Question: Based on the interview notes and documents, answer the following items relative to their 2019 Form 1040. If an amount is a deductible loss, put

|

|

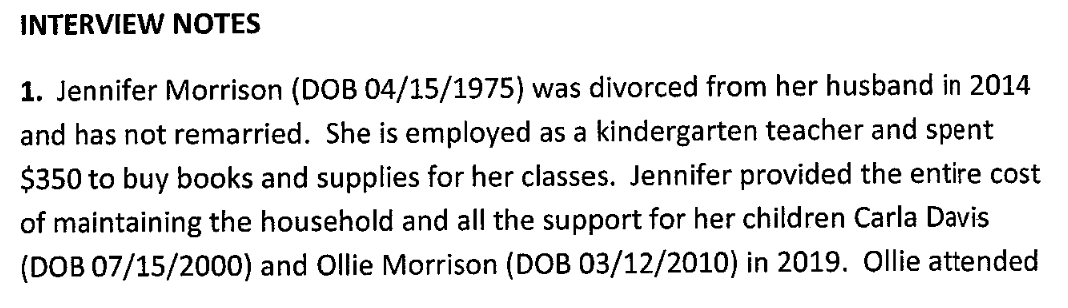

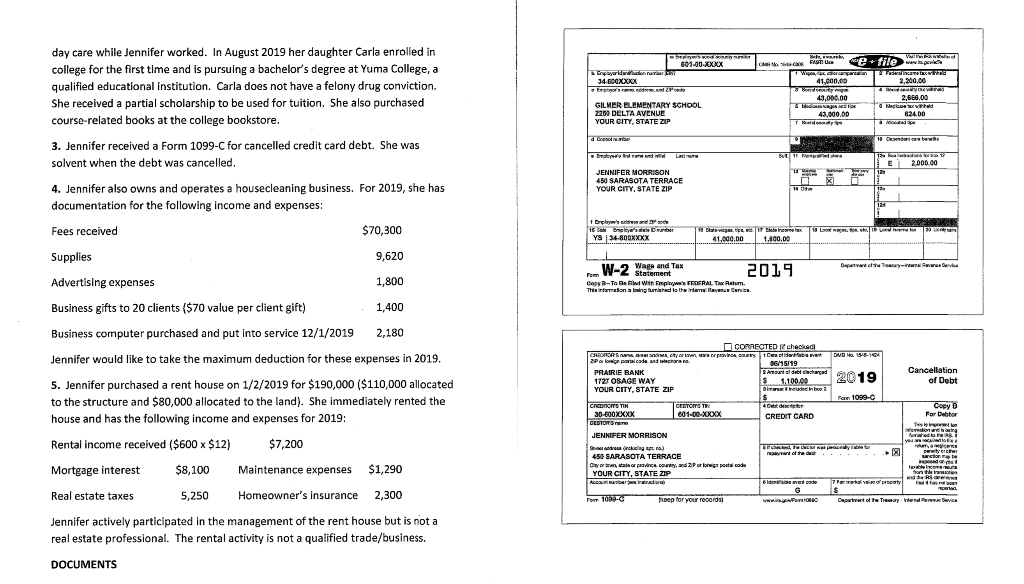

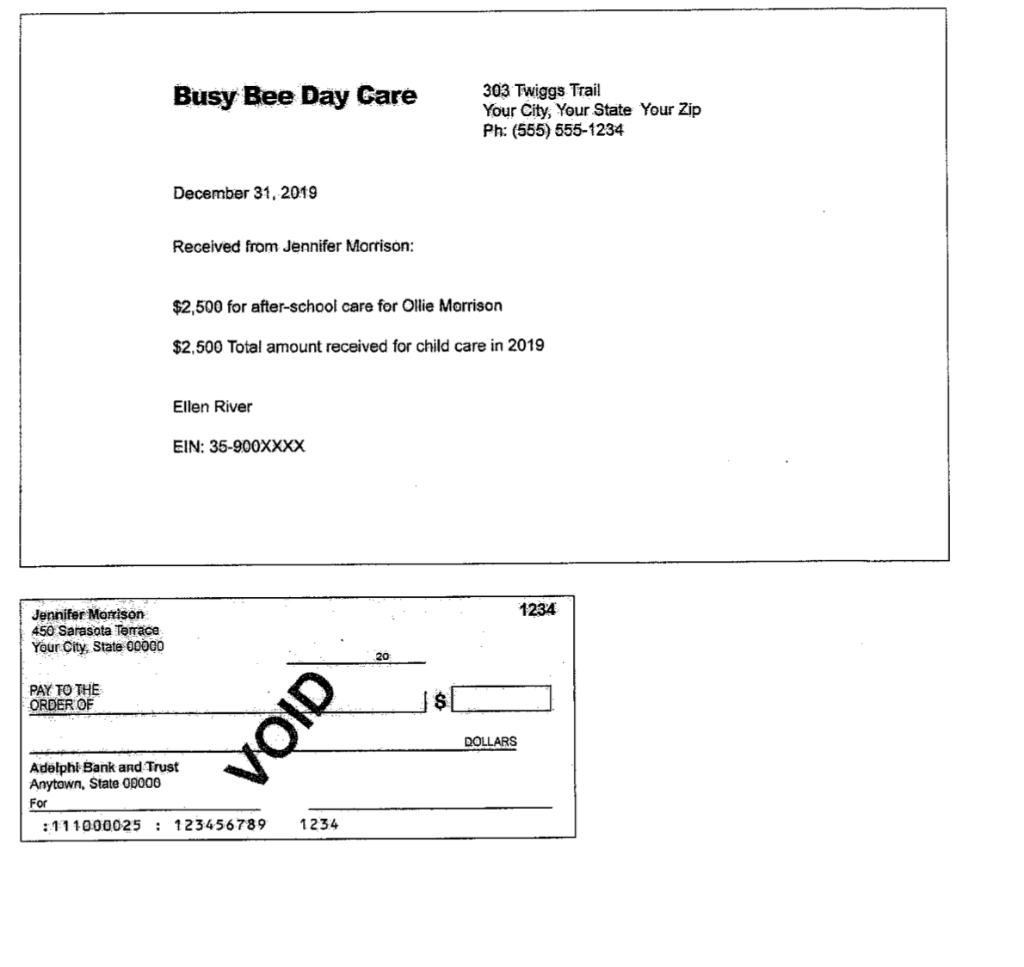

INTERVIEW NOTES 1. Jennifer Morrison (DOB 04/15/1975) was divorced from her husband in 2014 and has not remarried. She is employed as a kindergarten teacher and spent $350 to buy books and supplies for her classes. Jennifer provided the entire cost of maintaining the household and all the support for her children Carla Davis (DOB 07/15/2000) and Ollie Morrison (DOB 03/12/2010) in 2019. Ollie attended .. SETT day care while Jennifer worked. In August 2019 her daughter Carla enrolled in college for the first time and is pursuing a bachelor's degree at Yuma College, a 601-90-XXXX FAST e file www.guia FESTAS qualified educational institution. Carla does not have a felony drug conviction. 34.GOOxxo 41,000,00 2,200.00 tro. Po 43,000.00 She received a partial scholarship to be used for tuition. She also purchased 2,686,00 GILMER ELEMENTARY SCHOOL CARA ME Malevi course-related books at the college bookstore. 2200 DELTA AVENUE 43,000.00 824.00 YOUR CITY STATE ZIP wa d. 3. Jennifer received a Form 1099-C for cancelled credit card debt. She was 18 Odotan bers solvent when the debt was cancelled. Beskydende JENNIFER MORRISON 450 SARASOTA TERRACE x 4. Jennifer also owns and operates a housecleaning business. For 2019, she has YOUR CITY, STATE ZIP Hot documentation for the following income and expenses: Line 12 Hall E 2.000.00 13 Fees received $70,300 16 Luke Bryster YS 34-80DXXXX Ti Lond 29 133 EL DIT Bicentax 41,000,00 1.100,00 Supplies 9,620 Departawe 2019 Advertising expenses 1,800 Statement C-To Be Win www FORAL Tatum. This intamaton a bwngulated is the interyer Cerce. Business gifts to 20 clients ($70 value per client gift) 1,400 Business computer purchased and put into service 12/1/2019 2,180 2019 Jennifer would like to take the maximum deduction for these expenses in 2019. 5. Jennifer purchased a rent house on 1/2/2019 for $190,000 ($110,000 allocated to the structure and $80,000 allocated to the land). She immediately rented the house and has the following income and expenses for 2019: COMTECTED I checked CAROORSA, Storiawn, wer pravi Sarry 10 bin met DVD MO. 158-164 Por para cada andare 06/15/19 PRAIRIE BANK Bantal werd Cancellation 1727 OSAGE WAY $ 1.100.00 of Debt YOUR CITY, STATE ZIP Bir de hoo Po 1000. CREDITS TIM CESTOSTA Copy B 30-600XXXX 601-00-XXX CREDIT CARD For Debtor GEDDITS Woner boxing JENNIFER MORRISON fureditoru you CE 450 SARASOTA TERRACE permite Reynard at the... con te Cayor our sale or province country, and Portoroga posicode be YOUR CITY, STATE ZIP wider ACEST Tractor de todo 7YER ES Tow 1005- keep for your records Dasartment of the Treway Henderen Service Rental income received ($600 x $12) $7,200 Mortgage interest $8,100 Maintenance expenses $1,290 Real estate taxes 5,250 Homeowner's Insurance 2,300 Jennifer actively participated in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. DOCUMENTS OMB No. 1545-1574 CORRECTED FIEER'S name, street address, city or town, state or province country, ZIP or 1 Payments received for foreign postal code, and telephone number qualified tuition and related expenses YUMA COLLEGE 7,200.00 10 COLLEGE AVE YOUR CITY, STATE ZIP 2019 Tuition Statement Form 1098-T Yuma College 3 FLER'S employer identification no. 37-700XXXX STUDENT'S narne STUDENT'S TIN 602-00-XXXX Copy B For Student 4 Adjustments made for a prior year 5 Scholarships or grants Statement of Account GARLA DAVIS December 31, 2019 $ 6 Adjustments to scholarships or grants for a prior year Sireet address (including apt. no.) 450 SARASOTA TERRACE City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, STATE ZIP Service Provided/Acct. No. (Geo instr.) 8 Check if at least half-time student S 4,200.00 7 Checked if the amount in box 1 Includes amounts for an academic period beginning January- March 2020 10 Ins. contract reimb./refund This is important tax information and is being turished to the IRS. This form must be used to complete Form 8883 to claim education credits. Give it to the tax preparer or use it to prepare the tax retum. Carla Davis 9 Checked if a graduate student S Student ID 602-00-XXXX For 1098-T (keap for your records) www.irs.gov/Form 109BT Department of the Treasury - Internal Revenue Service Amount Paid Amount Billed +$7,200.00 -$4,200.00 Date Transaction 08/30/2019 Tuition - Fall Semester 2019 08/30/2019 Scholarship 09/03/2019 Meal plan 09/03/2019 Parking pass Campus Bookstore charge to 09/04/2019 student account 09/05/2019 Payment - check #1234 +$ 320.00 +$ 75.00 +$ 650.00 -$4,045.00 12/31/2019 Account Balance..... $0.00 Busy Bee Day Care 303 Twiggs Trail Your City, Your State Your Zip Ph: (555) 555-1234 December 31, 2019 Received from Jennifer Morrison: $2,500 for after-school care for Ollie Morrison $2,500 Total amount received for child care in 2019 Ellen River EIN: 35-900XXXX 1234 Jennifer Morrison 450 Sarasota Terrace Your City, State 00000 PAY TO THE ORDER OF VOID DOLLARS Adelphi Bank and Trust Anytown, State Op000 For : 111000025 : 123456789 1234 QUESTION 9 Child tax credit QUESTION 10 Child/dependent care credit QUESTION 11 Filing status (Single, Head of Household, Qualifying Widow with Dependent Child, Married Filing Jointly, Married Filing Separately) QUESTION 12 Is Jennifer's cleaning business a specified service trade or business (SSTB)? YES or NO INTERVIEW NOTES 1. Jennifer Morrison (DOB 04/15/1975) was divorced from her husband in 2014 and has not remarried. She is employed as a kindergarten teacher and spent $350 to buy books and supplies for her classes. Jennifer provided the entire cost of maintaining the household and all the support for her children Carla Davis (DOB 07/15/2000) and Ollie Morrison (DOB 03/12/2010) in 2019. Ollie attended .. SETT day care while Jennifer worked. In August 2019 her daughter Carla enrolled in college for the first time and is pursuing a bachelor's degree at Yuma College, a 601-90-XXXX FAST e file www.guia FESTAS qualified educational institution. Carla does not have a felony drug conviction. 34.GOOxxo 41,000,00 2,200.00 tro. Po 43,000.00 She received a partial scholarship to be used for tuition. She also purchased 2,686,00 GILMER ELEMENTARY SCHOOL CARA ME Malevi course-related books at the college bookstore. 2200 DELTA AVENUE 43,000.00 824.00 YOUR CITY STATE ZIP wa d. 3. Jennifer received a Form 1099-C for cancelled credit card debt. She was 18 Odotan bers solvent when the debt was cancelled. Beskydende JENNIFER MORRISON 450 SARASOTA TERRACE x 4. Jennifer also owns and operates a housecleaning business. For 2019, she has YOUR CITY, STATE ZIP Hot documentation for the following income and expenses: Line 12 Hall E 2.000.00 13 Fees received $70,300 16 Luke Bryster YS 34-80DXXXX Ti Lond 29 133 EL DIT Bicentax 41,000,00 1.100,00 Supplies 9,620 Departawe 2019 Advertising expenses 1,800 Statement C-To Be Win www FORAL Tatum. This intamaton a bwngulated is the interyer Cerce. Business gifts to 20 clients ($70 value per client gift) 1,400 Business computer purchased and put into service 12/1/2019 2,180 2019 Jennifer would like to take the maximum deduction for these expenses in 2019. 5. Jennifer purchased a rent house on 1/2/2019 for $190,000 ($110,000 allocated to the structure and $80,000 allocated to the land). She immediately rented the house and has the following income and expenses for 2019: COMTECTED I checked CAROORSA, Storiawn, wer pravi Sarry 10 bin met DVD MO. 158-164 Por para cada andare 06/15/19 PRAIRIE BANK Bantal werd Cancellation 1727 OSAGE WAY $ 1.100.00 of Debt YOUR CITY, STATE ZIP Bir de hoo Po 1000. CREDITS TIM CESTOSTA Copy B 30-600XXXX 601-00-XXX CREDIT CARD For Debtor GEDDITS Woner boxing JENNIFER MORRISON fureditoru you CE 450 SARASOTA TERRACE permite Reynard at the... con te Cayor our sale or province country, and Portoroga posicode be YOUR CITY, STATE ZIP wider ACEST Tractor de todo 7YER ES Tow 1005- keep for your records Dasartment of the Treway Henderen Service Rental income received ($600 x $12) $7,200 Mortgage interest $8,100 Maintenance expenses $1,290 Real estate taxes 5,250 Homeowner's Insurance 2,300 Jennifer actively participated in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. DOCUMENTS OMB No. 1545-1574 CORRECTED FIEER'S name, street address, city or town, state or province country, ZIP or 1 Payments received for foreign postal code, and telephone number qualified tuition and related expenses YUMA COLLEGE 7,200.00 10 COLLEGE AVE YOUR CITY, STATE ZIP 2019 Tuition Statement Form 1098-T Yuma College 3 FLER'S employer identification no. 37-700XXXX STUDENT'S narne STUDENT'S TIN 602-00-XXXX Copy B For Student 4 Adjustments made for a prior year 5 Scholarships or grants Statement of Account GARLA DAVIS December 31, 2019 $ 6 Adjustments to scholarships or grants for a prior year Sireet address (including apt. no.) 450 SARASOTA TERRACE City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, STATE ZIP Service Provided/Acct. No. (Geo instr.) 8 Check if at least half-time student S 4,200.00 7 Checked if the amount in box 1 Includes amounts for an academic period beginning January- March 2020 10 Ins. contract reimb./refund This is important tax information and is being turished to the IRS. This form must be used to complete Form 8883 to claim education credits. Give it to the tax preparer or use it to prepare the tax retum. Carla Davis 9 Checked if a graduate student S Student ID 602-00-XXXX For 1098-T (keap for your records) www.irs.gov/Form 109BT Department of the Treasury - Internal Revenue Service Amount Paid Amount Billed +$7,200.00 -$4,200.00 Date Transaction 08/30/2019 Tuition - Fall Semester 2019 08/30/2019 Scholarship 09/03/2019 Meal plan 09/03/2019 Parking pass Campus Bookstore charge to 09/04/2019 student account 09/05/2019 Payment - check #1234 +$ 320.00 +$ 75.00 +$ 650.00 -$4,045.00 12/31/2019 Account Balance..... $0.00 Busy Bee Day Care 303 Twiggs Trail Your City, Your State Your Zip Ph: (555) 555-1234 December 31, 2019 Received from Jennifer Morrison: $2,500 for after-school care for Ollie Morrison $2,500 Total amount received for child care in 2019 Ellen River EIN: 35-900XXXX 1234 Jennifer Morrison 450 Sarasota Terrace Your City, State 00000 PAY TO THE ORDER OF VOID DOLLARS Adelphi Bank and Trust Anytown, State Op000 For : 111000025 : 123456789 1234 QUESTION 9 Child tax credit QUESTION 10 Child/dependent care credit QUESTION 11 Filing status (Single, Head of Household, Qualifying Widow with Dependent Child, Married Filing Jointly, Married Filing Separately) QUESTION 12 Is Jennifer's cleaning business a specified service trade or business (SSTB)? YES or NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

Based on the interview notes and documents, answer the following items relative to their 2019 Form 1040. If an amount is a deductible loss, put a minus (-) before the number. If an amount is zero, write 0.

Based on the interview notes and documents, answer the following items relative to their 2019 Form 1040. If an amount is a deductible loss, put a minus (-) before the number. If an amount is zero, write 0.