Question: Based on the information provided in the previous question, assume the firm instead decided to do a 5-for-4 stock split. Instructions What would the effect

Based on the information provided in the previous question, assume the firm instead decided to do a 5-for-4 stock split.

Instructions

What would the effect be on the common stock account, the par value per share, the retained earnings balance, and additional paid-in capital be after the dividend?

Computations:

Par value per share:

Common stock:

Retained earnings:

Additional paid-in capital

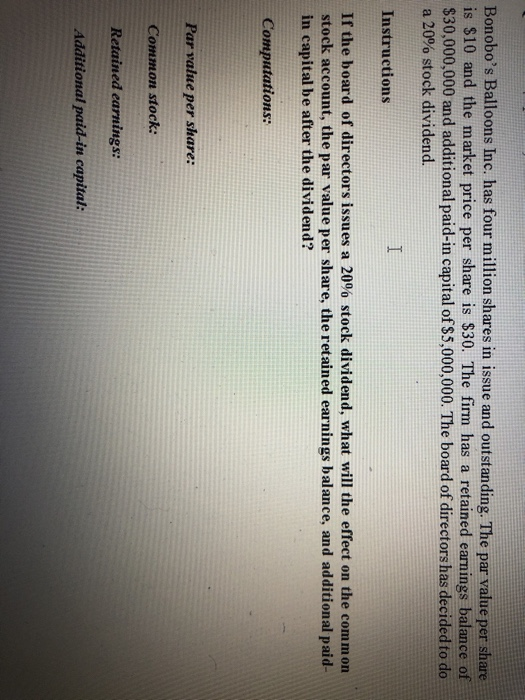

Bonobo's Balloons Inc. has four million shares in issue and outstanding. The par value per share is $10 and the market price per share is $30. The firm has a retained earnings balance of $30,000,000 and additional paid-in capital of $5,000,000. The board of directors has decided to do a 20% stock dividend. Instructions I If the board of directors issues a 20% stock dividend, what will the effect on the common stock account, the par value per share, the retained earnings balance, and additional paid- in capital be after the dividend? Computations: Par value per share: Common stock: Retained earnings: Additional paid-in capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts