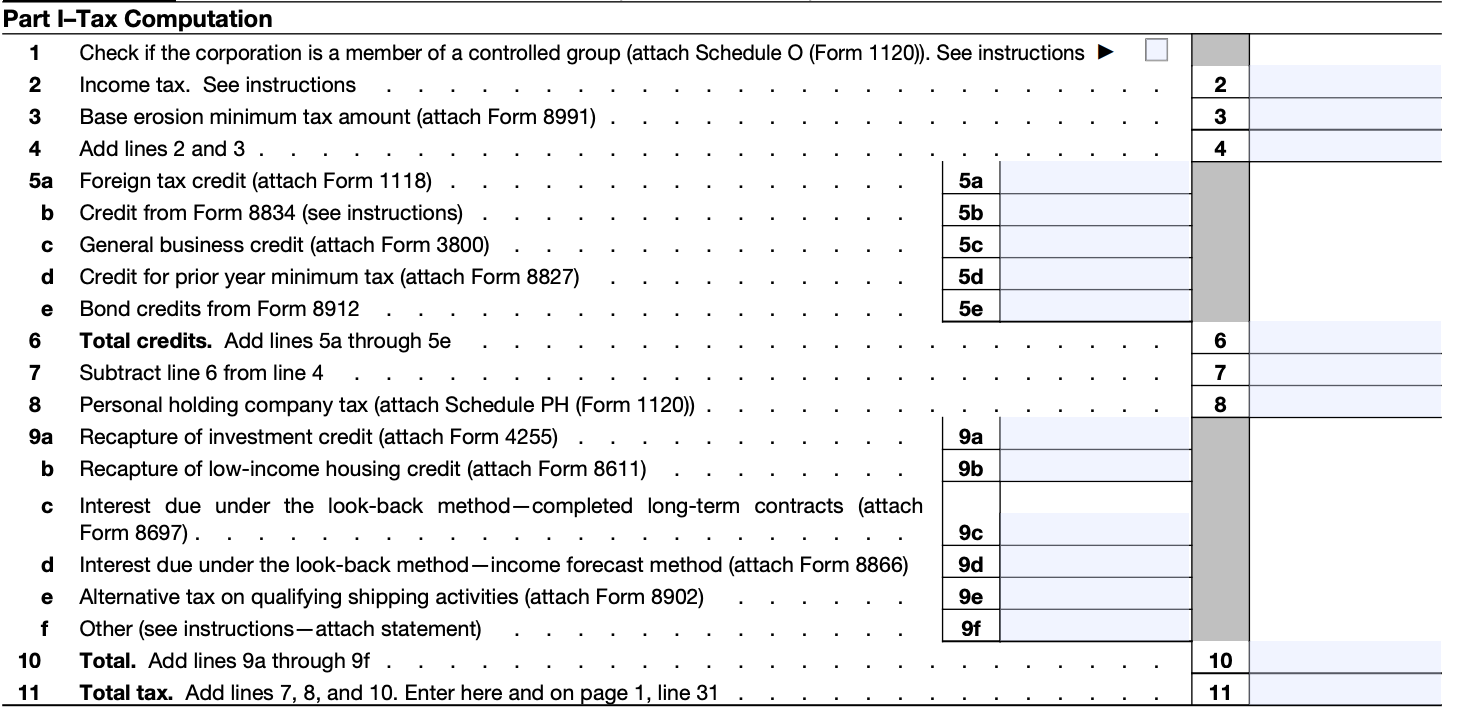

Question: Based on the information above please fill out the section from form 1120 to find total tax or compute tentative total tax for year 2019

Based on the information above please fill out the section from form 1120 to find total tax or compute tentative total tax for year 2019

Based on the information above please fill out the section from form 1120 to find total tax or compute tentative total tax for year 2019

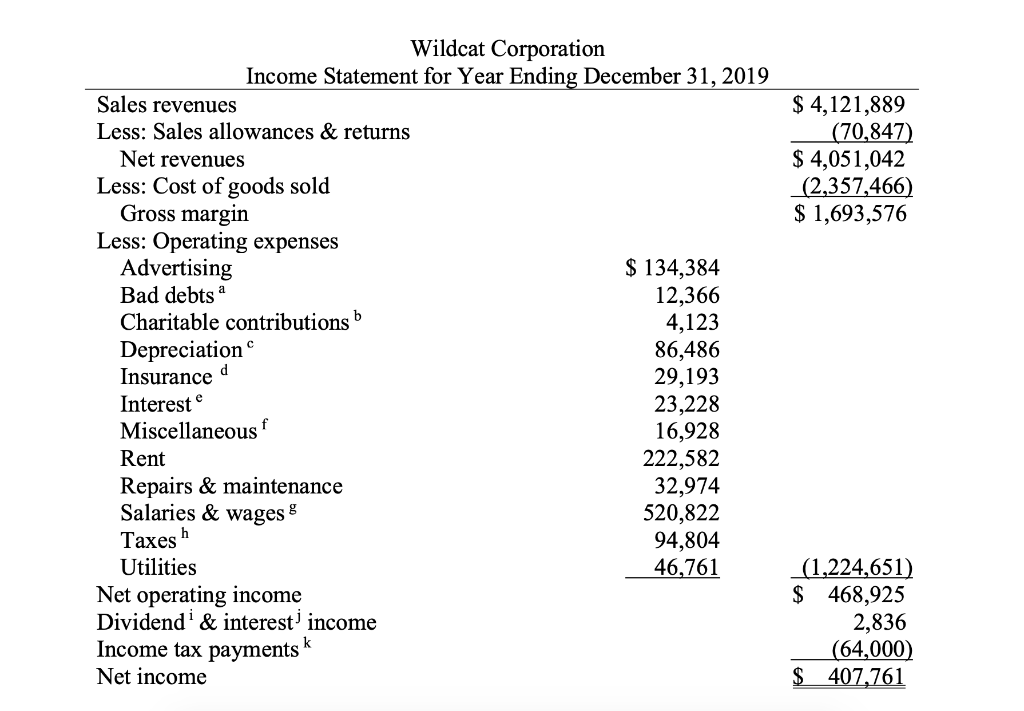

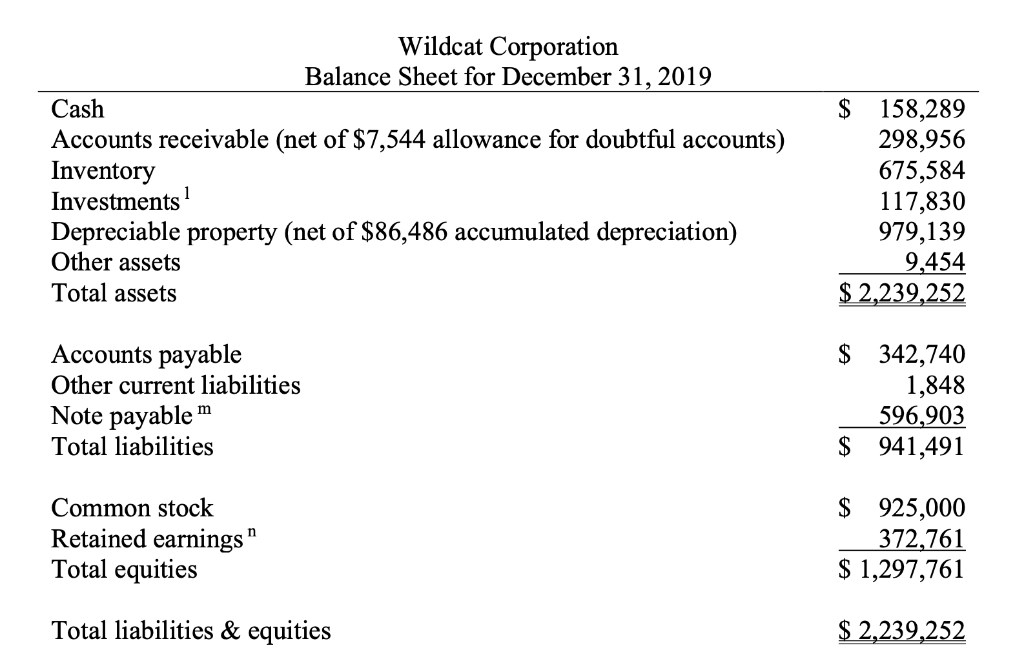

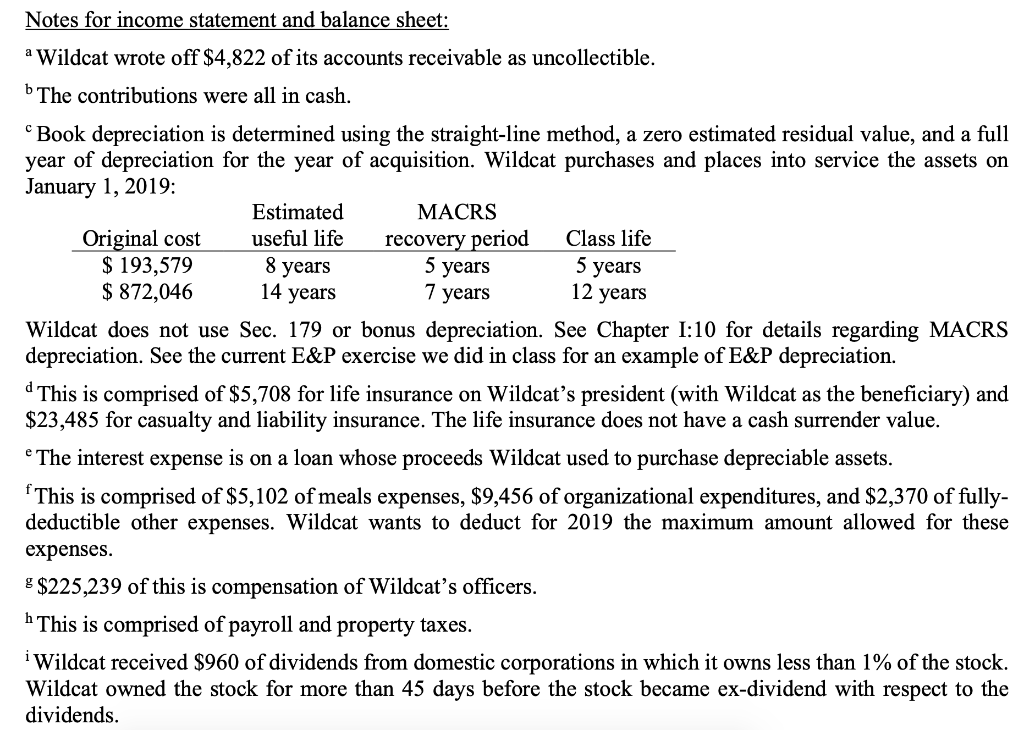

$ 4,121,889 (70,847) $ 4,051,042 (2,357,466) $ 1,693,576 Wildcat Corporation Income Statement for Year Ending December 31, 2019 Sales revenues Less: Sales allowances & returns Net revenues Less: Cost of goods sold Gross margin Less: Operating expenses Advertising $ 134,384 Bad debts a 12,366 Charitable contributions b 4,123 Depreciation 86,486 Insurance d 29,193 Interest 23,228 Miscellaneous 16,928 Rent 222,582 Repairs & maintenance 32,974 Salaries & wages ! 520,822 Taxesh 94,804 Utilities 46,761 Net operating income Dividendi & interest income Income tax payments Net income (1,224,651) $ 468,925 2,836 (64,000 $ 407,761 Wildcat Corporation Balance Sheet for December 31, 2019 Cash Accounts receivable (net of $7,544 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $86,486 accumulated depreciation) Other assets Total assets $ 158,289 298,956 675,584 117,830 979,139 9,454 $ 2,239,252 $ Accounts payable Other current liabilities Note payable m Total liabilities 342,740 1,848 596,903 941,491 $ Common stock Retained earnings Total equities $ 925,000 372,761 $ 1,297,761 Total liabilities & equities $ 2,239,252 Notes for income statement and balance sheet: a Wildcat wrote off $4,822 of its accounts receivable as uncollectible. b The contributions were all in cash. Book depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2019: Estimated MACRS Original cost useful life recovery period Class life $ 193,579 8 years 5 years 5 years $ 872,046 14 years 7 years 12 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter 1:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. for life insurance on Wildcat's president (with Wildcat as the beneficiary) and $23,485 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. * This is comprised of $5,102 of meals expenses, $9,456 of organizational expenditures, and $2,370 of fully- deductible other expenses. Wildcat wants to deduct for 2019 the maximum amount allowed for these expenses. $ $225,239 of this is compensation of Wildcat's officers. h This is comprised of payroll and property taxes. i Wildcat received $960 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildcat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. j Wildcat received $1,108 of interest on investments in corporate bonds and $768 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $16,000 each. This is comprised of $31,944 of stocks, $34,098 of corporate bonds, and $51,788 of municipal bonds. m $55,616 of the note payable is a current liability, and $541,287 is a long-term liability. n The retained earnings are unappropriated. Wildcat paid $35,000 of cash dividends to its shareholders during the year. Hint for items a, d, and f: See the highlights of the material for Thursday, January 30 and Tuesday, February 4. . . | 3 . 50 Part I-Tax Computation 1 Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions Income tax. See instructions . . . . . . . . . . . . . . . 3 Base erosion minimum tax amount (attach Form 8991) . . . . . . . . . . . . . . . . 4 Add lines 2 and 3. . . . . . . . . . . . . . . . . . . . . . 5a Foreign tax credit (attach Form 1118) . . . . . . . . . . . . . . . b Credit from Form 8834 (see instructions) . . . . . . . . . . . 5b General business credit (attach Form 3800) . . . . . . . . . . . d Credit for prior year minimum tax (attach Form 8827) . . 5d e Bond credits from Form 8912 . . . . . . . . . . . . . . 5e 6 Total credits. Add lines 5a through 5e . . . . . . . . . . . . . . . . . . . . 7 Subtract line 6 from line 4 . . . . . . . . . . . . . . . . . . . . . . . 8 Personal holding company tax (attach Schedule PH (Form 1120)). . . 9a Recapture of investment credit (attach Form 4255) . . . . . . . . . . . 9a Recapture of low-income housing credit (attach Form 8611) . . . . . . . . 9b Interest due under the look back method-completed long-term contracts (attach Form 8697). . . . . . . . . . . . . . . . . . . . . . d Interest due under the look-back method-income forecast method (attach Form 8866) | 9d e Alternative tax on qualifying shipping activities (attach Form 8902) . . . . . . 9e f Other (see instructions-attach statement) . . . . . . . . . . . . 9f 10 Total. Add lines 9a through 9f . . . . . . . . . . . . . . . . . . . . . 11 Total tax. Add lines 7, 8, and 10. Enter here and on page 1, line 31 . . . . . . . . . . . . . . . . 6 7 b . . . . 10 | 11 $ 4,121,889 (70,847) $ 4,051,042 (2,357,466) $ 1,693,576 Wildcat Corporation Income Statement for Year Ending December 31, 2019 Sales revenues Less: Sales allowances & returns Net revenues Less: Cost of goods sold Gross margin Less: Operating expenses Advertising $ 134,384 Bad debts a 12,366 Charitable contributions b 4,123 Depreciation 86,486 Insurance d 29,193 Interest 23,228 Miscellaneous 16,928 Rent 222,582 Repairs & maintenance 32,974 Salaries & wages ! 520,822 Taxesh 94,804 Utilities 46,761 Net operating income Dividendi & interest income Income tax payments Net income (1,224,651) $ 468,925 2,836 (64,000 $ 407,761 Wildcat Corporation Balance Sheet for December 31, 2019 Cash Accounts receivable (net of $7,544 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $86,486 accumulated depreciation) Other assets Total assets $ 158,289 298,956 675,584 117,830 979,139 9,454 $ 2,239,252 $ Accounts payable Other current liabilities Note payable m Total liabilities 342,740 1,848 596,903 941,491 $ Common stock Retained earnings Total equities $ 925,000 372,761 $ 1,297,761 Total liabilities & equities $ 2,239,252 Notes for income statement and balance sheet: a Wildcat wrote off $4,822 of its accounts receivable as uncollectible. b The contributions were all in cash. Book depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2019: Estimated MACRS Original cost useful life recovery period Class life $ 193,579 8 years 5 years 5 years $ 872,046 14 years 7 years 12 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter 1:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. for life insurance on Wildcat's president (with Wildcat as the beneficiary) and $23,485 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. * This is comprised of $5,102 of meals expenses, $9,456 of organizational expenditures, and $2,370 of fully- deductible other expenses. Wildcat wants to deduct for 2019 the maximum amount allowed for these expenses. $ $225,239 of this is compensation of Wildcat's officers. h This is comprised of payroll and property taxes. i Wildcat received $960 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildcat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. j Wildcat received $1,108 of interest on investments in corporate bonds and $768 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $16,000 each. This is comprised of $31,944 of stocks, $34,098 of corporate bonds, and $51,788 of municipal bonds. m $55,616 of the note payable is a current liability, and $541,287 is a long-term liability. n The retained earnings are unappropriated. Wildcat paid $35,000 of cash dividends to its shareholders during the year. Hint for items a, d, and f: See the highlights of the material for Thursday, January 30 and Tuesday, February 4. . . | 3 . 50 Part I-Tax Computation 1 Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions Income tax. See instructions . . . . . . . . . . . . . . . 3 Base erosion minimum tax amount (attach Form 8991) . . . . . . . . . . . . . . . . 4 Add lines 2 and 3. . . . . . . . . . . . . . . . . . . . . . 5a Foreign tax credit (attach Form 1118) . . . . . . . . . . . . . . . b Credit from Form 8834 (see instructions) . . . . . . . . . . . 5b General business credit (attach Form 3800) . . . . . . . . . . . d Credit for prior year minimum tax (attach Form 8827) . . 5d e Bond credits from Form 8912 . . . . . . . . . . . . . . 5e 6 Total credits. Add lines 5a through 5e . . . . . . . . . . . . . . . . . . . . 7 Subtract line 6 from line 4 . . . . . . . . . . . . . . . . . . . . . . . 8 Personal holding company tax (attach Schedule PH (Form 1120)). . . 9a Recapture of investment credit (attach Form 4255) . . . . . . . . . . . 9a Recapture of low-income housing credit (attach Form 8611) . . . . . . . . 9b Interest due under the look back method-completed long-term contracts (attach Form 8697). . . . . . . . . . . . . . . . . . . . . . d Interest due under the look-back method-income forecast method (attach Form 8866) | 9d e Alternative tax on qualifying shipping activities (attach Form 8902) . . . . . . 9e f Other (see instructions-attach statement) . . . . . . . . . . . . 9f 10 Total. Add lines 9a through 9f . . . . . . . . . . . . . . . . . . . . . 11 Total tax. Add lines 7, 8, and 10. Enter here and on page 1, line 31 . . . . . . . . . . . . . . . . 6 7 b . . . . 10 | 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts