Question: Based on the table, Is SMB or HML a reliable measure of systematic risk? An equity research is trying to verify if there is any

Based on the table, Is SMB or HML a reliable measure of systematic risk?

Based on the table, Is SMB or HML a reliable measure of systematic risk?

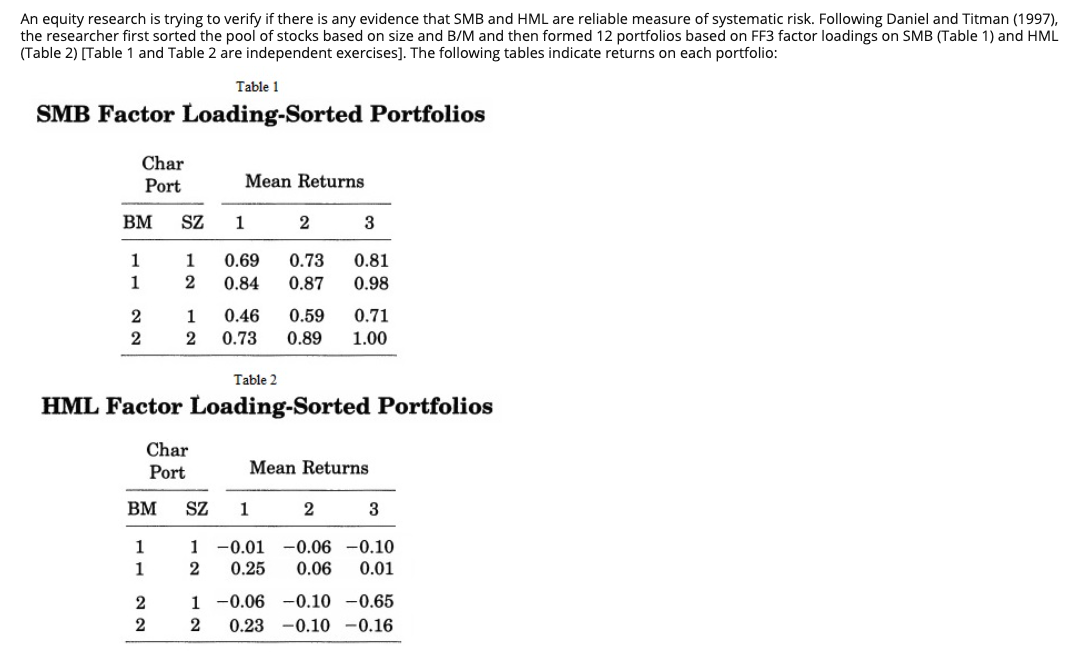

An equity research is trying to verify if there is any evidence that SMB and HML are reliable measure of systematic risk. Following Daniel and Titman (1997), the researcher first sorted the pool of stocks based on size and B/M and then formed 12 portfolios based on FF3 factor loadings on SMB (Table 1) and HML (Table 2) [Table 1 and Table 2 are independent exercises]. The following tables indicate returns on each portfolio: Table 1 SMB Factor Loading-Sorted Portfolios Char Port Mean Returns BM SZ 1 2 3 1 1 1 2 0.69 0.84 0.73 0.87 0.81 0.98 2 2 1 2 0.46 0.73 0.59 0.89 0.71 1.00 Table 2 HML Factor Loading-Sorted Portfolios Char Port Mean Returns BM SZ 1 2 3 1 1 1 -0.01 2 0.25 -0.06 -0.10 0.06 0.01 2 2 1 -0.06 -0.10 -0.65 2 0.23 -0.10 -0.16 An equity research is trying to verify if there is any evidence that SMB and HML are reliable measure of systematic risk. Following Daniel and Titman (1997), the researcher first sorted the pool of stocks based on size and B/M and then formed 12 portfolios based on FF3 factor loadings on SMB (Table 1) and HML (Table 2) [Table 1 and Table 2 are independent exercises]. The following tables indicate returns on each portfolio: Table 1 SMB Factor Loading-Sorted Portfolios Char Port Mean Returns BM SZ 1 2 3 1 1 1 2 0.69 0.84 0.73 0.87 0.81 0.98 2 2 1 2 0.46 0.73 0.59 0.89 0.71 1.00 Table 2 HML Factor Loading-Sorted Portfolios Char Port Mean Returns BM SZ 1 2 3 1 1 1 -0.01 2 0.25 -0.06 -0.10 0.06 0.01 2 2 1 -0.06 -0.10 -0.65 2 0.23 -0.10 -0.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts