Question: based on the information presented i need to answer part b. dont know where to begin Carrium Insights Inc. Income Statement For the year ended

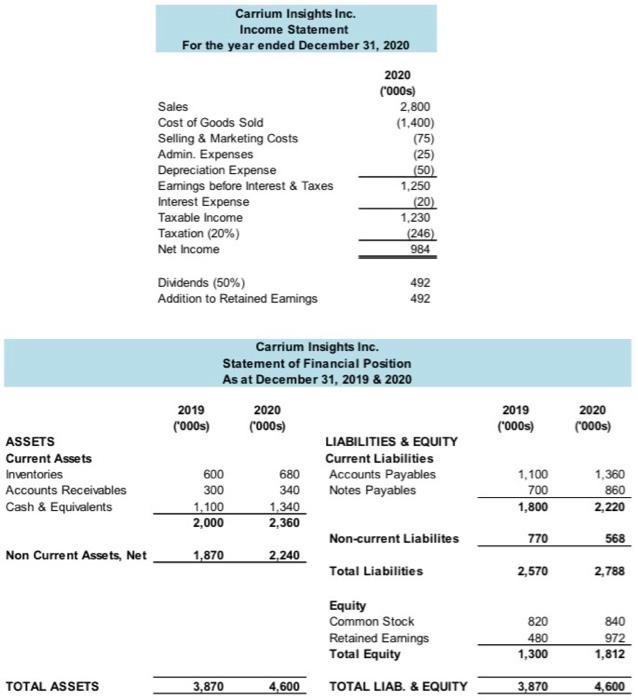

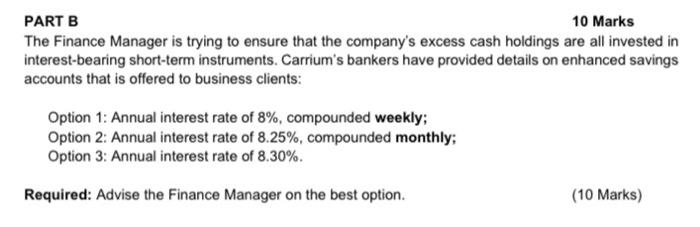

Carrium Insights Inc. Income Statement For the year ended December 31, 2020 Sales Cost of Goods Sold Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (20%) Net Income 2020 ('000) 2,800 (1,400) (75) (25) (50) 1.250 (20) 1,230 (246) 984 Dividends (50%) Addition to retained Eamings 492 492 2019 ('000) 2020 (000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents Carrium Insights Inc. Statement of Financial Position As at December 31, 2019 & 2020 2019 2020 ('000s) (000s) LIABILITIES & EQUITY Current Liabilities 600 680 Accounts Payables 300 340 Notes Payables 1.100 1.340 2,000 2,360 Non-current Liabilites 1,870 2.240 Total Liabilities 1.100 700 1,800 1,360 860 2,220 770 568 Non Current Assets, Net 2,570 2,788 Equity Common Stock Retained Earnings Total Equity 820 480 1,300 840 972 1,812 TOTAL ASSETS 3,870 4,600 TOTAL LIAB. & EQUITY 3,870 4,600 --- 2000 Bew De 10 BE one M 15 www 20 T. BLOC Se 16.00 DAN they Mr. PART B 10 Marks The Finance Manager is trying to ensure that the company's excess cash holdings are all invested in interest-bearing short-term instruments. Carrium's bankers have provided details on enhanced savings accounts that is offered to business clients: Option 1: Annual interest rate of 8%, compounded weekly; Option 2: Annual interest rate of 8.25%, compounded monthly; Option 3: Annual interest rate of 8.30%. Required: Advise the Finance Manager on the best option. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts