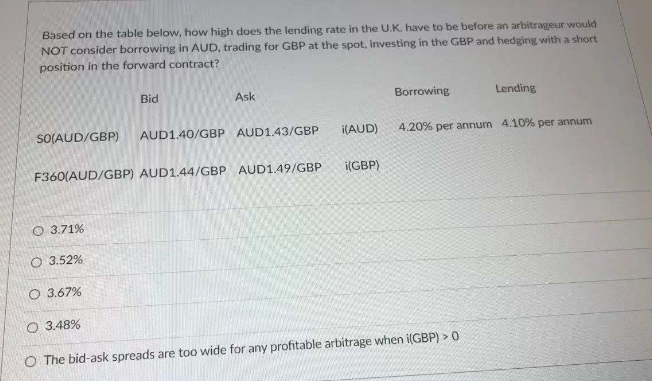

Question: Based on the table below, how high does the lending rate in the UK. have to be before an arbitrageur would NOT consider borrowing in

Based on the table below, how high does the lending rate in the UK. have to be before an arbitrageur would NOT consider borrowing in AUD, trading for GBP at the spot, investing in the GBP and hedging with a short position in the forward contract? Bid Lending Ask Borrowing i(AUD) 4.20% per annum 4.10% per annum SO(AUD/GBP) AUD1.40/GBP AUD1.43/GBP i(GBP) F360(AUD/GBP) AUD1.44/GBP AUD1.49/GBP O 3.71% O 3.52% 0 3.67% O 3.48% O The bid-ask spreads are too wide for any profitable arbitrage when i(GBP) > 0 Based on the table below, how high does the lending rate in the UK. have to be before an arbitrageur would NOT consider borrowing in AUD, trading for GBP at the spot, investing in the GBP and hedging with a short position in the forward contract? Bid Lending Ask Borrowing i(AUD) 4.20% per annum 4.10% per annum SO(AUD/GBP) AUD1.40/GBP AUD1.43/GBP i(GBP) F360(AUD/GBP) AUD1.44/GBP AUD1.49/GBP O 3.71% O 3.52% 0 3.67% O 3.48% O The bid-ask spreads are too wide for any profitable arbitrage when i(GBP) > 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts