Question: Based on the minimum variance hedge ratio approach what is the hedging effectiveness, given the following information. The correlation coefficient between changes in the underlying

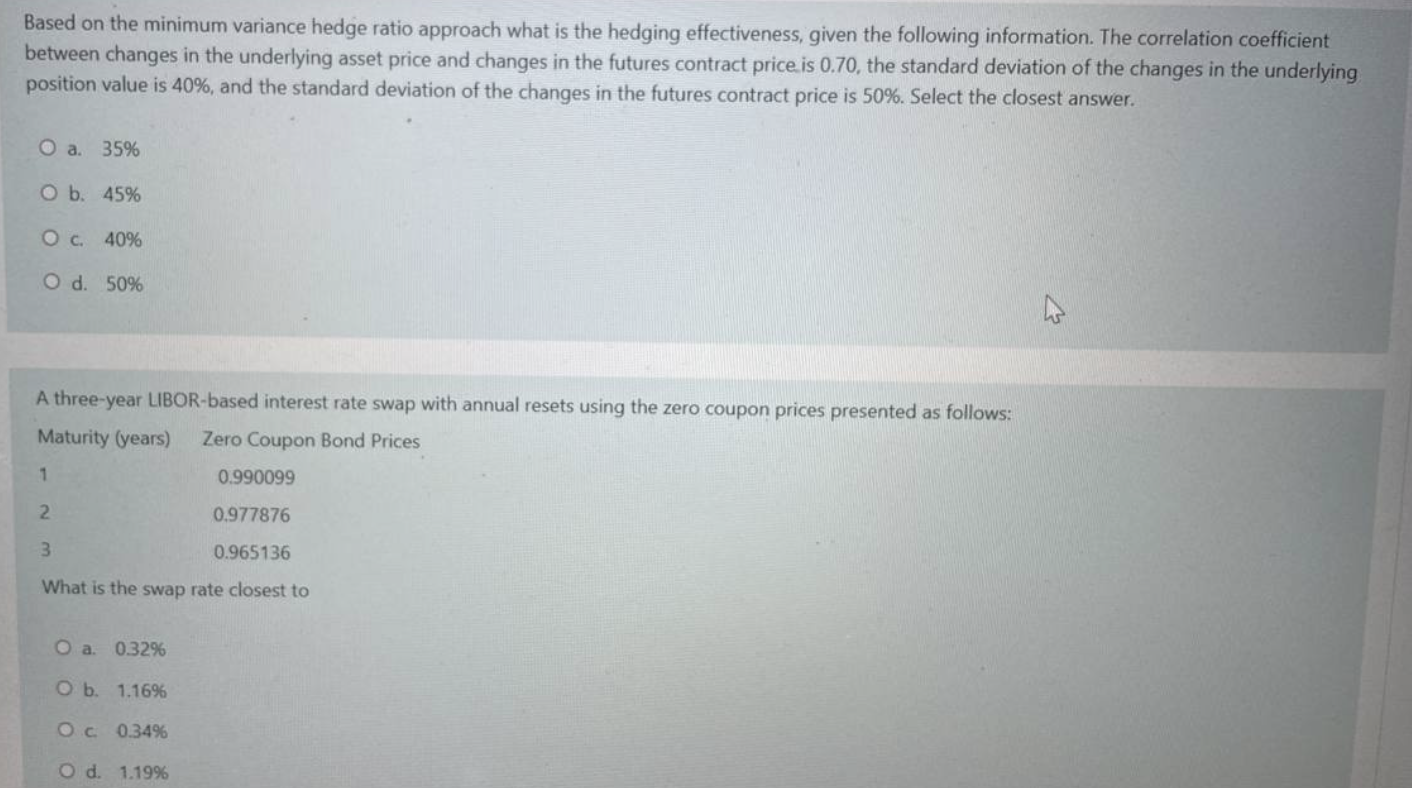

Based on the minimum variance hedge ratio approach what is the hedging effectiveness, given the following information. The correlation coefficient between changes in the underlying asset price and changes in the futures contract price is 0.70, the standard deviation of the changes in the underlying position value is 40%, and the standard deviation of the changes in the futures contract price is 50%. Select the closest answer. O a. 35% O b. 45% O c. 40% O d. 50% A three-year LIBOR-based interest rate swap with annual resets using the zero coupon prices presented as follows: Maturity (years) Zero Coupon Bond Prices 1 0.990099 2. 0.977876 3 0.965136 What is the swap rate closest to O a. 0.32% Ob. 1.16% Oc 0.34% O d. 1.19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts