Question: based on the information in the excel spreadsheet what is the answer for the bottom two questions? A B D E F G H K

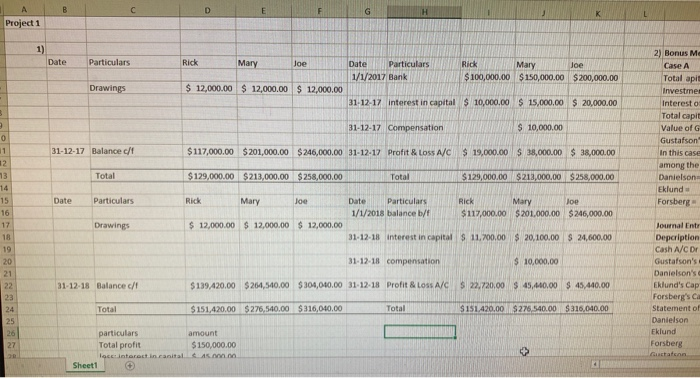

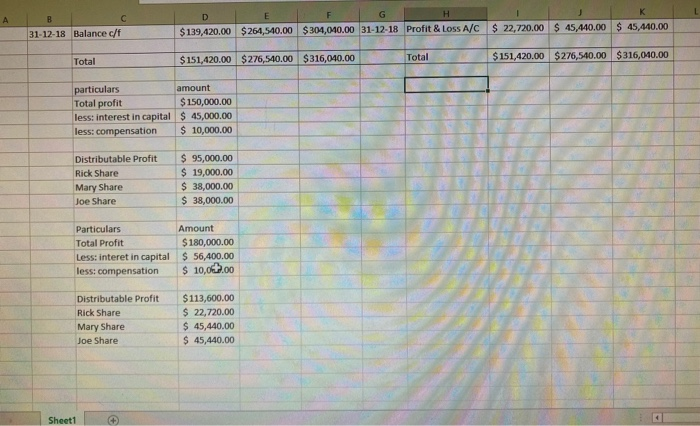

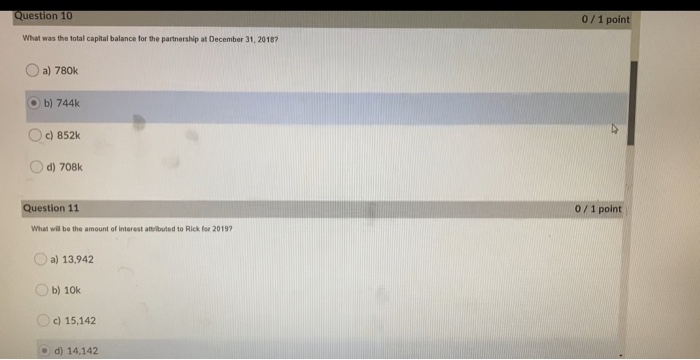

A B D E F G H K Project 1 1) Date Particulars Rick Mary Joe Date Particulars 1/1/2017 Bank Rick Mary Joe $100,000.00 $ 150,000.00 $200,000.00 Drawings $ 12,000.00 $ 12,000.00 $ 12,000.00 31-12-17 interest in capital $ 10,000.00 $ 15,000.00 $ 20,000.00 31-12-17 Compensation $ 10,000.00 2) Bonus MC Case A Total api Investmes Interest o Total capit Value of G Gustafson In this case among the Danielson Eklund Forsberg 31-12-17 Balance c/ 0 11 12 13 $117,000.00 $ 201,000.00 $ 246,000.00 31-12-17 Profit & Loss A/C $ 19,000.00 $ 38,000.00 $ 38,000.00 Total $129,000.00 $ 213,000.00 $ 258,000.00 Total $ 129,000.00 $213,000.00 $ 258,000.00 Date Particulars Rick Mary Joe Date Particulars 1/1/2018 balance b/ 15 16 17 18 Rick Mary Joe $117,000.00 $ 201,000.00 $ 246,000.00 Drawings $ 12,000.00 $ 12,000.00 $ 12,000.00 31-12-13 interest in capital $ 11,700.00 $ 20,100.00 S 24,600.00 19 31-12-18 compensation $ 10,000.00 20 21 22 23 31-12-18 Balance / $139,420.00 $ 204,540.00 $ 304,040.00 31-12-18 Profit & Loss A/C S 22,720,00 $ 45,440.00 $ 45,440.00 Journal Entr Depcription Cash A/CDI Gustafson's Danielson's Eklund's Cap Forsberg's C Statement of Danielson Eklund Forsberg Guctaten Total $ 151,420.00 $276,540.00 $316,040.00 Total $ 151.420,00 $276 540.00 $316,040.00 24 25 26 27 particulars amount Total profit $150,000.00 lace interest in ranital Sheet1 4 B 31-12-18 Balance c/f E G H K $ 139,420.00 $264,540.00 $ 304,040.00 31-12-18 Profit & Loss A/C $ 22,720.00 $ 45,440.00 $ 45,440.00 Total $ 151,420.00 $276,540.00 $316,040.00 Total $ 151,420.00 $276,540.00 $316,040.00 particulars amount Total profit $ 150,000.00 less: interest in capital $ 45,000.00 less: compensation $ 10,000.00 Distributable Profit Rick Share Mary Share Joe Share $ 95,000.00 $ 19,000.00 $ 38,000.00 $ 38,000.00 Particulars Amount Total Profit $ 180,000.00 Less: interet in capital $ 56,400.00 less: compensation $ 10,00.00 Distributable Profit Rick Share Mary Share Joe Share $113,600.00 $ 22,720.00 $ 45,440.00 $ 45,440.00 Sheet1 Question 10 0/1 point What was the total capital balance for the partnership at December 31, 20187 a) 780k b) 744 c) 852k d) 70Bk Question 11 0/1 point What will be the amount of interest attributed to Rick for 20197 a) 13,942 b) 10k c) 15,142 d) 14.142

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts