Question: Based on the information provided above what will be the IRR for the project? Should Square, inc accept or reject the project based on IRRR?

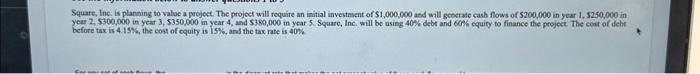

Based on the information provided above what will be the IRR for the project? Should Square, inc accept or reject the project based on IRRR? a. 13.06%; accept b. 13.06%, reject c. 9.06%; accept d. 10.00%; reject Square, Ine. is planning to valoe a peject. The project will require an initial investment of $1,000,000 asd will geserate cash flows of 5200,000 in year 1 , 52.50,000 in year 2, 5300,000 in yeat 3, 5350,000 in year 4 , and 5360,000 in year 5 . Square, Inc. will be using 40% debt and 60 ? equity to finance the project. The coet of dehe before tax is 4.15S, the cost of equity is 15%, and the tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts