Question: Based on the information given to Jeffery, he submits a report on January 1 with some important calculations for management to use, both for analysis

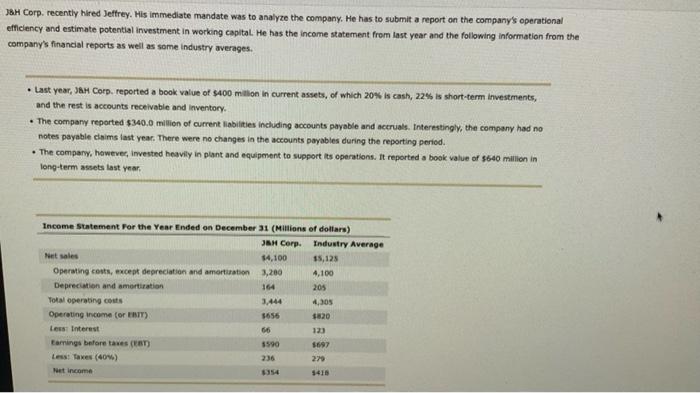

18H Corp. recently hired Jeftrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efflieiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. - Last year, Jart Corp. reported a book value of 3400 mallon in current assets, of which 20% is cash, 224 is short-term investments, and the rest is accounts receivable and inventory. - The compary reported $340.0 million of current liabilities incliding accounts payable and accruals. interestingly, the company had no notes payable cinims last year. There were no changes in the accounts payables during the reporting period. - The compary, hawever, invested heavily in plant and equipenent to support its operations. It reported a book value of s640 million in long-term assets last year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts