Question: Based on the information provided above, what is the value (NPV) of the Singapore target?a. $19.266 millionb. $39.298 millionc. $168.160 milliond. $128.861 million42. Based on

Based on the information provided above, what is the value (NPV) of the Singapore target?a. $19.266 millionb. $39.298 millionc. $168.160 milliond. $128.861 million42. Based on the information above, what is the Singapore target's value based on its stock price?a. $5 millionb. $25 millionc. $125 milliond. $87.5 million43. Refer to Exhibit above, the target's board has indicated that it finds a premium of 25 percentappropriate. Is that maximum percentage premium feasible given your numbers?a. No, they cannot afford to pay 25% premium, because the market's valuation is below JohnDeer's valuation (stock is underpriced).b. No, they should not offer any premium because the market's valuation is above John Deer'svaluation (stock is overpriced).c. No, they should only pay up to 8% premium, because the market's valuation is below JohnDeer's valuation by 8% only).d. Yes, they should be able to offer 25% premium since market's valuation is well below JohnDeer's valuation (stock is underprice).

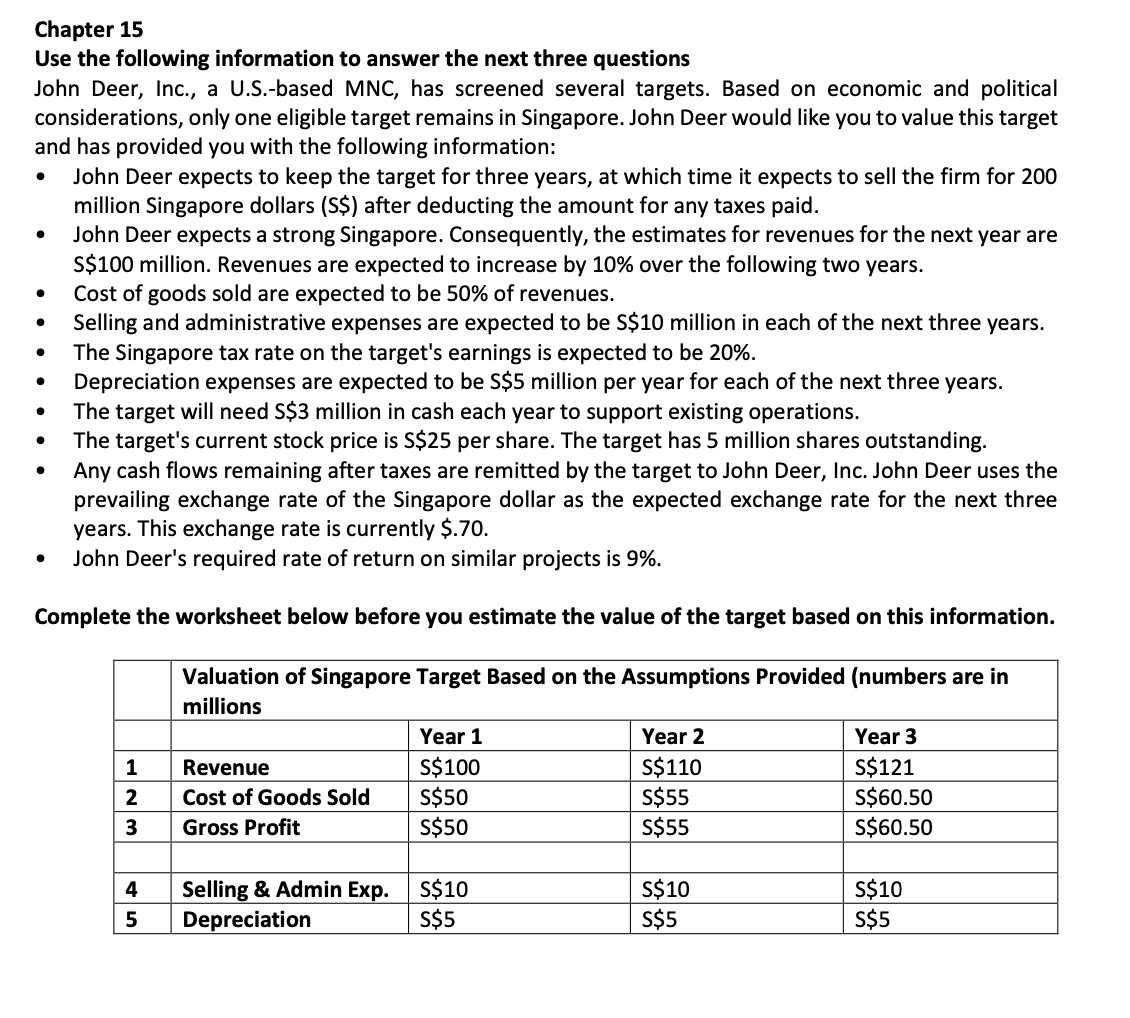

Chapter 15 Use the following information to answer the next three questions John Deer, Inc., a U.S.-based MNC, has screened several targets. Based on economic and political considerations, only one eligible target remains in Singapore. John Deer would like you to value this target and has provided you with the following information: e John Deer expects to keep the target for three years, at which time it expects to sell the firm for 200 million Singapore dollars (SS$) after deducting the amount for any taxes paid. e John Deer expects a strong Singapore. Consequently, the estimates for revenues for the next year are $5$100 million. Revenues are expected to increase by 10% over the following two years. e Cost of goods sold are expected to be 50% of revenues. * Selling and administrative expenses are expected to be $510 million in each of the next three years. * The Singapore tax rate on the target's earnings is expected to be 20%. e Depreciation expenses are expected to be S$5 million per year for each of the next three years. * The target will need S$3 million in cash each year to support existing operations. e The target's current stock price is S$25 per share. The target has 5 million shares outstanding. e Any cash flows remaining after taxes are remitted by the target to John Deer, Inc. John Deer uses the prevailing exchange rate of the Singapore dollar as the expected exchange rate for the next three years. This exchange rate is currently $.70. e John Deer's required rate of return on similar projects is 9%. Complete the worksheet below before you estimate the value of the target based on this information. Valuation of Singapore Target Based on the Assumptions Provided (numbers are in millions Year1 Year 2 Year3 Revenue S$100 S$110 S$121 Cost of Goods Sold SS50 SS55 $$60.50 Gross Profit SS50 SS55 $$60.50 Selling & Admin Exp. S$10 S$10 S$10 Depreciation S$5 SS5 SS5