Question: Based on the two recommendation I was going to use profitable ratios and timed interest earned? SO and CFO have presented you with the following

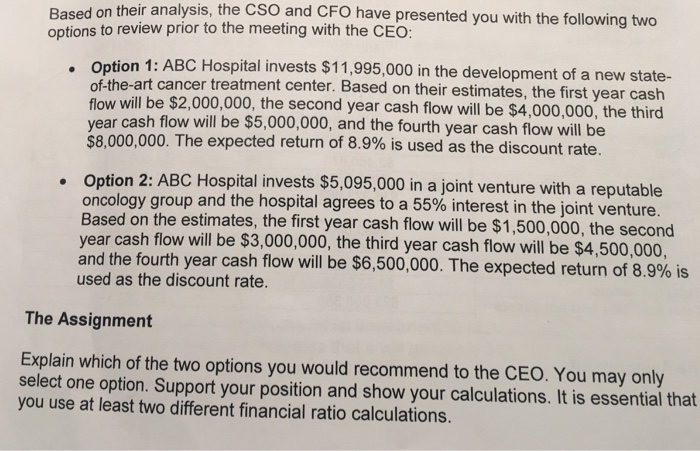

SO and CFO have presented you with the following two Based on their analysis, the C options to review prior to the meeting with the CEO: on 1: ABC Hospital invests $11,995,000 in the development of a new state- of- the-art cancer treatment center. Based on their estimates, the first year cash flow will be $2,000,000, the second year cash flow will be $4,000,000, the third r cash flow will be $5,000,000, and the fourth year cash flow will be year $8,000,000. The expected return of 8.9% is used as the discount rate. Option 2: ABC Hospital invests $5,095,000 in a joint venture with a reputable oncology group and the hospital agrees to a 55% interest in the joint venture. Based on the estimates, the first year cash flow will be $1,500,000, the second year cash flow will be $3,000,000, the third year cash flow will be $4,500,000 and the fourth year cash flow will be $6,500,000. The expected return of 8.9% is used as the discount rate. The Assignment Explain which of the two options you would recommend to the CEO. You may only select one option. Support your position and show your calculations. It is essential that you use at least two different financial ratio calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts