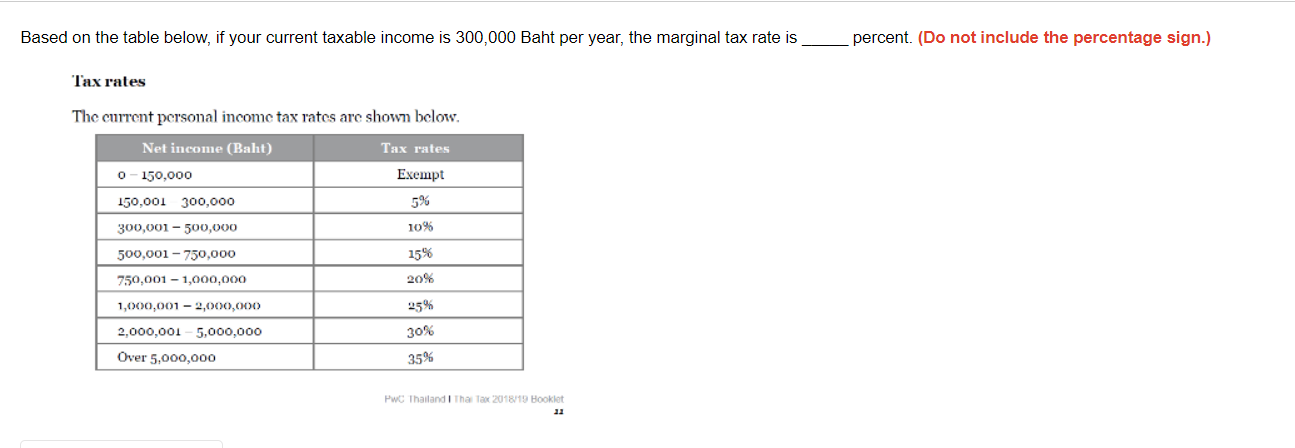

Question: Based on the table below, if your current taxable income is 300,000 Baht per year, the marginal tax rate is percent. (Do not include the

Based on the table below, if your current taxable income is 300,000 Baht per year, the marginal tax rate is percent. (Do not include the percentage sign.) Tax rates The current personal income tax rates are shown below. Net income (Baht) Tax rates 0 - 150,000 Exempt 150,001 300.000 300,001 - 500,000 10% 500,001 - 750,000 15% 750,001 - 1,000,000 20% 1,000,001 - 2,000,000 2,000,001 5,000,000 25% 30% 35% Over 5,000,000 PwC Thailand That Tax 2018/19 Booklet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts