Question: Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look

Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look like compared to the same yield curve without a positive liquidity premium? Please explain your answers.

Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look like compared to the same yield curve without a positive liquidity premium? Please explain your answers.

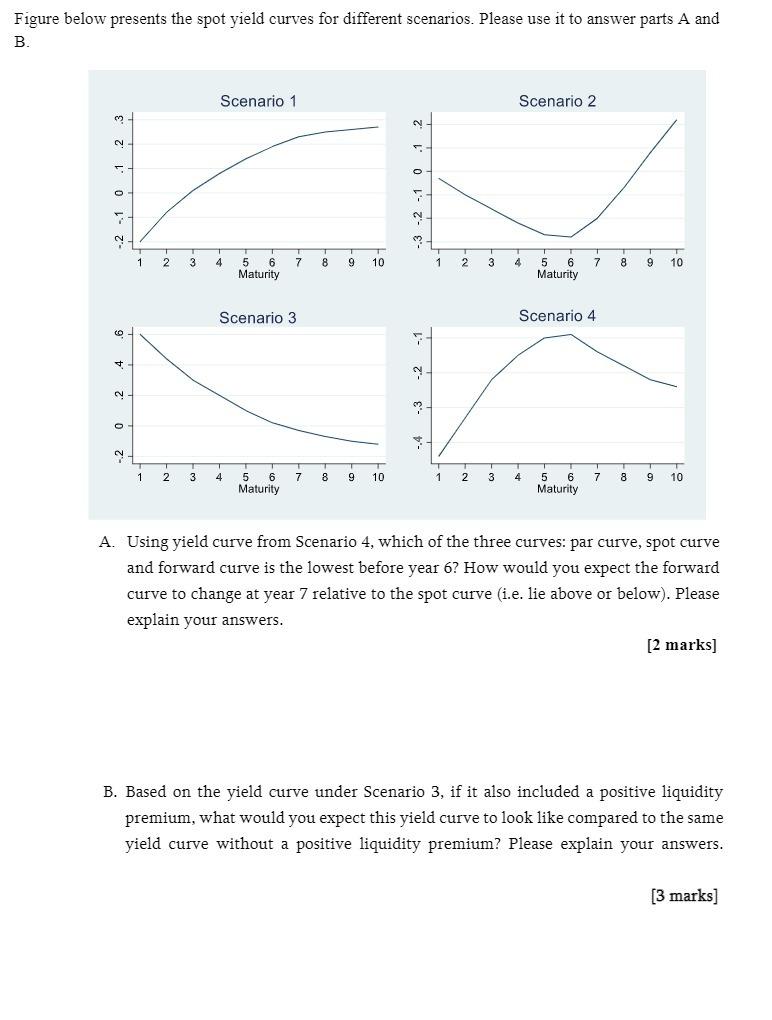

Figure below presents the spot yield curves for different scenarios. Please use it to answer parts A and B. Scenario 1 Scenario 2 N 3 -2 -1 0 1 2 2 -1 0 . 1 2 2 4 7 8 9 10 1 2 3 4 7 8 9 10 5 6 Maturity 5 6 Maturity Scenario 3 Scenario 4 . + 13 O : 1 2 3 4 5 7 8 9 10 1 2 3 8 9 10 Maturity 5 6 Maturity A. Using yield curve from Scenario 4, which of the three curves: par curve, spot curve and forward curve is the lowest before year 6? How would you expect the forward curve to change at year 7 relative to the spot curve (i.e. lie above or below). Please explain your answers. [2 marks] B. Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look like compared to the same yield curve without a positive liquidity premium? Please explain your answers. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts