Question: Based on the information given in the case study, Share brief answers to below Supplier Financial Analysis Worksheet Purchasers assess supplier financial health for several

Based on the information given in the case study, Share brief answers to below

Supplier Financial Analysis Worksheet

Purchasers assess supplier financial health for several reasons. The most important reason involves managing supply base risk. The analysis may highlight difficulties that will interfere with the smooth and timely flow of material. A supplier may be experiencing capacity constraint problems, have difficulty meeting its payables, have too many receivables, have poor inventory management as revealed by low inventory turns, or have cash flow problems as noted by current liabilities exceeding current assets.

A supplier financial analysis is likely whenever a purchaser is attempting to reduce a pool of potential supply sources. If a supplier does not meet certain thresholds as defined by the purchaser, then the supplier will likely not move to the next level of consideration.

Financial ratios are a key part of a supplier financial analysis. Of course, the key to a supplier financial analysis is a purchaser's ability to obtain reliable and complete financial data, which can be a challenge when evaluating closely or privately held corporations.

Besides calculating and attempting to interpret the meaning of financial ratios, comparing ratio data can provide even greater insight into a supplier's financial condition. While no correct answers exist for financial ratios, a comparison of a supplier's ratios to published industry norms can help identify if further financial analysis is necessary. An analyst should also compare several years of supplier financial data, if available, to identify favorable or unfavorable trends. Another comparison involves comparing a supplier's ratios with industry averages, which is likely when a purchaser has collected data from many suppliers or can refer to market intelligence demonstrating the norm for the industry.

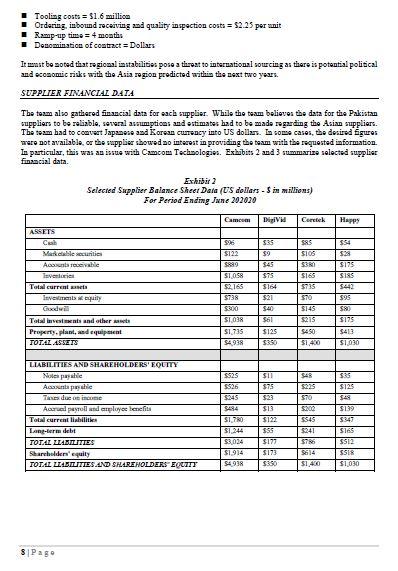

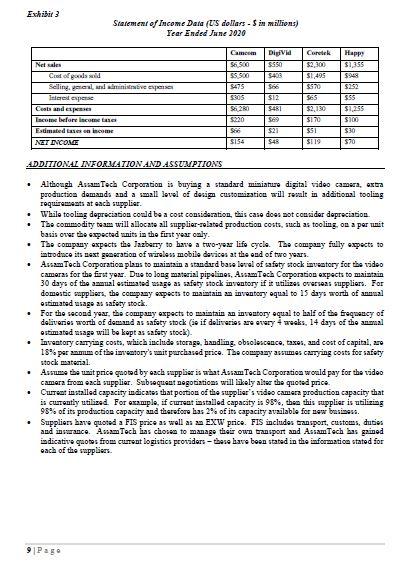

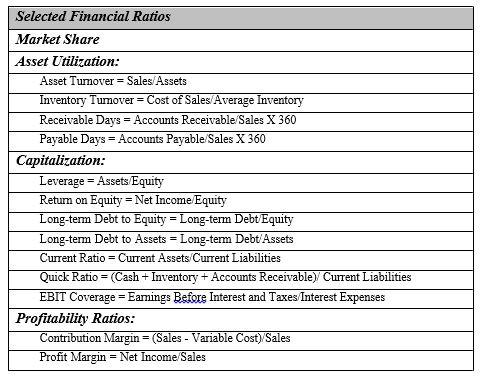

Selected Financial Ratios

Market Share

Asset Utilization:

Asset Turnover = Sales/Assets

Inventory Turnover = Cost of Sales/Average Inventory

Receivable Days = Accounts Receivable/Sales X 360

Payable Days = Accounts Payable/Sales X 360

Capitalization:

Leverage = Assets/Equity

Return on Equity = Net Income/Equity

Long-term Debt to Equity = Long-term Debt/Equity Long-term Debt to Assets = Long-term Debt/Assets Current Ratio = Current Assets/Current Liabilities

Quick Ratio = (Cash + Inventory + Accounts Receivable)/ Current Liabilities

EBIT Coverage = Earnings Before Interest and Taxes/Interest Expenses

Profitability Ratios:

Contribution Margin = (Sales - Variable Cost)/Sales

Profit Margin = Net Income/Sales

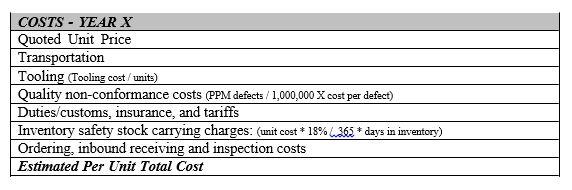

Total Cost Analysis Worksheet

This template requires the commodity group to quantify costs that are in addition to the quoted unit price. Using cost information provided in the case for each supplier, calculate the estimated per unit total cost from each supplier for year one and year two to determine the total cost to the business.

Total Cost Analysis Worksheet

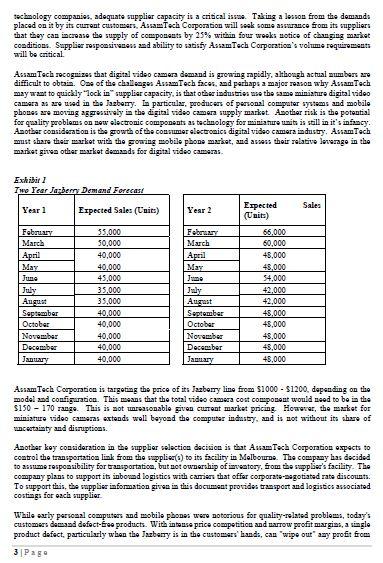

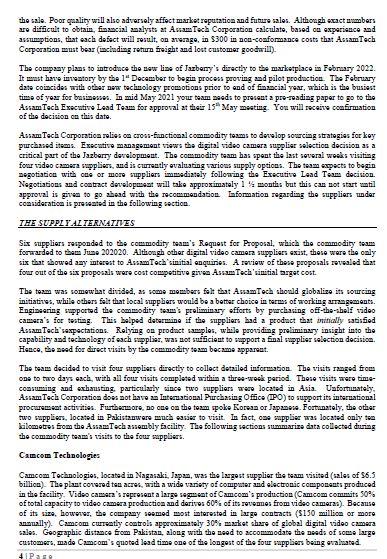

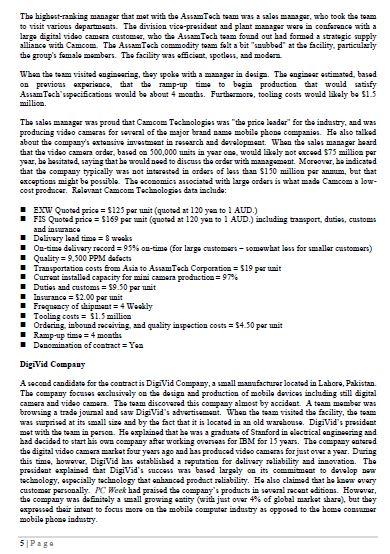

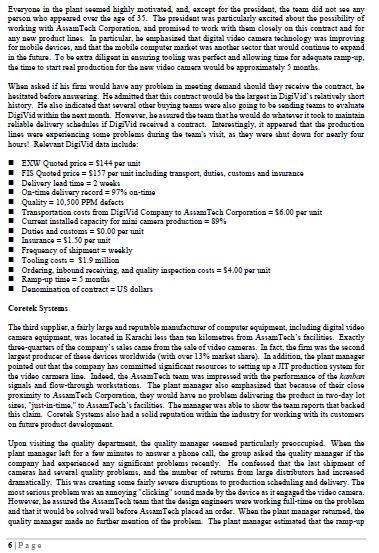

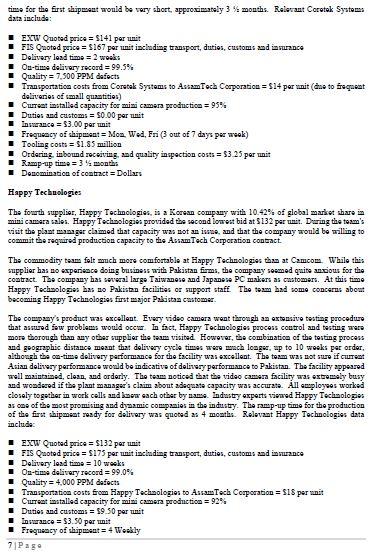

Case Study on Assam Tech Corporation Strategic Sourcing of Jazberry's You have recently been appointed on the cross functional team at AssamTech Corporation conducting market research to source a new miniature video camera - a component in a new line of AssamTech wireless palm held computers branded Jazbenry's. The Lead Team at AssamTech Corporation have requested your team prepare a position paper recommending the sourcing strategy of no more than 20 pages (not including appendices as supporting information) by the 1" May 2021 for pre-reading to the 13* May Lead Team meeting, when you will be advised of approval to proceed. The cross-functional team realized this supplier selection decision, which was one of the most critical involving the new product line, was going to be difficult. Until the team analyzed the numbers and discussed the findings from the field visits, it was clear that no consensus existed among team members concerning which supplier(s) to select. Your team has provided you with the following market and business summary. Conduct the analysis required by the team and ensure your paper covers the results in your company format of the strategie sowcing position paper. OVERVTEW AssamTech Corporation, Pty Ltd. (CharlTech) is a medium-sized high technology company located in Karachi. In its early years, Assam Tech produced component parts and subsystems for personal computers and engineering workstations. In 2010, AssamTech added its own line of hand held palm pilots and mini computers to its product offering Recently, the company decided to expand its product line to include fully assembled wireless palm held computers called "Jazbenry's". The company, recognized as a well- established component and subsystem manufacturer, has grown from a single product manufacturer with annual sales of $2.5 million, to a multi-product $2 billion firm in just ten years. This growth was helped in part through acquisitions in server markets and related computer industries. Assam Tech Corporation has a vision to be a trusted partner to business customers requiring high quality business products with on-time customer delivery. The company also emphasizes state-of-the-art technology in its product design production information, and delivery systems. AssamTech's decision to enter the wireless palm beld computer market occurred during the peak of the business mobility boom in the recent time in Pakistan. In particular, the marketing department decided to focus on the corporate executive user, to exploit the booming growth in mobility of the office. The projected growth rate of Jazberry sales to the business sect far exceeded the home sector, and is predicted to surpass the home sector in total share of shipments. Although Assam Tech Corporation is a small player in the global market, the company decided to pursue an aggressive strategy of selling high quality wireless palm held computers at affordable prices. The new line of palm held, called the Jazberry, allow a customer to use the Jazbeny in conjunction with a laptop. The stand-alone Jazbenry allows customers to receive and respond to e-mails, access the internet, view and edit documents, receive and make telephone calls and video/tele-conference. The Jazbenry would come with a high capacity microprocessor, memory, hard disk space, Bluetooth wireless access, a 4 -inch flat smart screen color monitor and a digital video camera to record real-time videos that can be transmitted instantaneously via the internet. Although industry forecasts for personal computers have certainly been downgraded, AssamTech is estimating that in the next two years the wireless mobile computer industry in Pakistan will grow at a slow but steady state as business executives upgrade their palm pilots and mobile accessories with the predicted slow but steady growth in the mobility requirements of industry. This decision poses some risks, given that there is a "mixed bag of opinions regarding the growth of the electronics sector. The decision was made to pursue the business computer user, through a strategy focused on shipping low-cost, high-quality Jazberry's directly to business customers as orders are received (make-to-order). This production model is similar to the Dell approach and appears to be the model that will dominate the PC industry. Because the company does not plan to build finished Jazbenry's (ie, make-to-stock) in anticipation of future sales, market demand forecasts, supplier quality, supplier capacity, lead time, and delivery reliability are critical factors. The company is willing to carry some units in component inventory as safety stock as a buffer against missing customer order commitments. AssamTech Corporation will assemble the Jazberry's in its own facilities, but intends to outsource many of the key product components and subassemblies, including the video camera, a feature that will be standard on each Assam Tech Jazberry. The decision to outsource the video camera resulted from an executive-level insourcing outsourcing study that concluded the cost to manufacture these drives in-house was highly prohibitive. The product requires production capabilities that are beyond Assam Tech'scurrent expertise. Marketing estimates that first year demand for the Jazberry, and therefore the video camera, would be approximately 500,000 units, with a 20% growth expected for year two. Expected pricing for the Jazberry will be around $1000 to $1200. Video camera demand depends totally on final product demand which can be volatile. Exhibit 1 details the monthly sales forecast for the Jazberry. However, given the volatility of the computer market and Assam Techslimited experience with marketing directly to end users, marketing estimates, with 95% confidence that actual demand will likely be between 400.000 and 600,000 units. As with most high 2 Page technology companies, adequate supplier capacity is a critical issue. Taking a lesson from the demands placed on it by its curent customers, Assam Tech Corporation will cook some assurance from its suppliers that they can increase the supply of components by 25% within four wosku notice of changing market conditions. Supplier responsiveness and ability to satisfy AssamTech Corporation's volume requirements will be critical Assam Tech recognizes that digital video camera demand is growing rapidly, although actual embers are difficult to obtain. One of the challenge. AsramTech faces and perhaps a major reason wby Assam Tech may want to quickly "lock in supplier capacity is that other industries use the same ministre digital video cameras are used in the Jazberry. La particular, producers of personal computer systems and mobile phones are moving aggressively in the digital video camera supply market. Another risk is the potential for quality problems on new electronic components as technology for miniature unit is still in it's infancy. Another consideration is the growth of the consumer electronics digital video camera industry, Assam Tech must share their market with the growing mobile phone market, and assess their relative leago in the market gives other market demands for digital video cameras Exhibir 1 Iwo Year Jarber Demand Forecas! Sales Year 1 Expected Sales (Units) Year 2 Espected (Units) February March April May June July August September October November December January 39.000 50,000 40,000 40,000 45,000 35.000 35,000 40.000 40.000 40,000 40,000 40,000 February March April May Jume July August September October November December January 66,000 60,000 48,000 43.000 54.000 42.000 42,000 45.000 45,000 48,000 43,000 48,000 Assam Tech Corporation is targeting the price of its lazbenry line from $1000 - $1200, depending on the model and configuration. This means that the total video camera cost component would need to be in the $150 - 170 range. This is not reasonable given cutent market pricing However, the market for miniature video cameras extends well beyond the computer industry, and is not without its share of uncertainty and disruptions. Another key consideration in the supplier selection decision is that Assam Tech Corporation expects to control the transportation link from the supplies) to its facility in Melbourne. The company has decided to assume responsibility for transportation, but not ownership of inventory, som the supplier's facility. The company plans to support it inbound logistics with carries that offer corporate-negotiated rate discounts To support this, the supplier information given in this document provides transport and logistics associated costings for each supplier While surly personal computers and mobile phones were notorious for quality-related problems, today's customers demand defect-c products. With intense price competition and narrow profit margins, a single product defect, particularly when the Jazberry is in the customers' lands, can wipe out any profit from 3 Pago the sale. Poor quality will also adversely affect market reputation and future sales. Although exact ambers are difficult to obtain financial analysts at AusTech Corporation calculate, based ca experience and assumptions, that each defect will result, on average, in $300 in non-conformance costs that Assam Tech Corporation must bear (including return freight and lost customer goodwilt) The company plans to introduce the new line of Jazbenry's directly to the marketplace in February 2022. It must have imestory by the 1" December to begin proces proving and pilot production. The February date coincides with other own technology promotions prior to and of financial year, which is the busiest time of year for business. In mid May 2021 your team eeds to present a pre-readias paper to go to the Assam Tech Executive Lead Team for approval at their 15 May meeting. You will receive confirmation of the decision on this dato. Assam Tech Corporation relies on cross-functional commodity teams to develop Sourcing strategies for key purchased items. Executive management view the digital video camera supplier selection decision as a critical part of the Jazberry development. The commodity team bas spent the last several works visiting four video camera suppliers, and is currently evaluating various supply options. The team expects to begin negotiation with one or more suppliers mediately following the Executive Lead Team decision. Negotiations and contract development will take approximately 15 months but this can not start til approval is given to go ahead with the recommendation Information regarding the suppliers under consideration is presented in the following action. THE SUPPLY ALTERNATIVES Six suppliers responded to the commodity team's Request for Proposal, which the commodity to forwarded to them. Juse 202020. Altisough other digital video camera suppliers exist, these were the only six that showed any interest to AssamTech initial enquiries. A review of these proposals revealed that four out of the six proposals were cost competitive given Assam Tech'sinitial arget cost. The team was somewhat divided, as some members felt that Assam Tech should globalize its sourcing initiatives, while others felt that local suppliers would be a better choice in terms of working arrangements. Engineering supported the commodity team's preliminary efforts by purchasing off-the-shelf video camera's for testing. This helped determine if the suppliers had a product that tially satisfied Assam Techsexpectations. Relying on product samples while providing preliminary insight into the capability and technology of each supplies, was not suicient to support a final applier selection decision Hence, the need for direct visits by the commodity team became apparaat The team decided to visit four suppliers directly to collect detailed information. The visits ranged from one to two days each, with all four visits completed within a three-wosk period. These visits were time- consuming and exhausting particularly since two cuppliers were located in Asia. Unfortunately, Assam Tech Corporation does not have an international Puchasing Office (IPO) to support its international procurement activities. Furthermore, no ne on the team spoke Korean or Japanese. Fortunately, the other two suppliers, located in Pakistanwere much easier to visit. In fact, se supplier was located only ten Lilometres from the Assam Tech assembly facility. The following sections summarize data collected during the commodity team's visits to the four suppliers. Camcom Technologies Camcom Technologies, located in Nagasaki, Japan, was the largest supplier the team visited (sales of $6.5 billica). The plant covered tea acres, with a wide variety of computer and electronic components produced in the facility. Video camera's represent a large segment of Camcom's production (Cam.com commit: 50% of total capacity to video camera production and darivos 60% of its rovemes from video cameras). Because of its size, however, the company seemed most interested in large contracts (5150 million or more annually). Camcom currently controls approximately 30% market share of global digital video camera sales. Goog aphic distance from Pakistan, along with the need to accommodate the needs of some largo customers, made Camcom's quoted lead time one of the longest of the four suppliers being evaluated 41 Pa The highest ranking manager that met with the Assam Toch team was a sales manager, who took the team to visit various departments. The division vice-president and plant manages were in conference with a large digital video camera customer who the Assam Toch team found out bad formed a strategic supply alliance with Camcom. The Assam Toch commodity team falt a bit "sabbed at the facility, particularly the group's female members. The facility was officient, spotless, and modern When the team visited ongiausias, they spoke with a manager in design. The engineer estimated based on previous experience that the ramp-up time to begin production that would satisfy Assam Tech specifications would be about 4 monti. Furthermore, tooling costs would likely to 1 3 million. The sales manager was proud that Cam.com Technologies was "the price leader for the industry, and was producing video cameras for several of the major brand names mobile phone companies. He also talked about the company's extensive investment in research and development. When the sales manager beard that the video camera order based ca 500.000 units in years, would likely not exceed 575 million per year, be besitated, saying that he would need to discuss the order with management. Moreover, be indicated that the company typically was not interested in orders of less than $150 million per annum, but that exceptions might be possible. The economics associated with large orders is what made Cam.com a low- cost producer. Relevant Cam.com Technologies data include: EXW Quoted price = $125 per unit (quoted at 120 yen to 1 AUD.) FIS Quoted price = $169 per mit (quoted at 120 you to 1 AUD.) including transport, duties, customs and insurance Delivery lead time = 8 weeks On-time delivery record = 95% on-time (for largo customers somewhat less for smaller customers) Quality = 9.500 PPM defects Transportation costs Eom Asia to Assam Tech Corporation = 519 per unit Cureat installed capacity for mini camera production = 97% Duties and customs = $9.50 per tunit Insurance = 52.00 per unit Frequency of skinsaat = 4 Weekly Tooling costs = $1.5 million Ordering, inbound receiving, and quality inspection costs = $4.50 per unit Ramp-up timo = 4 months Denomination of contract = Yen DigiVid Company A second candidate for the contractis DigiVid Company, a small manufacturer located in Lahore, Pakistan. The company focuses exclusively on the design and production of mobile devices including still digital camera and video camera. The team discovered this company almost by accident. A team member was browsing a trade journal and saw Dig. Vid's advertisement. When the team visited the facility, the team was suprised at its small size and by the fact that it is located in an old warehouse. DigiVid's president met with the team in person. He explained that he was a graduate of Stanford in electrical engineering and had decided to start his own company after working overseas for IBM for 15 years. The company entered the digital video camera market four years ago and bas produced video cameras for just over a year. During this time, however, DigiVid has established a reputation for delivery reliability and innovation. The president explained that DigiVid's success was based largely on its commitment to develop new technology, especially technology that enhanced product reliability. He also claimed that below overy customer personally PC Week had praised the company's products in several recent editions. However, the company was definitely a small growing eatity (with just over 4% of global market share), but they expressed their intent to focus more on the mobile computer industry as opposed to the home consumer mobile phone industry 5 Page Everyone in the plant seemed higiely motivated and except for the president, the team did not see any person who appeared over the age of 35. The president was particularly excited about the possibility of working with Assam Tech Corporation, and promised to work with them closely on this contract and for any new product lines. In particular, he emphasized that digital video camera technology was improving for mobile devices, and that the mobile computer market was another sector that would continue to expand in the future. To be extra diligent in casaring tooling was perfect and allowing time for adequate camp-p. the time to start real production for the sex video camera would be approximately 5 months When asked if his firm would have any problem in meeting demand should they receive the contract, he bositated before answering. He admitted that this contract would be the largest in DigiVid's relatively short history. He also indicated that several other buying teams were also going to be sending teams to evaluate DigiVid within the next month Honover, beascared the team that he would do whatever it took to maintain reliable delivery schedules if DiaVid received a contract. Interestingly, it appeared that the production lings were experiencing some problems during the team's visit, as they were shut down for nearly four bours! Relevant DigiVid data include: EXW Quoted price = $144 por tumit FIS Quoted price = $157 per unit iscinding transport, duties, customs and insurance Delivery lead time = 2 weeks On-time delivery record = 97% on-time Quality = 10,500 PPM defects Transportation costs from DigiVid Company to Assam Tech Corporation = 56.00 per mit Current installed capacity for mini camera production = 899 Duties and customs 50.00 per mit Insurance = $1.50 per unit Frequency of shipment weakly Tooling costs = $1.9 million Ordering, inbound receiving, and quality inspection costs = 54.00 por muit Ramp-up time = 5 months Denomination of contract = US dollars Careet System: The third supplier, a fairly large and reputable manufacturer of computer equipment, including digital video camera equipment, was located in Karachi less than ten kilometres from Assam.Tech's facilities. Exactly three-quarters of the company's sales came from the sale of video cameras. In fact, the firm was the second largest producer of these devices worldwide (with over 13% market share). In addition, the plant manager pointed out that the company has committed significant resources to Setting up a JIT production system for the video camera line. Indeed, the Asramoch team was impressed with the periormance of the kunico siguals and flow-through workstations. The plant manager also emphasized that because of their close proximity to AssamTech Corporation, they would have no problem delivering the product in two-day lot sizes, "just-in-time." to AssameTech's facilities. The manage was able to show the team reports that backed this claim. Coretek Systems also had a solid reputation within the industry for working with its customers on future product development Upon visiting the quality department, the quality manager seemed particularly preoccupied. When the plant manager left for a few minutes to answer a phone call, the group asked the quality manager if the company bad experienced my significant problems receady. He confered that the last shipment of cameras bad several quality problems, and the mamber of returns from large distributors had increased dramatically. This was creating some fairly severe disruptions to production scheduling and delivery. The most serious problem was an annoying "clicking sound made by the device as it engaged the video camera. However, he assured the Assam Toch team that the design cagineers were working full-time on the problem and that it would be solved well before Ascam Toch placed an order. When the plant manager returned, the quality manager made no further mention of the problem. The plant manager estimated that the ramp-up 6 Page time for the first shipment would be very short, approximately 3 months. Relevant Coretok Systems data include: EXW Quoted price = $141 per unit FIS Quoted price = $167 per unit including transport, duties, customs and amurance Delivery lead time = 2 wook: On-time delivery record = 99.5% Quality = 7.500 PPM defects Transportation costs from Coretak Systems to Assam Tech Corporation = $14 por unit (due to frequent deliveries of small quantities) Current installed capacity for mini camera production = 95% Duties and customs 50.00 per mit Insurance = $3.00 per mit Frequency of shipment = Mon Wed,Fri (3 out of 7 days per week) Tooling costs = $1.85 million Ordering inbound receiving and quality inspection costs = 53.25 per unit Ramp-up time = 3 months Denomination of contract Dollars Happy Techuologies The fourth supplier, Happy Technologies, is a Korean company with 10.42% of global market share in mini camera sales. Happy Technologies provided the second lowest bid at $132 per mit. During the team's visit the plant manager la that capacity was not an issue and the company would be willing to commit the required production capacity to the Assam Tech Corporation contact The commodity team felt much more comfortable at Happy Technologies than at Camcom. While this supplier bas no experience doing business with Pakistan firms, the company seemed quite cious for tirse contract. The company has several largo Taiwanese and Japanese PC makers as customers. At this time Happy Technologies bas so Pakistan facilities or support staff The team had come concerns about becoming Happy Technologies first major Pakistan customer The company's product was excellent. Every video camera went through an extensive testing procedure that assured bow problems would occw. In fact, Happy Technologies process control and testing area more thorough than any other supplier the team visited However, the combination of the testing process and geographic distance meant that delivery cycle times were monch longer, up to 10 weeks per order, although the on-time delivery performance for the facility was excellent. The team was not sure if current Asian delivery performance would be indicative of delivery performance to Pakistan. The facility appeared well maintained. clean and orderly. The team noticed that the video camera facility was extremely busy and wondered if the plant manager's claim about adequate capacity was accurate. All employees worked closely together in work cells and low cach other by sme Industry experts viewed Happy Technologies as one of the most promising and dynamic companies in the industry. The ramp-up time for the production of the first shipment ready for delivery was quoted as 4 months. Relevant Happy Technologies data include: EXW Quoted price = $132 per unit FIS Quoted price = $175 por tumitiscinding transport, duties, customs and instance Delivery lead time = 10 weeks On-time delivery record = 99.0% Quality = 4,000 PPM defects Transportation costs from Happy Technologies to Assam Tech Corporation = $1$ per unit Current installed capacity for mini camera production = 92% Duties and customs 59.50 per mit Insurance = $3.50 per unit Frequency of shipment = 4 Weekly 7 Page Tooling costs = $1.6 million Ordering, inbound receiving and quality inspection costs = $2.25 per unit Ramp-up time = 4 months Denomination of contract = Dollars It mit besoted that regional instabilities pose a threat to international sourcing as there is potential political and economic risks with the Asia region predicted within the next two years. SUPPLIER FINANCIAL DATA The team also gathered financial data for each supplier. While the team believes the data for the Pakistan suppliers to be reliable, several assumptions and estimates had to be made regarding the Asian suppliers. The team had to convert Japanese and Korean currency into US dollars. La come cases, the desired figures were not available, or the supplier showed an interest in providing the team with the requested information In particular, this was an issue with Camcom Technologies. Exhibits 2 and 3 summarize selected supplier financial data Exhibir 2 Selected Supplier Balance Sheer Dala (US dollars - Sin millions) For Period Ending June 292020 Cam Cortek Happy ASSETS 55 134 5122 $9 S&S SIOS SRO S185 5:15 Markleurities Acolle lsveien Total current Save quity Gixdi Total investments and others Property, plant, and equipment TOT.AZ.SSETS S1.058 $2.13 5738 $300 $164 $21 $40 $61 $125 570 $145 $215 5450 524 $123 SIRS $4 $95 $80 $175 $413 $1,030 $1.038 51.735 S428 $11 $4R $33 $123 548 $13 $23 $13 LIABILITIES AND SHAREHOLDERS' EQUITY Notepaalde Acope Te due Acred payroll and crployee lenefits Total current liabilities Lang-term debit TOTAL LIABILITIES Shared'equity TOTAL ZATLITIES AND SHAREHOLDERS EOCITY $S25 $526 $245 S494 SI7R0 S1 244 $3.034 $1.914 54938 570 5.2003 $S43 $55 $172 $173 5830 STRO 5165 SS12 SS18 S1030 $1,480 S Pago Exhibir 3 Statement of Income Dara (US dollars - Sin millions) Year Ended June 2020 DIVI Net als Coaf of goods and Selling enlive Cam 56 300 SS.500 5475 $803 Coretak $2,300 $1,40 $520 565 $403 $66 SI2 $4R1 569 $21 Happy SIIS $948 $252 $55 $125 $100 $30 $70 $220 Cests and expenses Income before con Estimated me AZT INCOME 566 SI56 $170 $51 SI 19 ADDITIONAL INFORMATION AND ASSUMPTIONS . . . Although Assam Tech Corporation buying a standard miniatura digital video camera extra production demands and a small level of design customization will result in additional tooling requirements at each supplier. While tooling depreciation could be a cost consideration, this case does not consider depreciation The commodity team will allocate all supplier-related production costs, such as tooling, on a permit basis over the expected units in the first year only The company expects the Jazberry to have a two-year life cycle. The company fully expects to introduce its next generation of wireless mobile devices at the end of two years. Assam Tech Corporation plans to maintain a standard base level of safety stock inventory for the video Cameras for the first year. Due to long material pipelines, Assam Tech Corporation expects to maintain 30 days of the ammual estimated usage as safety stock inventory if it utilizes overseas suppliers. For domestic suppliers, the company expects to maintain an inventory equal to 15 days worth of annual estimated usage as safety stock . For the second year, the company expects to maintain an inventory equal to half of the frequency of deliveries worth of demand as safety stock ( if deliveries are every weeks. 14 days of the anal estimated asage will be kept as safety stock) Inventory carrying costs, which include storage, bandling, obsolescence, taxes, and cost of capital, are 18% per ammum of the inventory's mit purchased price. The company assumes carrying costs for safety stock material Assume the unit price quoted by each supplier is what Assam Tech Corporation would pay for the video camera from each supplier. Subsequent negotiations will likely alter the quoted price. Current installed capacity indicates that portion of the supplier's video camera production capacity that is currently utilized. For example, if current installed capacity 98%, then this supplier is utilizing 95% of its production capacity and therefore bas 2% of its capacity available for new business Suppliers have quoted a FIS price as well as an EXW price. FIS includes transport, customs duties and insurance. Asam Toch bas chosen to manage their own transport and Assam Tech has gained indicative quotes from current logistics providers - these have been stated in the information stated for each of the suppliers . 9 Pago Selected Financial Ratios Market Share Asset Utilization: Asset Tumover = Sales Assets Inventory Tumover = Cost of Sales/Average Inventory Receivable Days = Accounts Receivable Sales X 360 Payable Days - Accounts Payable Sales X 360 Capitalization: Leverage - Assets Equity Return on Equity - Net Income Equity Long-term Debt to Equity = Long-term Debt Equity Long-term Debt to Assets = Long-term Debt Assets Current Ratio = Current Assets Current Liabilities Quick Ratio = (Cash + Inventory + Accounts Receivable) Current Liabilities EBIT Coverage = Earings Before Interest and Taxes Interest Expenses Profitability Ratios: Contribution Margin = (Sales - Variable Cost) Sales Profit Margin = Net Income Sales COSTS - YEAR X Quoted Unit Price Transportation Tooling (Tooling cost / units) Quality non-conformance costs (PPM defects / 1,000,000 X cost per defect) Duties/customs, insurance, and tariffs Inventory safety stock carrying charges: (unit cost * 18%.365 * days in inventory) Ordering, inbound receiving and inspection costs Estimated Per Unit Total Cost Case Study on Assam Tech Corporation Strategic Sourcing of Jazberry's You have recently been appointed on the cross functional team at AssamTech Corporation conducting market research to source a new miniature video camera - a component in a new line of AssamTech wireless palm held computers branded Jazbenry's. The Lead Team at AssamTech Corporation have requested your team prepare a position paper recommending the sourcing strategy of no more than 20 pages (not including appendices as supporting information) by the 1" May 2021 for pre-reading to the 13* May Lead Team meeting, when you will be advised of approval to proceed. The cross-functional team realized this supplier selection decision, which was one of the most critical involving the new product line, was going to be difficult. Until the team analyzed the numbers and discussed the findings from the field visits, it was clear that no consensus existed among team members concerning which supplier(s) to select. Your team has provided you with the following market and business summary. Conduct the analysis required by the team and ensure your paper covers the results in your company format of the strategie sowcing position paper. OVERVTEW AssamTech Corporation, Pty Ltd. (CharlTech) is a medium-sized high technology company located in Karachi. In its early years, Assam Tech produced component parts and subsystems for personal computers and engineering workstations. In 2010, AssamTech added its own line of hand held palm pilots and mini computers to its product offering Recently, the company decided to expand its product line to include fully assembled wireless palm held computers called "Jazbenry's". The company, recognized as a well- established component and subsystem manufacturer, has grown from a single product manufacturer with annual sales of $2.5 million, to a multi-product $2 billion firm in just ten years. This growth was helped in part through acquisitions in server markets and related computer industries. Assam Tech Corporation has a vision to be a trusted partner to business customers requiring high quality business products with on-time customer delivery. The company also emphasizes state-of-the-art technology in its product design production information, and delivery systems. AssamTech's decision to enter the wireless palm beld computer market occurred during the peak of the business mobility boom in the recent time in Pakistan. In particular, the marketing department decided to focus on the corporate executive user, to exploit the booming growth in mobility of the office. The projected growth rate of Jazberry sales to the business sect far exceeded the home sector, and is predicted to surpass the home sector in total share of shipments. Although Assam Tech Corporation is a small player in the global market, the company decided to pursue an aggressive strategy of selling high quality wireless palm held computers at affordable prices. The new line of palm held, called the Jazberry, allow a customer to use the Jazbeny in conjunction with a laptop. The stand-alone Jazbenry allows customers to receive and respond to e-mails, access the internet, view and edit documents, receive and make telephone calls and video/tele-conference. The Jazbenry would come with a high capacity microprocessor, memory, hard disk space, Bluetooth wireless access, a 4 -inch flat smart screen color monitor and a digital video camera to record real-time videos that can be transmitted instantaneously via the internet. Although industry forecasts for personal computers have certainly been downgraded, AssamTech is estimating that in the next two years the wireless mobile computer industry in Pakistan will grow at a slow but steady state as business executives upgrade their palm pilots and mobile accessories with the predicted slow but steady growth in the mobility requirements of industry. This decision poses some risks, given that there is a "mixed bag of opinions regarding the growth of the electronics sector. The decision was made to pursue the business computer user, through a strategy focused on shipping low-cost, high-quality Jazberry's directly to business customers as orders are received (make-to-order). This production model is similar to the Dell approach and appears to be the model that will dominate the PC industry. Because the company does not plan to build finished Jazbenry's (ie, make-to-stock) in anticipation of future sales, market demand forecasts, supplier quality, supplier capacity, lead time, and delivery reliability are critical factors. The company is willing to carry some units in component inventory as safety stock as a buffer against missing customer order commitments. AssamTech Corporation will assemble the Jazberry's in its own facilities, but intends to outsource many of the key product components and subassemblies, including the video camera, a feature that will be standard on each Assam Tech Jazberry. The decision to outsource the video camera resulted from an executive-level insourcing outsourcing study that concluded the cost to manufacture these drives in-house was highly prohibitive. The product requires production capabilities that are beyond Assam Tech'scurrent expertise. Marketing estimates that first year demand for the Jazberry, and therefore the video camera, would be approximately 500,000 units, with a 20% growth expected for year two. Expected pricing for the Jazberry will be around $1000 to $1200. Video camera demand depends totally on final product demand which can be volatile. Exhibit 1 details the monthly sales forecast for the Jazberry. However, given the volatility of the computer market and Assam Techslimited experience with marketing directly to end users, marketing estimates, with 95% confidence that actual demand will likely be between 400.000 and 600,000 units. As with most high 2 Page technology companies, adequate supplier capacity is a critical issue. Taking a lesson from the demands placed on it by its curent customers, Assam Tech Corporation will cook some assurance from its suppliers that they can increase the supply of components by 25% within four wosku notice of changing market conditions. Supplier responsiveness and ability to satisfy AssamTech Corporation's volume requirements will be critical Assam Tech recognizes that digital video camera demand is growing rapidly, although actual embers are difficult to obtain. One of the challenge. AsramTech faces and perhaps a major reason wby Assam Tech may want to quickly "lock in supplier capacity is that other industries use the same ministre digital video cameras are used in the Jazberry. La particular, producers of personal computer systems and mobile phones are moving aggressively in the digital video camera supply market. Another risk is the potential for quality problems on new electronic components as technology for miniature unit is still in it's infancy. Another consideration is the growth of the consumer electronics digital video camera industry, Assam Tech must share their market with the growing mobile phone market, and assess their relative leago in the market gives other market demands for digital video cameras Exhibir 1 Iwo Year Jarber Demand Forecas! Sales Year 1 Expected Sales (Units) Year 2 Espected (Units) February March April May June July August September October November December January 39.000 50,000 40,000 40,000 45,000 35.000 35,000 40.000 40.000 40,000 40,000 40,000 February March April May Jume July August September October November December January 66,000 60,000 48,000 43.000 54.000 42.000 42,000 45.000 45,000 48,000 43,000 48,000 Assam Tech Corporation is targeting the price of its lazbenry line from $1000 - $1200, depending on the model and configuration. This means that the total video camera cost component would need to be in the $150 - 170 range. This is not reasonable given cutent market pricing However, the market for miniature video cameras extends well beyond the computer industry, and is not without its share of uncertainty and disruptions. Another key consideration in the supplier selection decision is that Assam Tech Corporation expects to control the transportation link from the supplies) to its facility in Melbourne. The company has decided to assume responsibility for transportation, but not ownership of inventory, som the supplier's facility. The company plans to support it inbound logistics with carries that offer corporate-negotiated rate discounts To support this, the supplier information given in this document provides transport and logistics associated costings for each supplier While surly personal computers and mobile phones were notorious for quality-related problems, today's customers demand defect-c products. With intense price competition and narrow profit margins, a single product defect, particularly when the Jazberry is in the customers' lands, can wipe out any profit from 3 Pago the sale. Poor quality will also adversely affect market reputation and future sales. Although exact ambers are difficult to obtain financial analysts at AusTech Corporation calculate, based ca experience and assumptions, that each defect will result, on average, in $300 in non-conformance costs that Assam Tech Corporation must bear (including return freight and lost customer goodwilt) The company plans to introduce the new line of Jazbenry's directly to the marketplace in February 2022. It must have imestory by the 1" December to begin proces proving and pilot production. The February date coincides with other own technology promotions prior to and of financial year, which is the busiest time of year for business. In mid May 2021 your team eeds to present a pre-readias paper to go to the Assam Tech Executive Lead Team for approval at their 15 May meeting. You will receive confirmation of the decision on this dato. Assam Tech Corporation relies on cross-functional commodity teams to develop Sourcing strategies for key purchased items. Executive management view the digital video camera supplier selection decision as a critical part of the Jazberry development. The commodity team bas spent the last several works visiting four video camera suppliers, and is currently evaluating various supply options. The team expects to begin negotiation with one or more suppliers mediately following the Executive Lead Team decision. Negotiations and contract development will take approximately 15 months but this can not start til approval is given to go ahead with the recommendation Information regarding the suppliers under consideration is presented in the following action. THE SUPPLY ALTERNATIVES Six suppliers responded to the commodity team's Request for Proposal, which the commodity to forwarded to them. Juse 202020. Altisough other digital video camera suppliers exist, these were the only six that showed any interest to AssamTech initial enquiries. A review of these proposals revealed that four out of the six proposals were cost competitive given Assam Tech'sinitial arget cost. The team was somewhat divided, as some members felt that Assam Tech should globalize its sourcing initiatives, while others felt that local suppliers would be a better choice in terms of working arrangements. Engineering supported the commodity team's preliminary efforts by purchasing off-the-shelf video camera's for testing. This helped determine if the suppliers had a product that tially satisfied Assam Techsexpectations. Relying on product samples while providing preliminary insight into the capability and technology of each supplies, was not suicient to support a final applier selection decision Hence, the need for direct visits by the commodity team became apparaat The team decided to visit four suppliers directly to collect detailed information. The visits ranged from one to two days each, with all four visits completed within a three-wosk period. These visits were time- consuming and exhausting particularly since two cuppliers were located in Asia. Unfortunately, Assam Tech Corporation does not have an international Puchasing Office (IPO) to support its international procurement activities. Furthermore, no ne on the team spoke Korean or Japanese. Fortunately, the other two suppliers, located in Pakistanwere much easier to visit. In fact, se supplier was located only ten Lilometres from the Assam Tech assembly facility. The following sections summarize data collected during the commodity team's visits to the four suppliers. Camcom Technologies Camcom Technologies, located in Nagasaki, Japan, was the largest supplier the team visited (sales of $6.5 billica). The plant covered tea acres, with a wide variety of computer and electronic components produced in the facility. Video camera's represent a large segment of Camcom's production (Cam.com commit: 50% of total capacity to video camera production and darivos 60% of its rovemes from video cameras). Because of its size, however, the company seemed most interested in large contracts (5150 million or more annually). Camcom currently controls approximately 30% market share of global digital video camera sales. Goog aphic distance from Pakistan, along with the need to accommodate the needs of some largo customers, made Camcom's quoted lead time one of the longest of the four suppliers being evaluated 41 Pa The highest ranking manager that met with the Assam Toch team was a sales manager, who took the team to visit various departments. The division vice-president and plant manages were in conference with a large digital video camera customer who the Assam Toch team found out bad formed a strategic supply alliance with Camcom. The Assam Toch commodity team falt a bit "sabbed at the facility, particularly the group's female members. The facility was officient, spotless, and modern When the team visited ongiausias, they spoke with a manager in design. The engineer estimated based on previous experience that the ramp-up time to begin production that would satisfy Assam Tech specifications would be about 4 monti. Furthermore, tooling costs would likely to 1 3 million. The sales manager was proud that Cam.com Technologies was "the price leader for the industry, and was producing video cameras for several of the major brand names mobile phone companies. He also talked about the company's extensive investment in research and development. When the sales manager beard that the video camera order based ca 500.000 units in years, would likely not exceed 575 million per year, be besitated, saying that he would need to discuss the order with management. Moreover, be indicated that the company typically was not interested in orders of less than $150 million per annum, but that exceptions might be possible. The economics associated with large orders is what made Cam.com a low- cost producer. Relevant Cam.com Technologies data include: EXW Quoted price = $125 per unit (quoted at 120 yen to 1 AUD.) FIS Quoted price = $169 per mit (quoted at 120 you to 1 AUD.) including transport, duties, customs and insurance Delivery lead time = 8 weeks On-time delivery record = 95% on-time (for largo customers somewhat less for smaller customers) Quality = 9.500 PPM defects Transportation costs Eom Asia to Assam Tech Corporation = 519 per unit Cureat installed capacity for mini camera production = 97% Duties and customs = $9.50 per tunit Insurance = 52.00 per unit Frequency of skinsaat = 4 Weekly Tooling costs = $1.5 million Ordering, inbound receiving, and quality inspection costs = $4.50 per unit Ramp-up timo = 4 months Denomination of contract = Yen DigiVid Company A second candidate for the contractis DigiVid Company, a small manufacturer located in Lahore, Pakistan. The company focuses exclusively on the design and production of mobile devices including still digital camera and video camera. The team discovered this company almost by accident. A team member was browsing a trade journal and saw Dig. Vid's advertisement. When the team visited the facility, the team was suprised at its small size and by the fact that it is located in an old warehouse. DigiVid's president met with the team in person. He explained that he was a graduate of Stanford in electrical engineering and had decided to start his own company after working overseas for IBM for 15 years. The company entered the digital video camera market four years ago and bas produced video cameras for just over a year. During this time, however, DigiVid has established a reputation for delivery reliability and innovation. The president explained that DigiVid's success was based largely on its commitment to develop new technology, especially technology that enhanced product reliability. He also claimed that below overy customer personally PC Week had praised the company's products in several recent editions. However, the company was definitely a small growing eatity (with just over 4% of global market share), but they expressed their intent to focus more on the mobile computer industry as opposed to the home consumer mobile phone industry 5 Page Everyone in the plant seemed higiely motivated and except for the president, the team did not see any person who appeared over the age of 35. The president was particularly excited about the possibility of working with Assam Tech Corporation, and promised to work with them closely on this contract and for any new product lines. In particular, he emphasized that digital video camera technology was improving for mobile devices, and that the mobile computer market was another sector that would continue to expand in the future. To be extra diligent in casaring tooling was perfect and allowing time for adequate camp-p. the time to start real production for the sex video camera would be approximately 5 months When asked if his firm would have any problem in meeting demand should they receive the contract, he bositated before answering. He admitted that this contract would be the largest in DigiVid's relatively short history. He also indicated that several other buying teams were also going to be sending teams to evaluate DigiVid within the next month Honover, beascared the team that he would do whatever it took to maintain reliable delivery schedules if DiaVid received a contract. Interestingly, it appeared that the production lings were experiencing some problems during the team's visit, as they were shut down for nearly four bours! Relevant DigiVid data include: EXW Quoted price = $144 por tumit FIS Quoted price = $157 per unit iscinding transport, duties, customs and insurance Delivery lead time = 2 weeks On-time delivery record = 97% on-time Quality = 10,500 PPM defects Transportation costs from DigiVid Company to Assam Tech Corporation = 56.00 per mit Current installed capacity for mini camera production = 899 Duties and customs 50.00 per mit Insurance = $1.50 per unit Frequency of shipment weakly Tooling costs = $1.9 million Ordering, inbound receiving, and quality inspection costs = 54.00 por muit Ramp-up time = 5 months Denomination of contract = US dollars Careet System: The third supplier, a fairly large and reputable manufacturer of computer equipment, including digital video camera equipment, was located in Karachi less than ten kilometres from Assam.Tech's facilities. Exactly three-quarters of the company's sales came from the sale of video cameras. In fact, the firm was the second largest producer of these devices worldwide (with over 13% market share). In addition, the plant manager pointed out that the company has committed significant resources to Setting up a JIT production system for the video camera line. Indeed, the Asramoch team was impressed with the periormance of the kunico siguals and flow-through workstations. The plant manager also emphasized that because of their close proximity to AssamTech Corporation, they would have no problem delivering the product in two-day lot sizes, "just-in-time." to AssameTech's facilities. The manage was able to show the team reports that backed this claim. Coretek Systems also had a solid reputation within the industry for working with its customers on future product development Upon visiting the quality department, the quality manager seemed particularly preoccupied. When the plant manager left for a few minutes to answer a phone call, the group asked the quality manager if the company bad experienced my significant problems receady. He confered that the last shipment of cameras bad several quality problems, and the mamber of returns from large distributors had increased dramatically. This was creating some fairly severe disruptions to production scheduling and delivery. The most serious problem was an annoying "clicking sound made by the device as it engaged the video camera. However, he assured the Assam Toch team that the design cagineers were working full-time on the problem and that it would be solved well before Ascam Toch placed an order. When the plant manager returned, the quality manager made no further mention of the problem. The plant manager estimated that the ramp-up 6 Page time for the first shipment would be very short, approximately 3 months. Relevant Coretok Systems data include: EXW Quoted price = $141 per unit FIS Quoted price = $167 per unit including transport, duties, customs and amurance Delivery lead time = 2 wook: On-time delivery record = 99.5% Quality = 7.500 PPM defects Transportation costs from Coretak Systems to Assam Tech Corporation = $14 por unit (due to frequent deliveries of small quantities) Current installed capacity for mini camera production = 95% Duties and customs 50.00 per mit Insurance = $3.00 per mit Frequency of shipment = Mon Wed,Fri (3 out of 7 days per week) Tooling costs = $1.85 million Ordering inbound receiving and quality inspection costs = 53.25 per unit Ramp-up time = 3 months Denomination of contract Dollars Happy Techuologies The fourth supplier, Happy Technologies, is a Korean company with 10.42% of global market share in mini camera sales. Happy Technologies provided the second lowest bid at $132 per mit. During the team's visit the plant manager la that capacity was not an issue and the company would be willing to commit the required production capacity to the Assam Tech Corporation contact The commodity team felt much more comfortable at Happy Technologies than at Camcom. While this supplier bas no experience doing business with Pakistan firms, the company seemed quite cious for tirse contract. The company has several largo Taiwanese and Japanese PC makers as customers. At this time Happy Technologies bas so Pakistan facilities or support staff The team had come concerns about becoming Happy Technologies first major Pakistan customer The company's product was excellent. Every video camera went through an extensive testing procedure that assured bow problems would occw. In fact, Happy Technologies process control and testing area more thorough than any other supplier the team visited However, the combination of the testing process and geographic distance meant that delivery cycle times were monch longer, up to 10 weeks per order, although the on-time delivery performance for the facility was excellent. The team was not sure if current Asian delivery performance would be indicative of delivery performance to Pakistan. The facility appeared well maintained. clean and orderly. The team noticed that the video camera facility was extremely busy and wondered if the plant manager's claim about adequate capacity was accurate. All employees worked closely together in work cells and low cach other by sme Industry experts viewed Happy Technologies as one of the most promising and dynamic companies in the industry. The ramp-up time for the production of the first shipment ready for delivery was quoted as 4 months. Relevant Happy Technologies data include: EXW Quoted price = $132 per unit FIS Quoted price = $175 por tumitiscinding transport, duties, customs and instance Delivery lead time = 10 weeks On-time delivery record = 99.0% Quality = 4,000 PPM defects Transportation costs from Happy Technologies to Assam Tech Corporation = $1$ per unit Current installed capacity for mini camera production = 92% Duties and customs 59.50 per mit Insurance = $3.50 per unit Frequency of shipment = 4 Weekly 7 Page Tooling costs = $1.6 million Ordering, inbound receiving and quality inspection costs = $2.25 per unit Ramp-up time = 4 months Denomination of contract = Dollars It mit besoted that regional instabilities pose a threat to international sourcing as there is potential political and economic risks with the Asia region predicted within the next two years. SUPPLIER FINANCIAL DATA The team also gathered financial data for each supplier. While the team believes the data for the Pakistan suppliers to be reliable, several assumptions and estimates had to be made regarding the Asian suppliers. The team had to convert Japanese and Korean currency into US dollars. La come cases, the desired figures were not available, or the supplier showed an interest in providing the team with the requested information In particular, this was an issue with Camcom Technologies. Exhibits 2 and 3 summarize selected supplier financial data Exhibir 2 Selected Supplier Balance Sheer Dala (US dollars - Sin millions) For Period Ending June 292020 Cam Cortek Happy ASSETS 55 134 5122 $9 S&S SIOS SRO S185 5:15 Markleurities Acolle lsveien Total current Save quity Gixdi Total investments and others Property, plant, and equipment TOT.AZ.SSETS S1.058 $2.13 5738 $300 $164 $21 $40 $61 $125 570 $145 $215 5450 524 $123 SIRS $4 $95 $80 $175 $413 $1,030 $1.038 51.735 S428 $11 $4R $33 $123 548 $13 $23 $13 LIABILITIES AND SHAREHOLDERS' EQUITY Notepaalde Acope Te due Acred payroll and crployee lenefits Total current liabilities Lang-term debit TOTAL LIABILITIES Shared'equity TOTAL ZATLITIES AND SHAREHOLDERS EOCITY $S25 $526 $245 S494 SI7R0 S1 244 $3.034 $1.914 54938 570 5.2003 $S43 $55 $172 $173 5830 STRO 5165 SS12 SS18 S1030 $1,480 S Pago Exhibir 3 Statement of Income Dara (US dollars - Sin millions) Year Ended June 2020 DIVI Net als Coaf of goods and Selling enlive Cam 56 300 SS.500 5475 $803 Coretak $2,300 $1,40 $520 565 $403 $66 SI2 $4R1 569 $21 Happy SIIS $948 $252 $55 $125 $100 $30 $70 $220 Cests and expenses Income before con Estimated me AZT INCOME 566 SI56 $170 $51 SI 19 ADDITIONAL INFORMATION AND ASSUMPTIONS . . . Although Assam Tech Corporation buying a standard miniatura digital video camera extra production demands and a small level of design customization will result in additional tooling requirements at each supplier. While tooling depreciation could be a cost consideration, this case does not consider depreciation The commodity team will allocate all supplier-related production costs, such as tooling, on a permit basis over the expected units in the first year only The company expects the Jazberry to have a two-year life cycle. The company fully expects to introduce its next generation of wireless mobile devices at the end of two years. Assam Tech Corporation plans to maintain a standard base level of safety stock inventory for the video Cameras for the first year. Due to long material pipelines, Assam Tech Corporation expects to maintain 30 days of the ammual estimated usage as safety stock inventory if it utilizes overseas suppliers. For domestic suppliers, the company expects to maintain an inventory equal to 15 days worth of annual estimated usage as safety stock . For the second year, the company expects to maintain an inventory equal to half of the frequency of deliveries worth of demand as safety stock ( if deliveries are every weeks. 14 days of the anal estimated asage will be kept as safety stock) Inventory carrying costs, which include storage, bandling, obsolescence, taxes, and cost of capital, are 18% per ammum of the inventory's mit purchased price. The company assumes carrying costs for safety stock material Assume the unit price quoted by each supplier is what Assam Tech Corporation would pay for the video camera from each supplier. Subsequent negotiations will likely alter the quoted price. Current installed capacity indicates that portion of the supplier's video camera production capacity that is currently utilized. For example, if current installed capacity 98%, then this supplier is utilizing 95% of its production capacity and therefore bas 2% of its capacity available for new business Suppliers have quoted a FIS price as well as an EXW price. FIS includes transport, customs duties and insurance. Asam Toch bas chosen to manage their own transport and Assam Tech has gained indicative quotes from current logistics providers - these have been stated in the information stated for each of the suppliers . 9 Pago Selected Financial Ratios Market Share Asset Utilization: Asset Tumover = Sales Assets Inventory Tumover = Cost of Sales/Average Inventory Receivable Days = Accounts Receivable Sales X 360 Payable Days - Accounts Payable Sales X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts