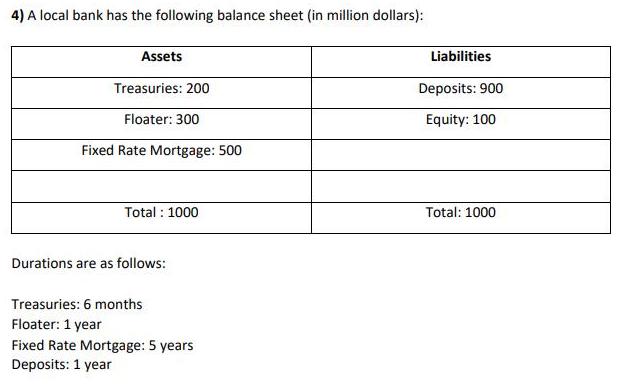

Question: 4) A local bank has the following balance sheet (in million dollars): Assets Treasuries: 200 Floater: 300 Fixed Rate Mortgage: 500 Total: 1000 Durations

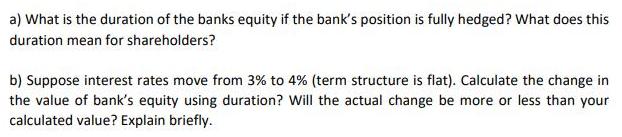

4) A local bank has the following balance sheet (in million dollars): Assets Treasuries: 200 Floater: 300 Fixed Rate Mortgage: 500 Total: 1000 Durations are as follows: Treasuries: 6 months Floater: 1 year Fixed Rate Mortgage: 5 years Deposits: 1 year Liabilities Deposits: 900 Equity: 100 Total: 1000 a) What is the duration of the banks equity if the bank's position is fully hedged? What does this duration mean for shareholders? b) Suppose interest rates move from 3% to 4% (term structure is flat). Calculate the change in the value of bank's equity using duration? Will the actual change be more or less than your calculated value? Explain briefly.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the change in the value of the banks equity using duration we can use the following for... View full answer

Get step-by-step solutions from verified subject matter experts