Question: Based on these data and Table 3-1, calculate slow output growth (1%), while Korea had the change in the exchange rate from 2015 relatively robust

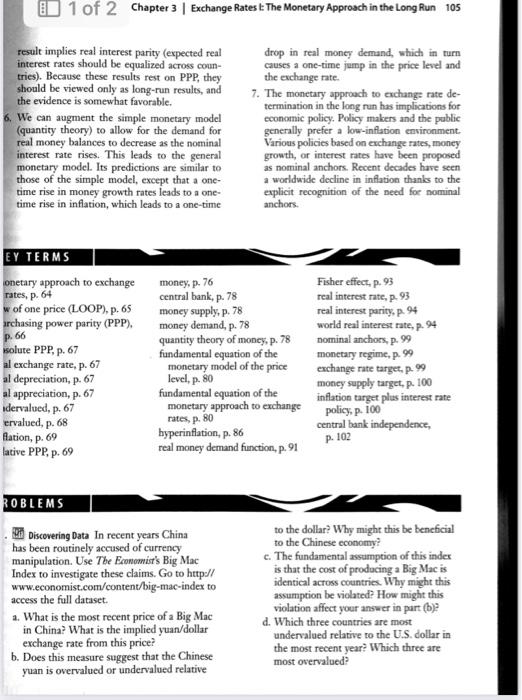

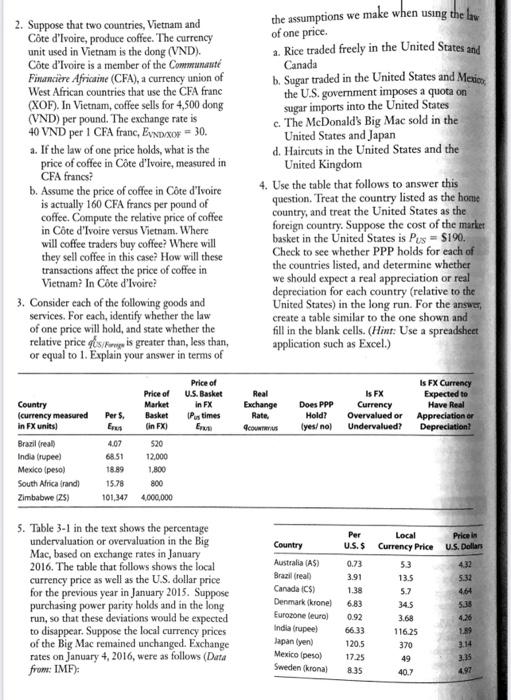

Based on these data and Table 3-1, calculate slow output growth (1\%), while Korea had the change in the exchange rate from 2015 relatively robust output growth (6%). Supposi to 2016, and state whether the direction of the Bank of Japan allowed the money supply change was consistent with the PPP-implied to grow by 2% each year, while the Bank of exchange rate using the Big Mac Index. How Korea chose to maintain relatively high mone might you explain the failure of the Big Mac growth of 15% per year. Index to correctly predict the change in the For the following questions, use the nominal exchange rate between January 2015 simple monetary model (where L is constant and January 2016? You will find it easiest to treat South Korea as the home country and Japan as the foreig WORK IT OUT LaunchPad |interactive adtivity country. a. What is the inflation rate in South Korea? You are given the following information. The current dollatIn Japan? und exchange rate is $1.5 per pound. A U.S. basket that b. What is the expected rate of depreciation its $100 would cost $120 in the United Kingdom. For the in the Korean won relative to the Japanese xt year, the Federal Reserve is predicted to keep U.S, inflayen (V) ? in at 2% and the Bank of England is predicted to keep U.K. lation at 3\%. The speed of convergence to absolute PPP is c. Suppose the Bank of Korea decreases the Oo per year. money growth rate from 15% to 12%. If nothing in Japan changes, what is the new What is the expected U.S. minus U.K. inflation differential for inflation rate in South Korea? the coming yeat? d. Using time series diagrams, illustrate how What is the current U.S. real exchange rate qusux with the this decrease in the money growth rate United Kingdom? affects the money supply MK, South Korea: How much is the dollar overvalued/undervalued? interest rate, prices PK, real money supply, and Ewonv over time. (Plot each variable on What do you predict the U.S. real exchange rate with the the vertical axis and time on the horizontal United Kingdom will be in one year's time? axis.) What is the expected rate of real depreciation for the United e. Suppose the Bank of Korea wants to States (versus the United Kingdom)? maintain an exchange rate peg with the Japanese yen. What money growth rate L. What is the expected rate of nominal depreciation for the would the Bank of Korea have to choose to United States (versus the United Kingdom!? keep the value of the won fixed relative to 1. What do you predict will be the dollar price of one pound a the yen? year from now? f. Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money 6. Describe how each of the following factors growth rate (assuming positive values) might explain why PPP is a better guide for would allow the Bank of Korea to achieve exchange rate movements in the long run this objective? versus the short run: (i) transactions costs, (ii) nontraded goods, (iii) imperfect 8. This question uses the general monetary competition, (iv) price stickiness. As markets model, where L is no longer assumed constant. become increasingly integrated, do you suspect and money demand is inversely related to PPP will become a more useful guide in the the nominal interest rate. Consider the same future? Why or why not? scenario described at the beginning of the previous question. In addition, the bank 7. Consider two countries: Japan and South deposits in Japan pay a 3% interest rate, Korea. In 1996 Japan experienced relatively Ah=3%. result implies real interest parity (expected real_ drop in real money demand, which in turn interest rates should be equalized across coun- causes a one-time jump in the price level and tries). Because these results rest on PPP, they the exchange rate. should be viewed only as long-run resules, and 7. The monetary approuch to exchange rate dethe evidence is somewhat favorable. termination in the long run has implications for 6. We can augment the simple monetary model economic policy. Policy makers and the pablic (quantity theory) to allow for the demand for generally prefer a low-inflation environment. real money balances to decrease as the nominal Various policies based on exchange rates, money interest rate rises. This leads to the general growth, or interest rates have been proposed monetary model. Its predictions are similar to as nominal anchors. Recent decades have seen those of the simple model, except that a onea worldwide decline in inflation thanks to the time rise in money growth rates leads to a oneexplicit recognition of the need foe nominal time rise in inflation, which leads to a one-time anchors. EY TER MS onetary appro- rates, p. 64 w of one price archasing powe p. 66 solute PPP, p. al exchange ra al depreciation al appreciation idervalued, p. ervalued, p. 68 Alation, p. 69 lative PPP, p. 6 R 0 B L E M S money,p.76centralbank,p.78Fishereffect,p.93realinterestrate,p.93 moncy supply, p. 78 real interest parity, p. 94 money demand, p. 78 world real interest rate, p.94 quantity theory of money, p. 78 nominal anchors, p. 99 fundamental equation of the monetary regime, p. 99 monetary model of the price exchange rate target, p. 99 level, p. 80 moncy supply target, p. 100 fundamental equation of the inflation target plas interest rate monetary approach to exchange policy, p. 100 rates, p. 80 hyperinflation, p. 86 central bank independence, p. 102 real moncy demand function, p. 91 . Qifif Discovering Data In recent years China to the dollar? Why might this be beneficial has been routinely accused of currency to the Chinese economy? manipulation. Use Tbe Eronomist's Big Mac c. The fundamental assumption of this inder Indes to investigate these claims. Go to http/l is that the cost of producing a Big Mac is www.economist.com/content/big-mac-index to identical across countries. Why might this access the full dataset. assumption be violated? How might this a. What is the most recent price of a Big Mac violation affect your answer in part (b)? d. Which three countries are most in China? What is the implied yuan/dollar undervalued relative to the U.S. dollar in exchange rate from this price? b. Does this measure suggest that the Chinese the most recent year? Which three are yuan is overvalued or undervalued relative 2. Suppose that two countries, Vietnam and the assumptions we make when using the hw Cte d'Ivoire, produce coffee. The currency of one price. unit used in Vietnam is the dong (VND). a. Rice traded freely in the United States and Cte d'Ivoire is a member of the Communante Canada Financitire Africaine (CFA), a currency union of b. Sugar traded in the United States and Mericor West African countries that use the CFA franc the U.S. government imposes a quota on (XOF). In Vietnam, coffee sells for 4,500 dong sugar imports into the United States (VND) per pound. The exchange rate is c. The McDonald's Big Mac sold in the 40 VND per 1 CFA franc, Evndxor =30. United States and Japan a. If the law of one price holds, what is the d. Haircuts in the United States and the price of coffee in Cte d'lvoire, measured in United Kingdom CFA franes? b. Assume the price of coffee in Cte d'lvoire 4. Use the table that follows to answer this is actually 160 CFA francs per pound of question. Treat the country listed as the hone coffee. Compute the relative price of coffee country, and treat the United States as the in Coote d'Tvoire versus Vietnam. Where foreign country. Suppose the cost of the market will coffee traders buy coffee? Where will basket in the United States is PUS=$190. they sell coffee in this case? How will these Check to see whether PPP holds for each of transactions affect the price of coffee in the countries listed, and determine whether Vietnam? In Cte d'lvoire? we should expect a real appreciation or real depreciation for each country (relative to the 3. Consider each of the following goods and United States) in the long run. For the answe, services. For each, identify whether the law create a table similar to the one shown and of one price will hold, and state whether the fill in the blank cells. (Hint: Use a spreadsheet relative price qtis/kmene is greater than, less than, application such as Excel.) or equal to 1. Explain your answer in terms of 5. Table 3-1 in the text shows the percentage undervaluation or overvaluation in the Big Mac, based on exchange rates in January 2016. The table that follows shows the local currency price as well as the U.S. dollar price for the previous year in January 2015. Suppose purchasing power parity holds and in the long run, so that these deviations would be expected to disappear. Suppose the local currency prices of the Big Mac remained unchanged. Exchange rates on January 4,2016 , were as follows (Data from: IMF): Based on these data and Table 3-1, calculate slow output growth (1\%), while Korea had the change in the exchange rate from 2015 relatively robust output growth (6%). Supposi to 2016, and state whether the direction of the Bank of Japan allowed the money supply change was consistent with the PPP-implied to grow by 2% each year, while the Bank of exchange rate using the Big Mac Index. How Korea chose to maintain relatively high mone might you explain the failure of the Big Mac growth of 15% per year. Index to correctly predict the change in the For the following questions, use the nominal exchange rate between January 2015 simple monetary model (where L is constant and January 2016? You will find it easiest to treat South Korea as the home country and Japan as the foreig WORK IT OUT LaunchPad |interactive adtivity country. a. What is the inflation rate in South Korea? You are given the following information. The current dollatIn Japan? und exchange rate is $1.5 per pound. A U.S. basket that b. What is the expected rate of depreciation its $100 would cost $120 in the United Kingdom. For the in the Korean won relative to the Japanese xt year, the Federal Reserve is predicted to keep U.S, inflayen (V) ? in at 2% and the Bank of England is predicted to keep U.K. lation at 3\%. The speed of convergence to absolute PPP is c. Suppose the Bank of Korea decreases the Oo per year. money growth rate from 15% to 12%. If nothing in Japan changes, what is the new What is the expected U.S. minus U.K. inflation differential for inflation rate in South Korea? the coming yeat? d. Using time series diagrams, illustrate how What is the current U.S. real exchange rate qusux with the this decrease in the money growth rate United Kingdom? affects the money supply MK, South Korea: How much is the dollar overvalued/undervalued? interest rate, prices PK, real money supply, and Ewonv over time. (Plot each variable on What do you predict the U.S. real exchange rate with the the vertical axis and time on the horizontal United Kingdom will be in one year's time? axis.) What is the expected rate of real depreciation for the United e. Suppose the Bank of Korea wants to States (versus the United Kingdom)? maintain an exchange rate peg with the Japanese yen. What money growth rate L. What is the expected rate of nominal depreciation for the would the Bank of Korea have to choose to United States (versus the United Kingdom!? keep the value of the won fixed relative to 1. What do you predict will be the dollar price of one pound a the yen? year from now? f. Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money 6. Describe how each of the following factors growth rate (assuming positive values) might explain why PPP is a better guide for would allow the Bank of Korea to achieve exchange rate movements in the long run this objective? versus the short run: (i) transactions costs, (ii) nontraded goods, (iii) imperfect 8. This question uses the general monetary competition, (iv) price stickiness. As markets model, where L is no longer assumed constant. become increasingly integrated, do you suspect and money demand is inversely related to PPP will become a more useful guide in the the nominal interest rate. Consider the same future? Why or why not? scenario described at the beginning of the previous question. In addition, the bank 7. Consider two countries: Japan and South deposits in Japan pay a 3% interest rate, Korea. In 1996 Japan experienced relatively Ah=3%. result implies real interest parity (expected real_ drop in real money demand, which in turn interest rates should be equalized across coun- causes a one-time jump in the price level and tries). Because these results rest on PPP, they the exchange rate. should be viewed only as long-run resules, and 7. The monetary approuch to exchange rate dethe evidence is somewhat favorable. termination in the long run has implications for 6. We can augment the simple monetary model economic policy. Policy makers and the pablic (quantity theory) to allow for the demand for generally prefer a low-inflation environment. real money balances to decrease as the nominal Various policies based on exchange rates, money interest rate rises. This leads to the general growth, or interest rates have been proposed monetary model. Its predictions are similar to as nominal anchors. Recent decades have seen those of the simple model, except that a onea worldwide decline in inflation thanks to the time rise in money growth rates leads to a oneexplicit recognition of the need foe nominal time rise in inflation, which leads to a one-time anchors. EY TER MS onetary appro- rates, p. 64 w of one price archasing powe p. 66 solute PPP, p. al exchange ra al depreciation al appreciation idervalued, p. ervalued, p. 68 Alation, p. 69 lative PPP, p. 6 R 0 B L E M S money,p.76centralbank,p.78Fishereffect,p.93realinterestrate,p.93 moncy supply, p. 78 real interest parity, p. 94 money demand, p. 78 world real interest rate, p.94 quantity theory of money, p. 78 nominal anchors, p. 99 fundamental equation of the monetary regime, p. 99 monetary model of the price exchange rate target, p. 99 level, p. 80 moncy supply target, p. 100 fundamental equation of the inflation target plas interest rate monetary approach to exchange policy, p. 100 rates, p. 80 hyperinflation, p. 86 central bank independence, p. 102 real moncy demand function, p. 91 . Qifif Discovering Data In recent years China to the dollar? Why might this be beneficial has been routinely accused of currency to the Chinese economy? manipulation. Use Tbe Eronomist's Big Mac c. The fundamental assumption of this inder Indes to investigate these claims. Go to http/l is that the cost of producing a Big Mac is www.economist.com/content/big-mac-index to identical across countries. Why might this access the full dataset. assumption be violated? How might this a. What is the most recent price of a Big Mac violation affect your answer in part (b)? d. Which three countries are most in China? What is the implied yuan/dollar undervalued relative to the U.S. dollar in exchange rate from this price? b. Does this measure suggest that the Chinese the most recent year? Which three are yuan is overvalued or undervalued relative 2. Suppose that two countries, Vietnam and the assumptions we make when using the hw Cte d'Ivoire, produce coffee. The currency of one price. unit used in Vietnam is the dong (VND). a. Rice traded freely in the United States and Cte d'Ivoire is a member of the Communante Canada Financitire Africaine (CFA), a currency union of b. Sugar traded in the United States and Mericor West African countries that use the CFA franc the U.S. government imposes a quota on (XOF). In Vietnam, coffee sells for 4,500 dong sugar imports into the United States (VND) per pound. The exchange rate is c. The McDonald's Big Mac sold in the 40 VND per 1 CFA franc, Evndxor =30. United States and Japan a. If the law of one price holds, what is the d. Haircuts in the United States and the price of coffee in Cte d'lvoire, measured in United Kingdom CFA franes? b. Assume the price of coffee in Cte d'lvoire 4. Use the table that follows to answer this is actually 160 CFA francs per pound of question. Treat the country listed as the hone coffee. Compute the relative price of coffee country, and treat the United States as the in Coote d'Tvoire versus Vietnam. Where foreign country. Suppose the cost of the market will coffee traders buy coffee? Where will basket in the United States is PUS=$190. they sell coffee in this case? How will these Check to see whether PPP holds for each of transactions affect the price of coffee in the countries listed, and determine whether Vietnam? In Cte d'lvoire? we should expect a real appreciation or real depreciation for each country (relative to the 3. Consider each of the following goods and United States) in the long run. For the answe, services. For each, identify whether the law create a table similar to the one shown and of one price will hold, and state whether the fill in the blank cells. (Hint: Use a spreadsheet relative price qtis/kmene is greater than, less than, application such as Excel.) or equal to 1. Explain your answer in terms of 5. Table 3-1 in the text shows the percentage undervaluation or overvaluation in the Big Mac, based on exchange rates in January 2016. The table that follows shows the local currency price as well as the U.S. dollar price for the previous year in January 2015. Suppose purchasing power parity holds and in the long run, so that these deviations would be expected to disappear. Suppose the local currency prices of the Big Mac remained unchanged. Exchange rates on January 4,2016 , were as follows (Data from: IMF)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts