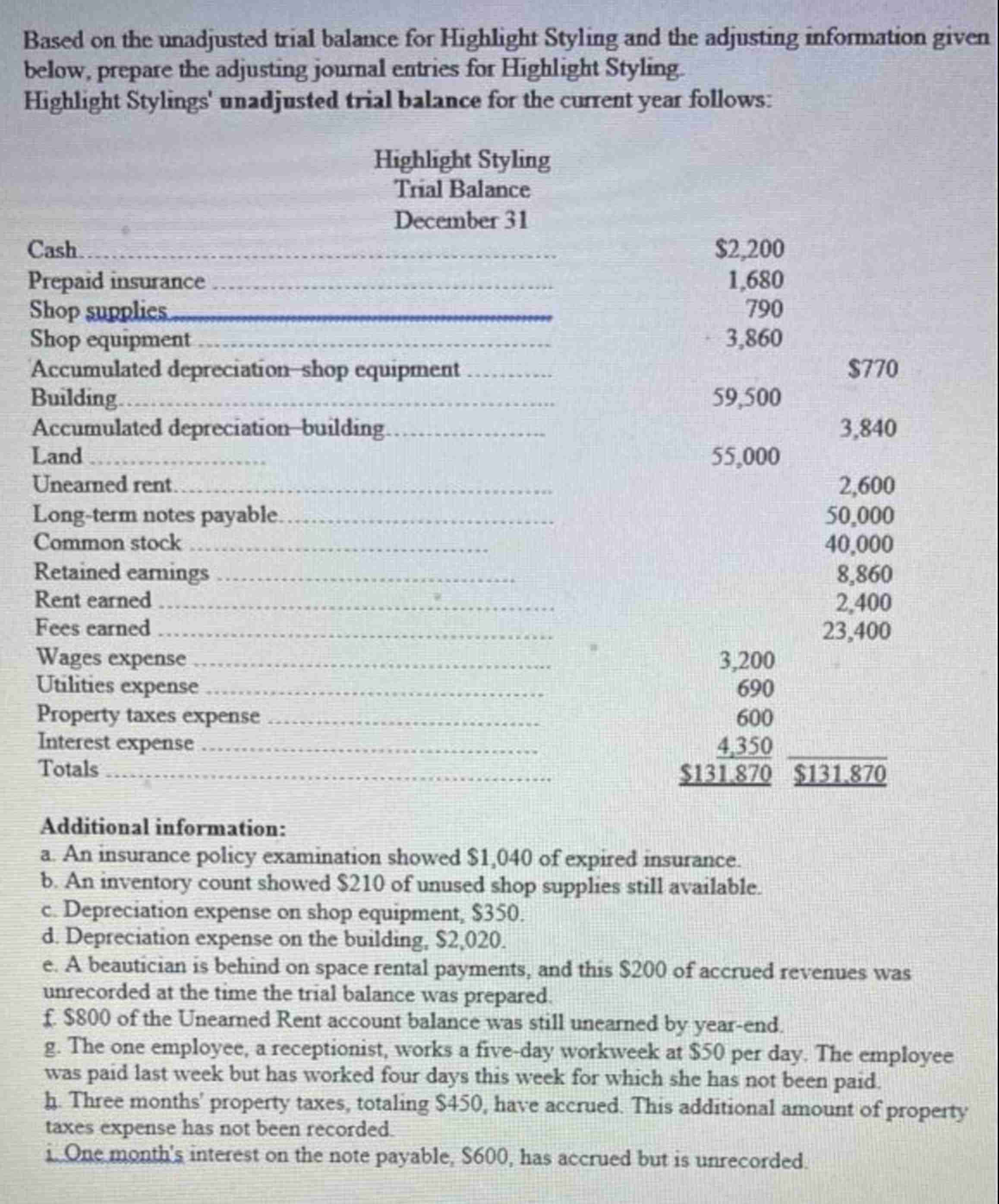

Question: Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below, prepare the adjusting joumal entries for Highlight Styling and adjusted

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given

below, prepare the adjusting joumal entries for Highlight Styling and adjusted trial balance

Highlight Stylings' unadjusted trial balance for the current year follows:

Highlight Styling

Trial Balance

December

Cash.

Prepaid insurance

Shop supplies

Shop equipment

$

Accumulated depreciationshop equipment

Building

Accumulated depreciationbuilding

Land

Unearned rent.

Longterm notes payable.

Common stock

Retained earnings

Rent earned

Fees earned

Wages expense

Utilities expense

Property taxes expense

Interest expense

Totals

$

$

Additional information:

a An insurance policy examination showed $ of expired insurance.

b An inventory count showed $ of unused shop supplies still available.

c Depreciation expense on shop equipment, $

d Depreciation expense on the building, $

e A beautician is behind on space rental payments, and this $ of accrued revenues was

unrecorded at the time the trial balance was prepared.

f $ of the Unearned Rent account balance was still unearned by yearend.

g The one employee, a receptionist, works a fiveday workweek at $ per day. The employee

was paid last week but has worked four days this week for which she has not been paid.

h Three months' property taxes, totaling $ have accrued. This additional amount of property

taxes expense has not been recorded.

i One month's interest on the note payable, $ has accrued but is unrecorded.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock