Question: Based on the information provided (the calculation work is already done), what GENERIC conclusion can be reached about the fruit drink project based on this

Based on the information provided (the calculation work is already done), what GENERIC conclusion can be reached about the fruit drink project based on this sensitivity analysis I have completed? I need Part G only, just a brief explanation of what these numbers tell us in an analysis. Please/thanks

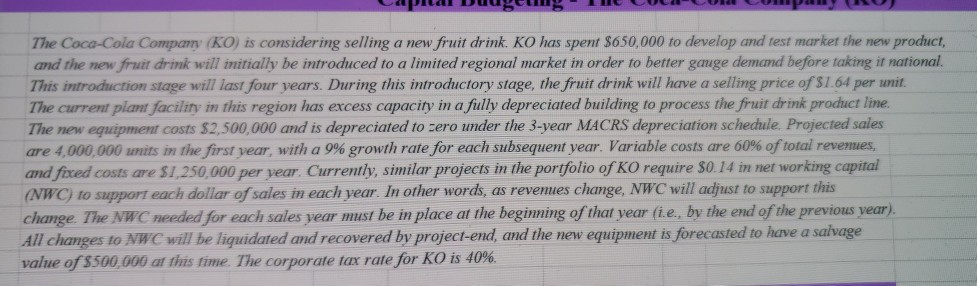

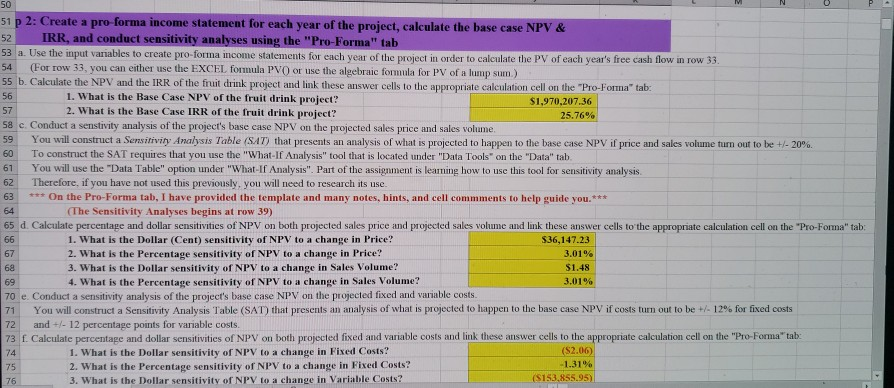

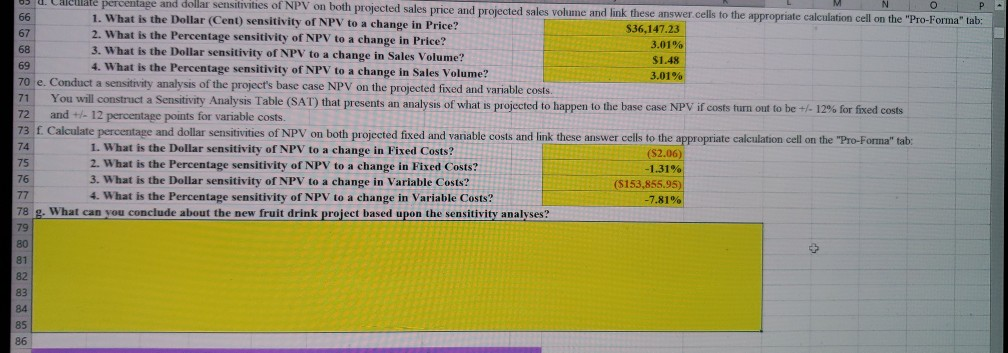

The Coca-Cola Compamy (KO) is considering selling a new fruit drink. KO has spent $650,000 to develop and test market the new product and the new fruit drink will initially be introduced to a limited regional market in order to better gauge demand before taking it national. This introduction stage will last four years. During this introductory stage, the fruit drink will have a selling price of $1.64 per unit. The current plant aclnm this regt has excess capacity in a fully depreciated building to process the ruit drmk product line. The new eguipment costs $2,500,000 and is depreciated to zero under the 3-year MACRS depreciation schedule. Projected sales are 4,000,000 units in the rst vear, with a 9% growth rate for each subsequent year. Variable costs are 60% of total revenues and fixed costs are $1,250,000 per year Currently, similar projects in the portfolio of KO require S0.14 in net working capital NWC) to support each doliar of sales in each year. In other words, as revemues change, NWC will adjust to support this change The NWC needed for each sales year must be in place at the beginning of that year (i.e, by the end of the previous year) All changes to NWC will be liquidated and recovered by project-end, and the new equipment is forecasted to have a salvage value of $500,000 at this time The corporate tax rate for KO is 40% 51 p 2: Create a pro-forma income statement for each year of the project, calculate the base case NPV & 52 IRR, and conduct sensitivity analyses using the "Pro-Forma" tab 53 a. Use the input variables to create pro-forma income statements for each year of the project in order to calculate the PV of each year's free cash flow in row 33 54 (For row 33, you can either use the EXCEL formula PVO or use the algebraic formula for PV of a lump sum.) 55 b. Calcula te the NPV and the IRR of the fruit drink project and link these answer cells to the appropriate calculation cell on the "Pro-Forma" tab 1. What is the Base Case NPV of the fruit drink project:? 2. What is the Base Case IRR of the fruit drink project? $1,970,.207.36 25.76% 58 c. Conduct a senstivity analysis of the project's base case NPV on the projected sales price and sales volume 59 You will construct a Sensirvin Anahsis Table (SAT that presents an analysis of what s projected to ha en to the lase case NPV l price and sales voline turn o r tobe tl 20% 60 To construct the SAT requires that you use the "What-If Analysis" tool that is located under "Data Tools" on the "Data" talb. 61 You will use the "Data Table" option under "What-If Analysis". Part of the assignment is leaming how to use this tool for sensitivity analysis. 62 Therefore, if you have not used this previously, you will need to research its use. 63On the Pro-Forma tab, I have provided the template and many notes, hints, and cell commments to help guide you.** The Sensitivity Analyses begins at row 39) 65- Calculate percentage and dollar sen in tics ofNPV on both proyecte s ce and k t sea er cels the appropriate ca u ation sel n the Pro-Fon arab sa s price and pro sa 1. What is the Dollar (Cent) sensitivity of NPV to a change in Price? 2. What is the Percentage sensitivity of NPV to a change in Price? 3. What is the Dollar sensitivity of NPV to a change in Sales Volume? 4. What is the Percentage sensitivity of NPV to a change in Sales Volume? 36,147.23 $1.48 3.01% 70 e. Conduct a sensitivity analysis of the project's base case NPV on the projected fixed and variable costs. 71 You will construct a Sensitivity Analysis Table (SAT) that presents an analysis of what is projected to happen to the base case NPV if costs turn out to be+- 12% for fixed costs 72 and +- 12 percentage points for variable costs. 73 f. Calculate percentage and dollar sensitivities of NPV on iable costs and link these answer cells to the a both projected fixed and var te calculation cell on the "Pro-Forma" tab: 1. What is the Dollar sensitivity of NPV to a change in Fixed Costs? 2. What is the Percentage sensitivity of NPV to a change in Fixed Costs? 3. what is the Dollar sensitivity of NPV to a change in Variable Cost 1.31% si sus s-95) percentage and dollar sensitivities of NPV on both projected sales price and p answer cells to the appropriate calculation cell on the "Pro-Forma" tab: 1. What is the Dollar (Cent) sensitivity of NPV to a change in Price? 2. What is the Percentage sensitivity of NPV to a change in Price? 3. What is the Dollar sensitivity of NPV to a change in Sales Volume? 4. What is the Percentage sensitivity of NPV to a change in Sales Volume? $36,147.23 67 68 69 70 e. Conduct a sensitivity analysis of the project's base case NPV on the projected fixed and variable costs 3.01 % $1.48 3.01 % Analysis Table SAT) that presents an analysis of what is projected to happen to the base case NPV if costs turn out to be +/-12% for fixed costs 72 and +/- 12 percentage points for variable costs. 73 f Calculate percentage and dollar sensitivities of NPV on both projected fixed and variable costs and link these answer cells to the appropriate calculation cell on the "Pro-Forma" tab: 74 1. What is the Dollar sensitivity of NPV to a change in Fixed Costs? 2. What is the Percentage sensitivity of NPV to a change in Fixed Costs? 3. What is the Dollar sensitivity of NPV to a change in Variable Costs? 4. What is the Percentage sensitivity of NPV to a change in Variable Costs? ($2.06) 1.31% ($153,855.95 7.81 % 75 78 g. What can you conclude about the new fruit drink project based upon the sensitivity analyses? 79 81 83 84 85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts