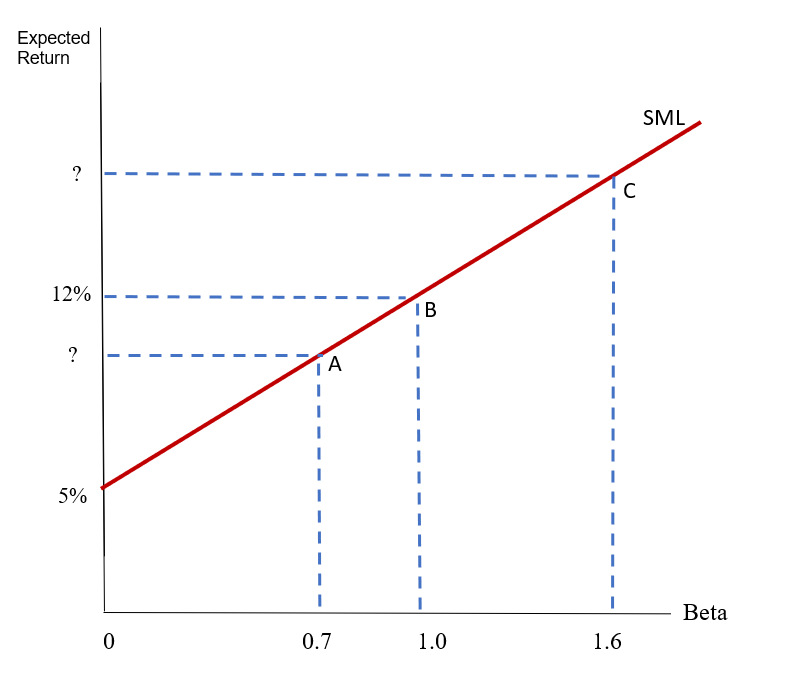

Question: Based on the information shown in the figure and table below, answer question (1) to (3) Stock Standard Deviation Beta A 20% 0.7 B 10%

Based on the information shown in the figure and table below, answer question (1) to (3)

|

Stock | Standard Deviation |

Beta |

| A | 20% | 0.7 |

| B | 10% | 1.0 |

| C | 12% | 1.6 |

1) According to the SML shown above, what is the risk-free rate and market return? Please write down the Capital Market Pricing Model (CAPM).

2) What are the expected returns for stock A, B, and C?

3) Suppose your portfolio consists of 30% stock A, 55% stock B, and 15% stock C. What is your portfolio return and portfolio beta?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts