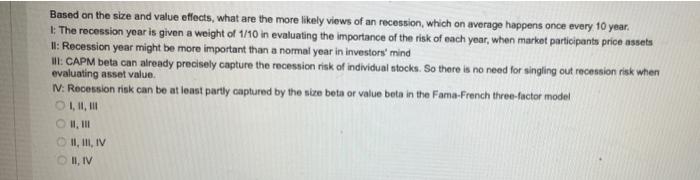

Question: Based on the size and value offects, what are the more likely views of an recession, which on average happens once every 10 year. :

Based on the size and value offects, what are the more likely views of an recession, which on average happens once every 10 year. : The recession year is given a weight of 1/10 in evaluating the importance of the risk of each year, when market participants price assets II: Recession year might be more important than a normal year in investors' mind : CAPM beta can already precisely capture the recession risk of individual stocks. So there is no need for singling out recession risk when evaluating asset value W: Rocession risk can be at loost partly captured by the nize beta or value bota in the Fama-French three-factor model I, II, III 1,111 II, III, IV II, IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts