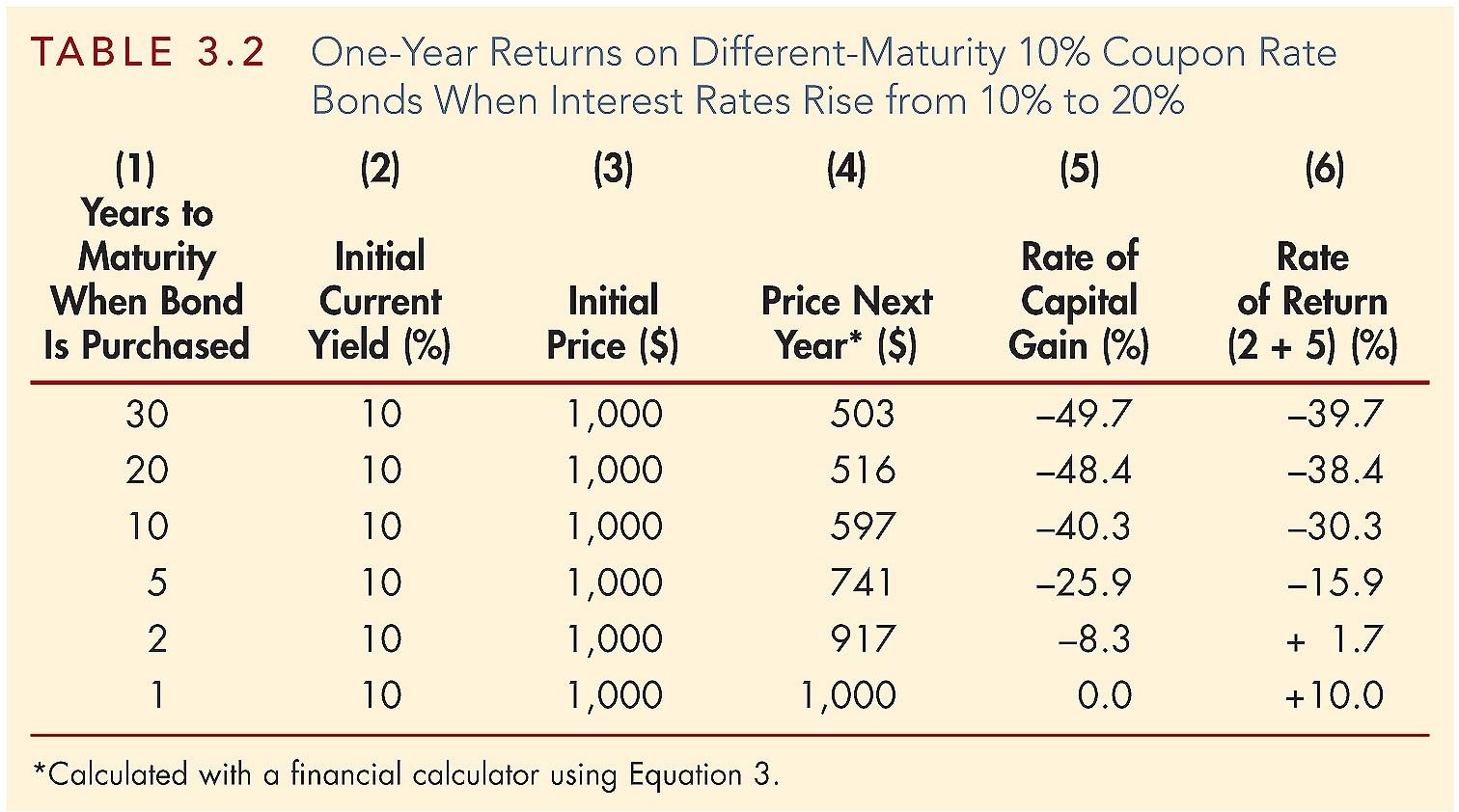

Question: Based on the information in the figure below, please analyze what will happen to the returns on bonds of different maturities when interest rates rise?

Based on the information in the figure below, please analyze what will happen to the returns on bonds of different maturities when interest rates rise?

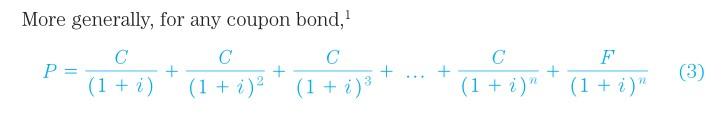

TABLE 3.2 One-Year Returns on Different-Maturity 10% Coupon Rate Bonds When Interest Rates Rise from 10% to 20% (2) (3) (4) (5) (6) (1) Years to Maturity When Bond Is Purchased Initial Current Initial Rate of Capital Gain (%) Price Next Year* ($) Rate of Return (2 + 5) (%) Yield (%) Price ($) 30 10 503 -49.7 -39.7 20 10 516 -48.4 -38.4 10 10 597 -40.3 -30.3 1,000 1,000 1,000 1,000 1,000 1,000 5 10 741 -25.9 -15.9 2 10 917 -8.3 + 1.7 1 10 1,000 0.0 +10.0 *Calculated with a financial calculator using Equation 3. More generally, for any coupon bond, C C F P= + + + + + (3) (1 + i) (1 + i) (1 + i) (1 + i)" (1 + i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts