Question: Based on the information provided, compute the following items for the year 2018: 1. Depreciation expense. 2. Income tax paid in cash. 3. Purchase of

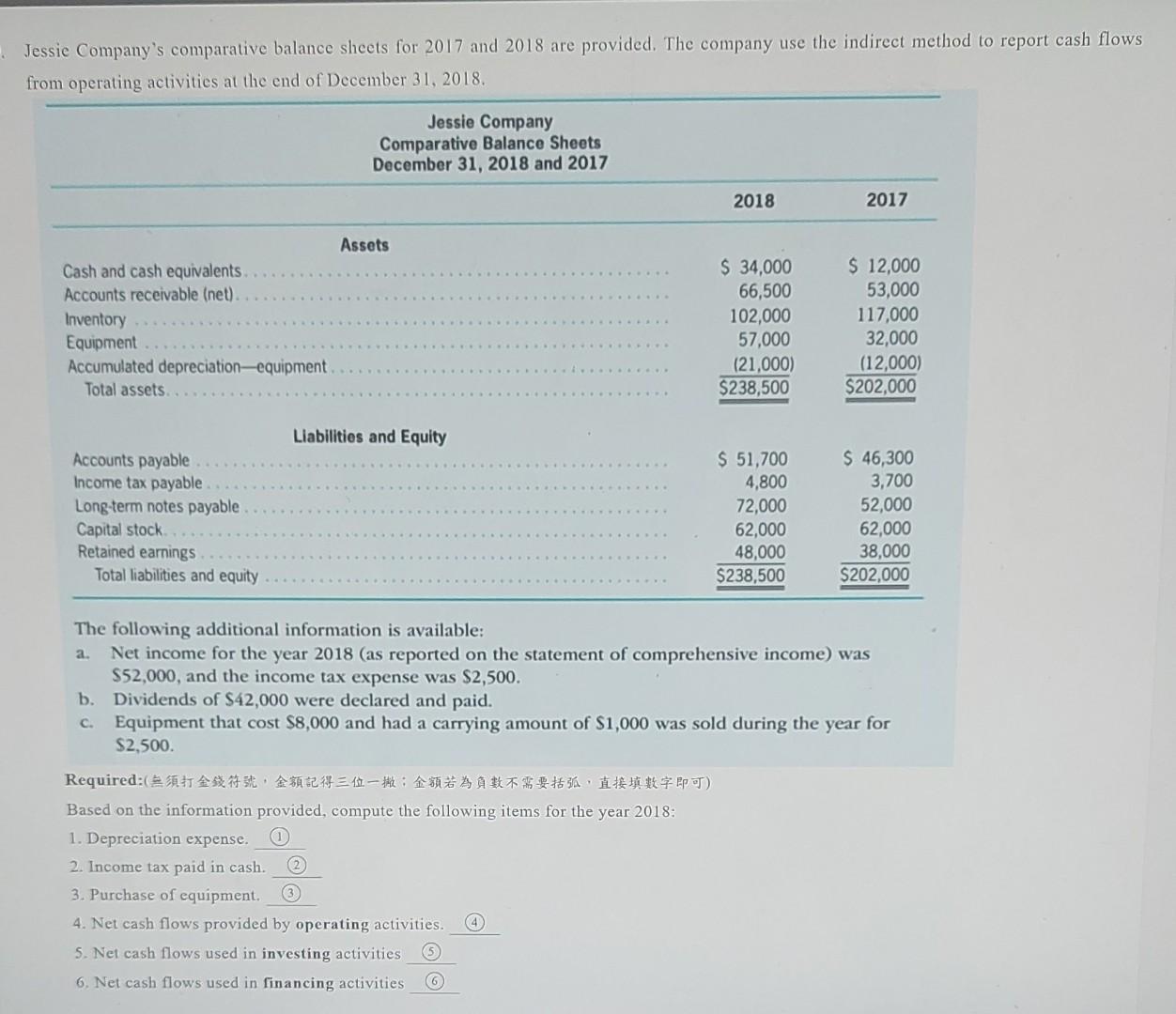

Based on the information provided, compute the following items for the year 2018: 1. Depreciation expense. 2. Income tax paid in cash. 3. Purchase of equipment. 4. Net cash flows provided by operating activities. 5. Net cash flows used in investing activities 6. Net cash flows used in financing activities

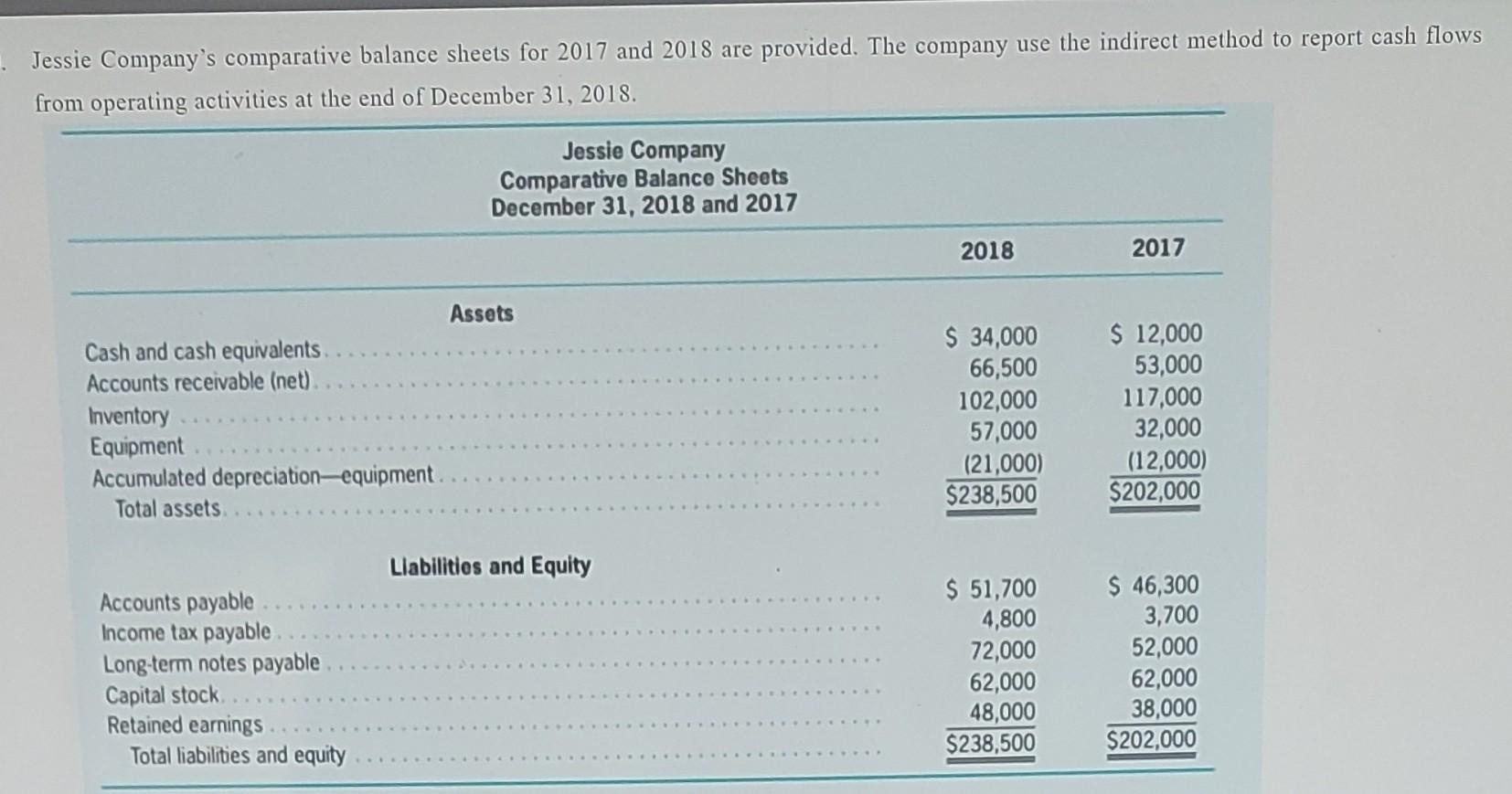

Iessie Company's comparative balance sheets for 2017 and 2018 are provided. The company use the indirect method to report cash flows from operating activities at the end of December 31,2018. Jessie Company's comparative balance sheets for 2017 and 2018 are provided. The company use the indirect method to report cash flows from operating activities at the end of December 31,2018. The following additional information is available: a. Net income for the year 2018 (as reported on the statement of comprehensive income) was $52,000, and the income tax expense was $2,500. b. Dividends of $42,000 were declared and paid. c. Equipment that cost $8,000 and had a carrying amount of $1,000 was sold during the year for $2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts