Question: Based on the solution provided, how can you obtain the PW of investment, cost, benefits, disbenefits? retail corridors on both sides of the toll road.

Based on the solution provided, how can you obtain the PW of investment, cost, benefits, disbenefits?

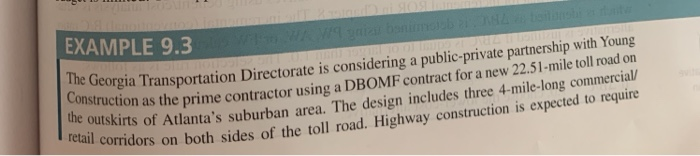

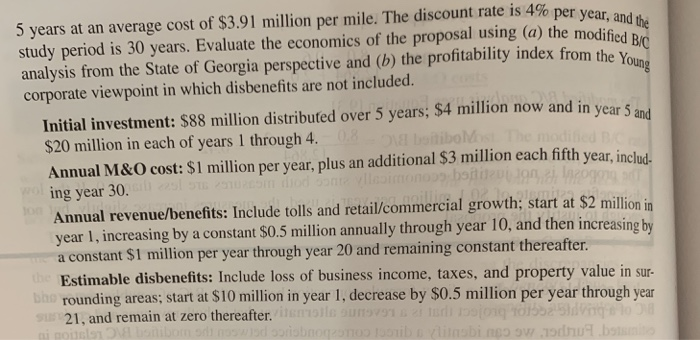

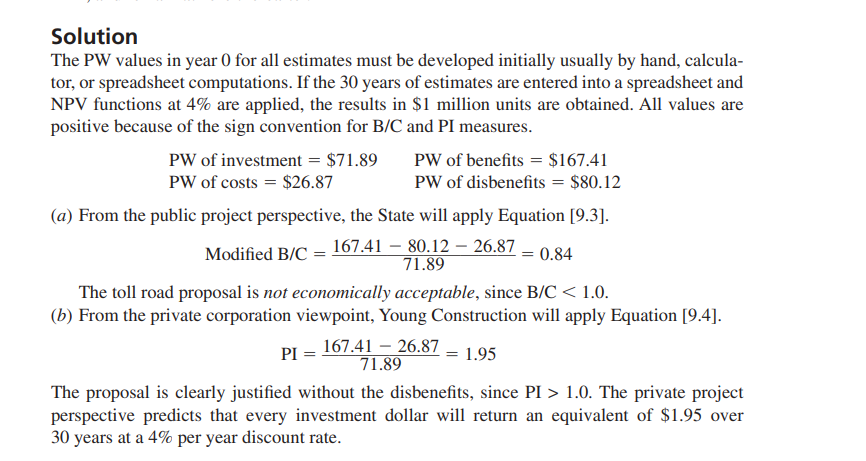

retail corridors on both sides of the toll road. Highway construction is expected to require EXAMPLE 9.3 The Georgia Transportation Directorate is considering a public-private partnership with Young Construction as the prime contractor using a DBOMF contract for a new 22.51-mile toll road on the outskirts of Atlanta's suburban area. The design includes three 4-mile-long commercial million now analysis from the State of Georgia perspective and (b) the profitability index from the Young 5 years at an average cost of $3.91 million per mile. The discount rate is 4% per year , and the study period is 30 years. Evaluate the economics of the proposal using (a) the modified Bic corporate viewpoint in which disbenefits are not included. Initial investment: $88 million distributed over 5 years; $4 now and in year 5 and $20 million in each of years 1 through 4. Ola botiboMemo Annual M&O cost: $1 million per year, plus an additional $3 million each fifth year, includ- ing year 30.57in od bolimono Annual revenue/benefits: Include tolls and retail/commercial growth; start at $2 million in year 1, increasing by a constant $0.5 million annually through year 10, and then increasing by a constant $1 million per year through year 20 and remaining constant thereafter. th Estimable disbenefits: Include loss of business income, taxes, and property value in sur- the rounding areas; start at $10 million in year 1, decrease by $0.5 million per year through year SH21, and remain at zero thereafter. in 91 tri bojong bong mi doorbro ponosib olisbi no 9.out. Solution The PW values in year for all estimates must be developed initially usually by hand, calcula- tor, or spreadsheet computations. If the 30 years of estimates are entered into a spreadsheet and NPV functions at 4% are applied, the results in $1 million units are obtained. All values are positive because of the sign convention for B/C and PI measures. PW of investment = $71.89 PW of benefits = $167.41 PW of costs = $26.87 PW of disbenefits = $80.12 (a) From the public project perspective, the State will apply Equation [9.3]. Modified B/C = 167.41 80:12 26.87 = 0.84 71.89 The toll road proposal is not economically acceptable, since B/C 1.0. The private project perspective predicts that every investment dollar will return an equivalent of $1.95 over 30 years at a 4% per year discount rate. retail corridors on both sides of the toll road. Highway construction is expected to require EXAMPLE 9.3 The Georgia Transportation Directorate is considering a public-private partnership with Young Construction as the prime contractor using a DBOMF contract for a new 22.51-mile toll road on the outskirts of Atlanta's suburban area. The design includes three 4-mile-long commercial million now analysis from the State of Georgia perspective and (b) the profitability index from the Young 5 years at an average cost of $3.91 million per mile. The discount rate is 4% per year , and the study period is 30 years. Evaluate the economics of the proposal using (a) the modified Bic corporate viewpoint in which disbenefits are not included. Initial investment: $88 million distributed over 5 years; $4 now and in year 5 and $20 million in each of years 1 through 4. Ola botiboMemo Annual M&O cost: $1 million per year, plus an additional $3 million each fifth year, includ- ing year 30.57in od bolimono Annual revenue/benefits: Include tolls and retail/commercial growth; start at $2 million in year 1, increasing by a constant $0.5 million annually through year 10, and then increasing by a constant $1 million per year through year 20 and remaining constant thereafter. th Estimable disbenefits: Include loss of business income, taxes, and property value in sur- the rounding areas; start at $10 million in year 1, decrease by $0.5 million per year through year SH21, and remain at zero thereafter. in 91 tri bojong bong mi doorbro ponosib olisbi no 9.out. Solution The PW values in year for all estimates must be developed initially usually by hand, calcula- tor, or spreadsheet computations. If the 30 years of estimates are entered into a spreadsheet and NPV functions at 4% are applied, the results in $1 million units are obtained. All values are positive because of the sign convention for B/C and PI measures. PW of investment = $71.89 PW of benefits = $167.41 PW of costs = $26.87 PW of disbenefits = $80.12 (a) From the public project perspective, the State will apply Equation [9.3]. Modified B/C = 167.41 80:12 26.87 = 0.84 71.89 The toll road proposal is not economically acceptable, since B/C 1.0. The private project perspective predicts that every investment dollar will return an equivalent of $1.95 over 30 years at a 4% per year discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts