Question: Based on the information below, please decide whether or not you would approve the loan request. Why or why not? MILWAUKEE MACHINING, INC. CASE This

Based on the information below, please decide whether or not you would approve the loan request. Why or why not?

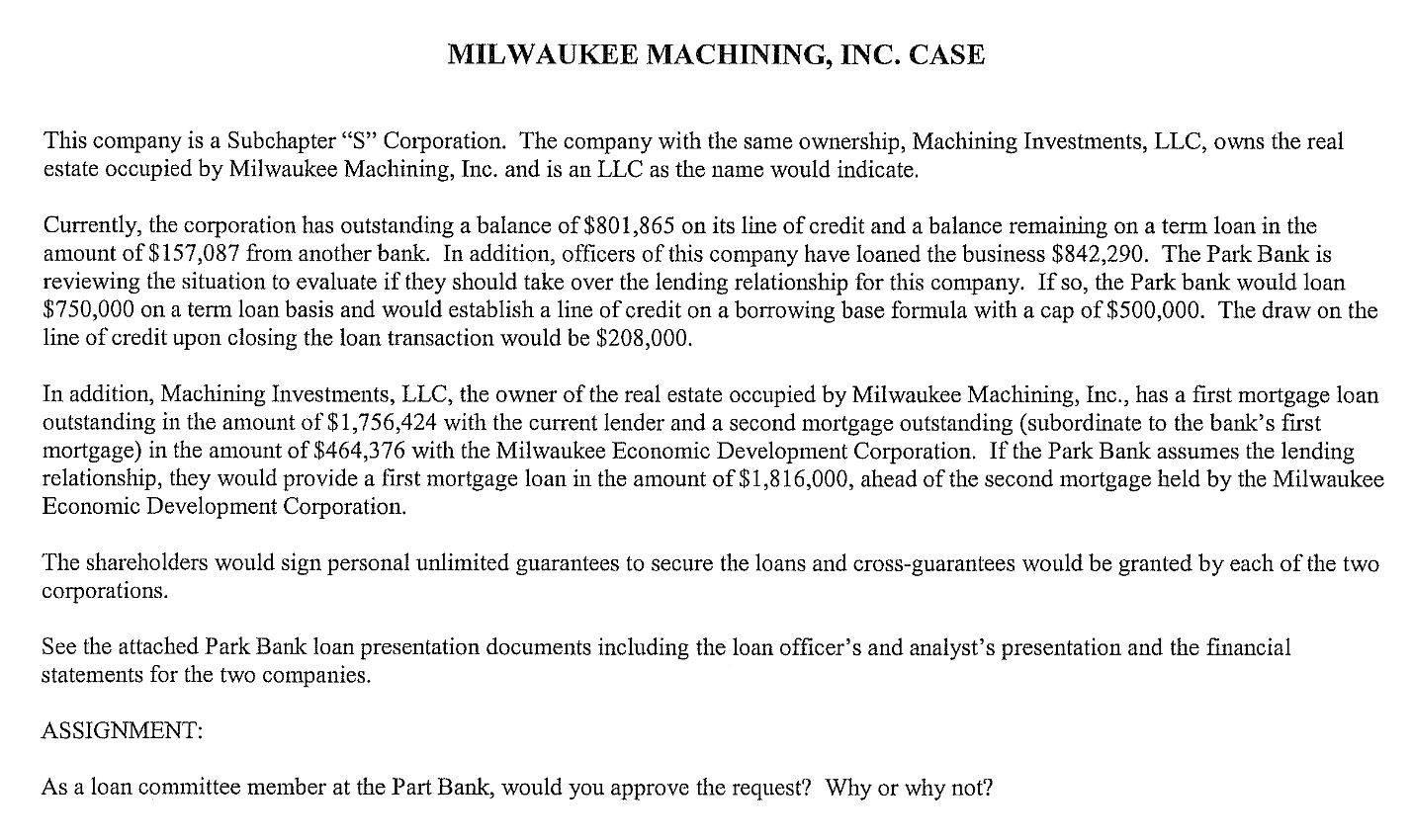

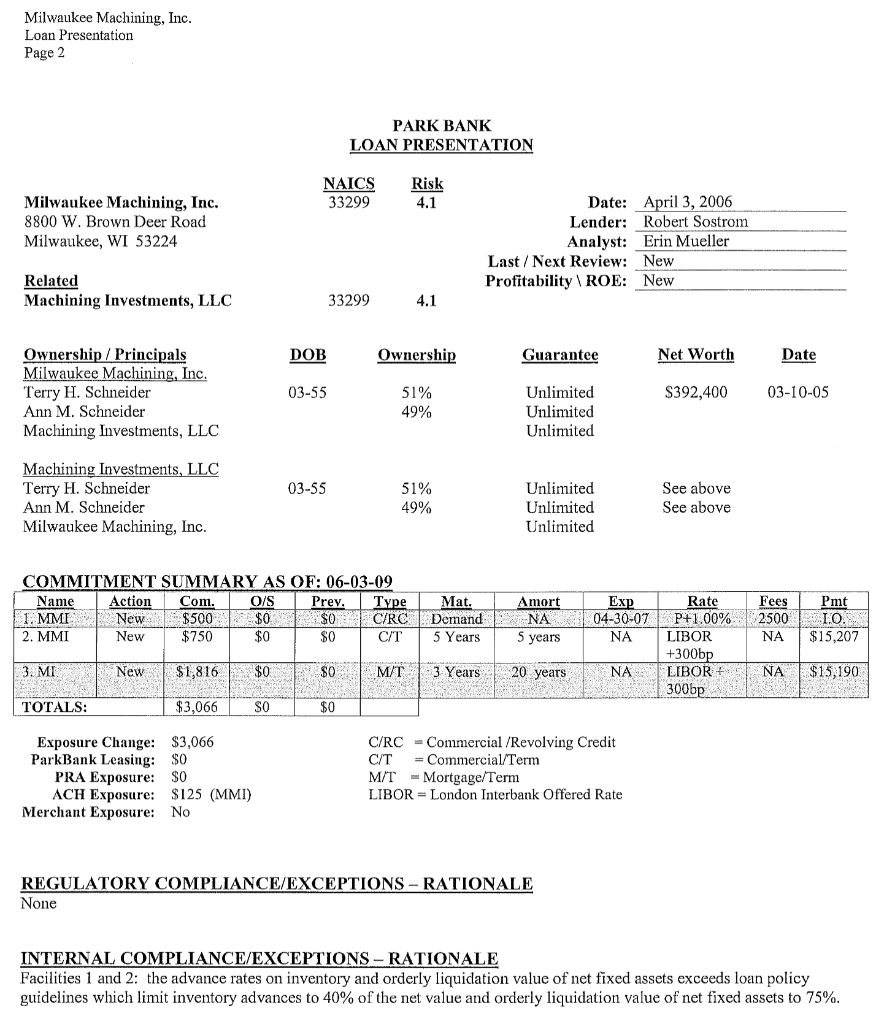

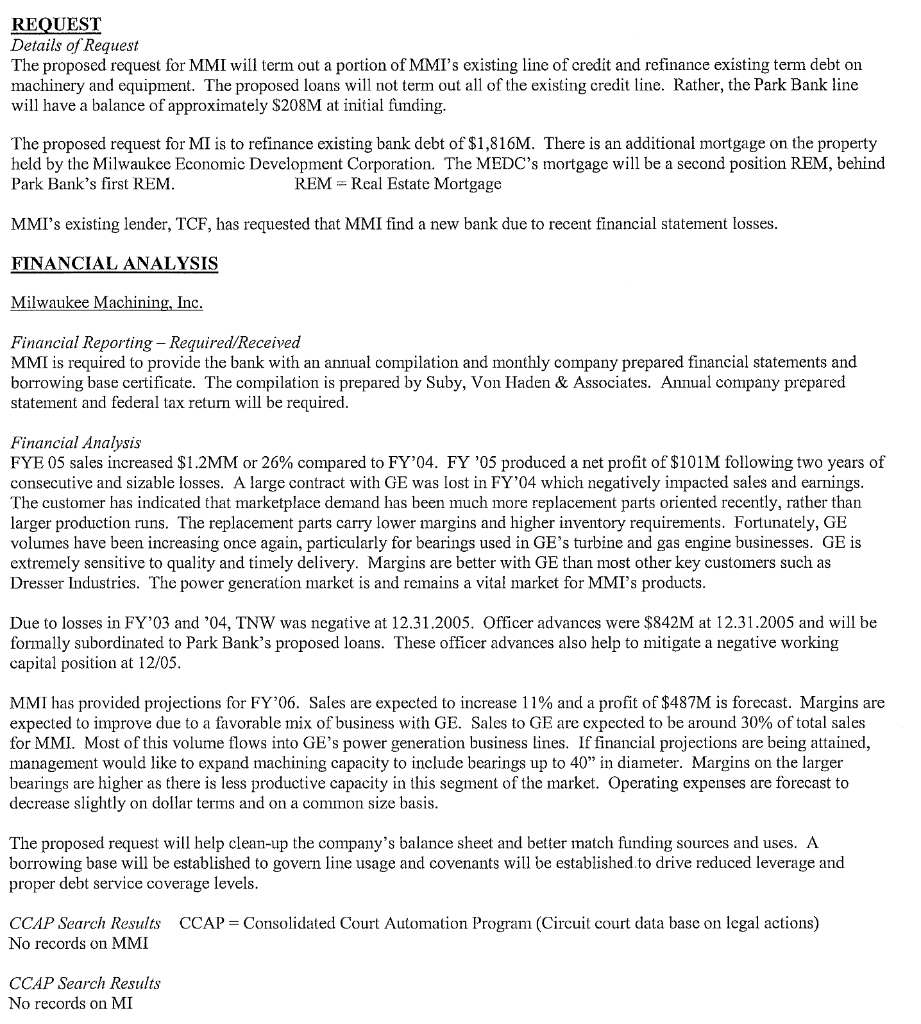

MILWAUKEE MACHINING, INC. CASE This company is a Subchapter S Corporation. The company with the same ownership, Machining Investments, LLC, owns the real estate occupied by Milwaukee Machining, Inc. and is an LLC as the name would indicate. Currently, the corporation has outstanding a balance of $801,865 on its line of credit and a balance remaining on a term loan in the amount of $157,087 from another bank. In addition, officers of this company have loaned the business $842,290. The Park Bank is reviewing the situation to evaluate if they should take over the lending relationship for this company. If so, the Park bank would loan $750,000 on a term loan basis and would establish a line of credit on a borrowing base formula with a cap of $500,000. The draw on the line of credit upon closing the loan transaction would be $208,000. In addition, Machining Investments, LLC, the owner of the real estate occupied by Milwaukee Machining, Inc., has a first mortgage loan outstanding in the amount of $1,756,424 with the current lender and a second mortgage outstanding (subordinate to the bank's first mortgage) in the amount of $464,376 with the Milwaukee Economic Development Corporation. If the Park Bank assumes the lending relationship, they would provide a first mortgage loan in the amount of $1,816,000, ahead of the second mortgage held by the Milwaukee Economic Development Corporation. The shareholders would sign personal unlimited guarantees to secure the loans and cross-guarantees would be granted by each of the two corporations. See the attached Park Bank loan presentation documents including the loan officer's and analyst's presentation and the financial statements for the two companies. ASSIGNMENT: As a loan committee member at the Part Bank, would you approve the request? Why or why not? Milwaukee Machining, Inc. Loan Presentation Page 2 PARK BANK LOAN PRESENTATION Risk NAICS 33299 4.1 Milwaukee Machining, Inc. 8800 W. Brown Deer Road Milwaukee, WI 53224 Date: April 3, 2006 Lender: Robert Sostrom Analyst: Erin Mueller Last/Next Review: New Profitability \ ROE: New Related Machining Investments, LLC 33299 4.1 DOB Ownership Guarantee Net Worth Date Ownership / Principals Milwaukee Machining, Inc. Terry H. Schneider Ann M. Schneider Machining Investments, LLC 03-55 51% 49% $392,400 03-10-05 Unlimited Unlimited Unlimited 03-55 Machining Investments, LLC Terry H. Schneider Ann M. Schneider Milwaukee Machining, Inc. 51% 49% Unlimited Unlimited Unlimited See above See above COMMITMENT SUMMARY AS OF: 06-03-09 Name Action Com. O/S Prev. Type 1. MME New $500 $0 $0 C/RC 2. MMI New $750 $0 $0 C/T Mat. Demand 5 Years Amort NA 5 years Exp 04-30-07 NA Rate P+1.00% LIBOR +300bp LIBOR + Fees 2500 NA Pmt LO $15,207 3. MI New to * * * * $1,816 $0 0 M/T 3 Years 20 years NA NA $15,190 TOTALS: $3,066 SO $0 Exposure Change: $3,066 ParkBank Leasing: $0 PRA Exposure: $0 ACH Exposure: $125 (MMI) Merchant Exposure: No C/RC = Commercial/Revolving Credit C/T = Commercial/Term M/T-Mortgage/Term LIBOR = London Interbank Offered Rate REGULATORY COMPLIANCE/EXCEPTIONS - RATIONALE None INTERNAL COMPLIANCE/EXCEPTIONS - RATIONALE Facilities 1 and 2: the advance rates on inventory and orderly liquidation value of net fixed assets exceeds loan policy guidelines which limit inventory advances to 40% of the net value and orderly liquidation value of net fixed assets to 75%. REQUEST Details of Request The proposed request for MMI will term out a portion of MMI's existing line of credit and refinance existing term debt on machinery and equipment. The proposed loans will not term out all of the existing credit line. Rather, the Park Bank line will have a balance of approximately $208M at initial funding. The proposed request for MI is to refinance existing bank debt of $1,816M. There is an additional mortgage on the property held by the Milwaukee Economic Development Corporation. The MEDC's mortgage will be a second position REM, behind Park Bank's first REM. REM = Real Estate Mortgage MMI's existing lender, TCF, has requested that MMI find a new bank due to recent financial statement losses. FINANCIAL ANALYSIS Milwaukee Machining, Inc. Financial Reporting - Required/Received MMI is required to provide the bank with an annual compilation and monthly company prepared financial statements and borrowing base certificate. The compilation is prepared by Suby, Von Haden & Associates. Annual company prepared statement and federal tax return will be required. Financial Analysis YE 05 sales increased $1.2MM or 26% compared FY'04. FY '05 produced a net profit of $101M following two years of consecutive and sizable losses. A large contract with GE was lost in FY'04 which negatively impacted sales and earnings. The customer has indicated that marketplace demand has been much more replacement parts oriented recently, rather than larger production runs. The replacement parts carry lower margins and higher inventory requirements. Fortunately, GE volumes have been increasing once again, particularly for bearings used in GE's turbine and gas engine businesses. GE is extremely sensitive to quality and timely delivery. Margins are better with GE than most other key customers such as Dresser Industries. The power generation market is and remains a vital market for MMI's products. Due to losses in FY'03 and '04, TNW was negative at 12.31.2005. Officer advances were $842M at 12.31.2005 and will be formally subordinated to Park Bank's proposed loans. These officer advances also help to mitigate a negative working capital position at 12/05. MMI has provided projections for FY'06. Sales are expected to increase 11% and a profit of $487M is forecast. Margins are expected to improve due to a favorable mix of business with GE. Sales to GE are expected to be around 30% of total sales for MMI. Most of this volume flows into GE's power generation business lines. If financial projections are being attained, management would like to expand machining capacity to include bearings up to 40" in diameter. Margins on the larger bearings are higher as there is less productive capacity in this segment of the market. Operating expenses are forecast to decrease slightly on dollar terms and on a common size basis. The proposed request will help clean-up the company's balance sheet and better match funding sources and uses. A borrowing base will be established to govern line usage and covenants will be established to drive reduced leverage and proper debt service coverage levels. CCAP Search Results CCAP = Consolidated Court Automation Program (Circuit court data base on legal actions) No records on MMI CCAP Search Results No records on MI WHAT CRITERIA DO BANKS USE IN MAKING LOANS? 1. The old four Cs of credit are still applicable. a. Character of the managers of the business b. Capacity of the business to repay interest and principal on time c. Conditions of the industry and the economy d. Collateral that can be used to secure the loan 2. Other factors used are RMA ratio comparisons. 3. Key to remember - banks are lending out depositors' dollars, not our own, therefore must be extremely cautious in making loan decisions. 4. "Gut feel" plays an important role in this process to assess management strength. Various non-financial elements can be important, such as a proprietary product, an important patent or trademark, an extensive distribution system, a strong customer list, a specially designed computer system, etc. MILWAUKEE MACHINING, INC. CASE This company is a Subchapter S Corporation. The company with the same ownership, Machining Investments, LLC, owns the real estate occupied by Milwaukee Machining, Inc. and is an LLC as the name would indicate. Currently, the corporation has outstanding a balance of $801,865 on its line of credit and a balance remaining on a term loan in the amount of $157,087 from another bank. In addition, officers of this company have loaned the business $842,290. The Park Bank is reviewing the situation to evaluate if they should take over the lending relationship for this company. If so, the Park bank would loan $750,000 on a term loan basis and would establish a line of credit on a borrowing base formula with a cap of $500,000. The draw on the line of credit upon closing the loan transaction would be $208,000. In addition, Machining Investments, LLC, the owner of the real estate occupied by Milwaukee Machining, Inc., has a first mortgage loan outstanding in the amount of $1,756,424 with the current lender and a second mortgage outstanding (subordinate to the bank's first mortgage) in the amount of $464,376 with the Milwaukee Economic Development Corporation. If the Park Bank assumes the lending relationship, they would provide a first mortgage loan in the amount of $1,816,000, ahead of the second mortgage held by the Milwaukee Economic Development Corporation. The shareholders would sign personal unlimited guarantees to secure the loans and cross-guarantees would be granted by each of the two corporations. See the attached Park Bank loan presentation documents including the loan officer's and analyst's presentation and the financial statements for the two companies. ASSIGNMENT: As a loan committee member at the Part Bank, would you approve the request? Why or why not? Milwaukee Machining, Inc. Loan Presentation Page 2 PARK BANK LOAN PRESENTATION Risk NAICS 33299 4.1 Milwaukee Machining, Inc. 8800 W. Brown Deer Road Milwaukee, WI 53224 Date: April 3, 2006 Lender: Robert Sostrom Analyst: Erin Mueller Last/Next Review: New Profitability \ ROE: New Related Machining Investments, LLC 33299 4.1 DOB Ownership Guarantee Net Worth Date Ownership / Principals Milwaukee Machining, Inc. Terry H. Schneider Ann M. Schneider Machining Investments, LLC 03-55 51% 49% $392,400 03-10-05 Unlimited Unlimited Unlimited 03-55 Machining Investments, LLC Terry H. Schneider Ann M. Schneider Milwaukee Machining, Inc. 51% 49% Unlimited Unlimited Unlimited See above See above COMMITMENT SUMMARY AS OF: 06-03-09 Name Action Com. O/S Prev. Type 1. MME New $500 $0 $0 C/RC 2. MMI New $750 $0 $0 C/T Mat. Demand 5 Years Amort NA 5 years Exp 04-30-07 NA Rate P+1.00% LIBOR +300bp LIBOR + Fees 2500 NA Pmt LO $15,207 3. MI New to * * * * $1,816 $0 0 M/T 3 Years 20 years NA NA $15,190 TOTALS: $3,066 SO $0 Exposure Change: $3,066 ParkBank Leasing: $0 PRA Exposure: $0 ACH Exposure: $125 (MMI) Merchant Exposure: No C/RC = Commercial/Revolving Credit C/T = Commercial/Term M/T-Mortgage/Term LIBOR = London Interbank Offered Rate REGULATORY COMPLIANCE/EXCEPTIONS - RATIONALE None INTERNAL COMPLIANCE/EXCEPTIONS - RATIONALE Facilities 1 and 2: the advance rates on inventory and orderly liquidation value of net fixed assets exceeds loan policy guidelines which limit inventory advances to 40% of the net value and orderly liquidation value of net fixed assets to 75%. REQUEST Details of Request The proposed request for MMI will term out a portion of MMI's existing line of credit and refinance existing term debt on machinery and equipment. The proposed loans will not term out all of the existing credit line. Rather, the Park Bank line will have a balance of approximately $208M at initial funding. The proposed request for MI is to refinance existing bank debt of $1,816M. There is an additional mortgage on the property held by the Milwaukee Economic Development Corporation. The MEDC's mortgage will be a second position REM, behind Park Bank's first REM. REM = Real Estate Mortgage MMI's existing lender, TCF, has requested that MMI find a new bank due to recent financial statement losses. FINANCIAL ANALYSIS Milwaukee Machining, Inc. Financial Reporting - Required/Received MMI is required to provide the bank with an annual compilation and monthly company prepared financial statements and borrowing base certificate. The compilation is prepared by Suby, Von Haden & Associates. Annual company prepared statement and federal tax return will be required. Financial Analysis YE 05 sales increased $1.2MM or 26% compared FY'04. FY '05 produced a net profit of $101M following two years of consecutive and sizable losses. A large contract with GE was lost in FY'04 which negatively impacted sales and earnings. The customer has indicated that marketplace demand has been much more replacement parts oriented recently, rather than larger production runs. The replacement parts carry lower margins and higher inventory requirements. Fortunately, GE volumes have been increasing once again, particularly for bearings used in GE's turbine and gas engine businesses. GE is extremely sensitive to quality and timely delivery. Margins are better with GE than most other key customers such as Dresser Industries. The power generation market is and remains a vital market for MMI's products. Due to losses in FY'03 and '04, TNW was negative at 12.31.2005. Officer advances were $842M at 12.31.2005 and will be formally subordinated to Park Bank's proposed loans. These officer advances also help to mitigate a negative working capital position at 12/05. MMI has provided projections for FY'06. Sales are expected to increase 11% and a profit of $487M is forecast. Margins are expected to improve due to a favorable mix of business with GE. Sales to GE are expected to be around 30% of total sales for MMI. Most of this volume flows into GE's power generation business lines. If financial projections are being attained, management would like to expand machining capacity to include bearings up to 40" in diameter. Margins on the larger bearings are higher as there is less productive capacity in this segment of the market. Operating expenses are forecast to decrease slightly on dollar terms and on a common size basis. The proposed request will help clean-up the company's balance sheet and better match funding sources and uses. A borrowing base will be established to govern line usage and covenants will be established to drive reduced leverage and proper debt service coverage levels. CCAP Search Results CCAP = Consolidated Court Automation Program (Circuit court data base on legal actions) No records on MMI CCAP Search Results No records on MI WHAT CRITERIA DO BANKS USE IN MAKING LOANS? 1. The old four Cs of credit are still applicable. a. Character of the managers of the business b. Capacity of the business to repay interest and principal on time c. Conditions of the industry and the economy d. Collateral that can be used to secure the loan 2. Other factors used are RMA ratio comparisons. 3. Key to remember - banks are lending out depositors' dollars, not our own, therefore must be extremely cautious in making loan decisions. 4. "Gut feel" plays an important role in this process to assess management strength. Various non-financial elements can be important, such as a proprietary product, an important patent or trademark, an extensive distribution system, a strong customer list, a specially designed computer system, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts