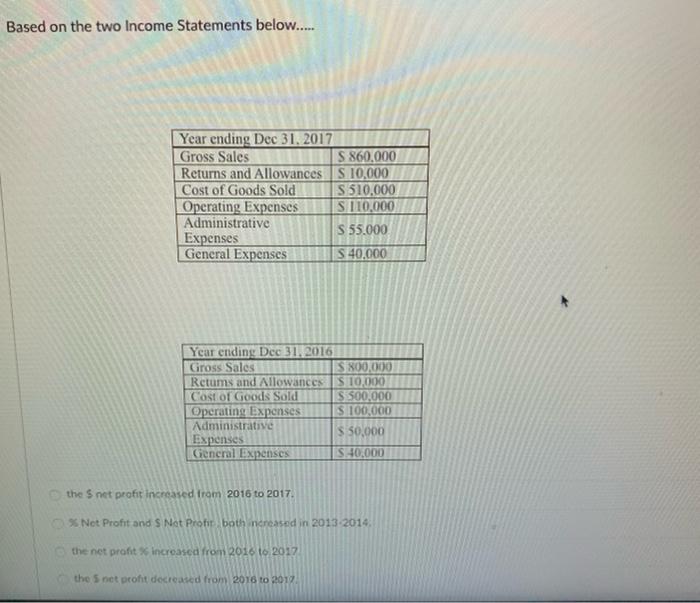

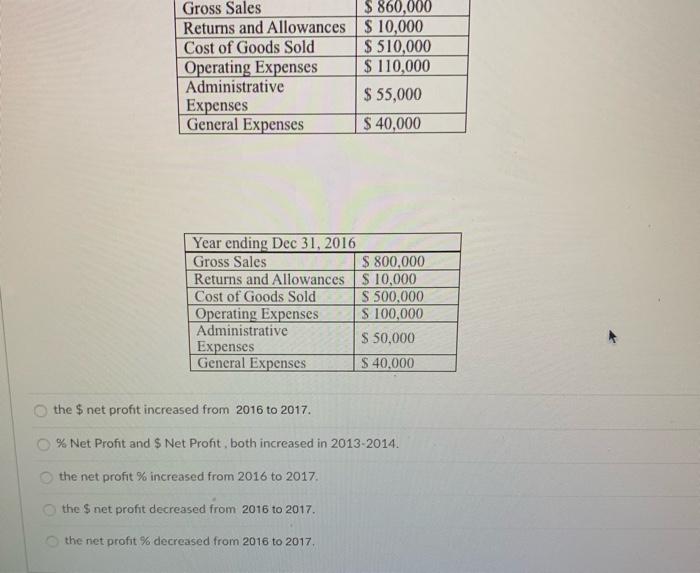

Question: Based on the two Income Statements below..... Year ending Dec 31, 2017 Gross Sales S 860,000 Returns and Allowances S 10,000 Cost of Goods Sold

Based on the two Income Statements below..... Year ending Dec 31, 2017 Gross Sales S 860,000 Returns and Allowances S 10,000 Cost of Goods Sold S 510,000 Operating Expenses S110,000 Administrative S 55.000 Expenses General Expenses S 40.000 Year ending Dec 31, 2016 Gross Sales S 800,000 Retums and Allowances S 10,000 Cost of Goods Sold S 500,000 Operating Expenses $ 100,000 Administrative S 50.000 Expenses Gencral Expenses S.40.000 the net profit increased from 2016 to 2017 36 Net Profit and S Not Profir both creased in 2013-2014 the net profit increased from 2016 to 2017 the 5 net profit decreased from 2016 to 2017 Gross Sales $ 860,000 Returns and Allowances $ 10,000 Cost of Goods Sold $ 510,000 Operating Expenses $ 110,000 Administrative $ 55,000 Expenses General Expenses $ 40,000 Year ending Dec 31, 2016 Gross Sales $ 800,000 Returns and Allowances S 10,000 Cost of Goods Sold S 500,000 Operating Expenses S 100,000 Administrative S 50,000 Expenses General Expenses $ 40.000 the $ net profit increased from 2016 to 2017 % Net Profit and $ Net Profit, both increased in 2013-2014 the net profit % increased from 2016 to 2017 the $ net profit decreased from 2016 to 2017. the net profit % decreased from 2016 to 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts